Only an idiot cheers high taxes on the rich, because they always start there then expand the taxes to more people. People should be less worried about getting free stuff and more focused on how to earn it.

Poor Warren Buffet, imagine, a poor employee, somebody who wouldn’t even work for him as janitor of who knows, working in one of his subsidiaries or companies calling him an idiot? This is so embarrassing, really! ![]()

![]()

![]()

![]()

![]()

I love when we talk about wealth distribution, from the poor to the rich corporations while cutting off Medicare or any public services for “we the people”. Meanwhile, our kids are stuck with another $1 trillion that was redistributed from the bottom to the top. ![]()

Oh! the so called “FREE STUFF” aka $12 billion socialist handout from the commie in the white house and his cheerful commie supporters to the socialist farmers while we the taxpayers have to get less from our tax returns…![]()

![]()

![]()

![]()

Free stuff? The thing you get from the government without working for it or deserve it, or as some not smart guy said “you have to earn it?” ![]()

The Trump administration has pledged up to $12 billion in aid for farmers to offset their losses from the trade fights. Perdue said more than $8 billion has been paid as part of those programs to date. USDA has said there will not be an aid package for 2019.

MARGA!

MAke Russia Great Again! ![]()

Ohhh…watch your credit card, this guy can set you up…….![]()

![]()

![]()

The founder of a private company that makes plastic gift cards, Mr. Prince is among the wealthy elite who stand to benefit enormously from the Trump tax cuts passed in 2017. He estimates that his tax bill this year will be $3 million less than it would have been absent the changes.

So, I had to give the government $500 from my tax returns so he and other archi millionaires can fatten their wallets? GTFOH! ![]()

![]()

![]()

![]()

![]()

Yet Mr. Prince, a Democrat from Nashville, is none too pleased about his windfall. He believes the Trump tax cuts are misguided and ultimately bad for the country, even as they pad his already robust bank account.

“I’m pissed off about it,” said Mr. Prince, speaking via FaceTime during a four-month, around-the-world cruise with his wife.

Too embarrassed to talk more ![]()

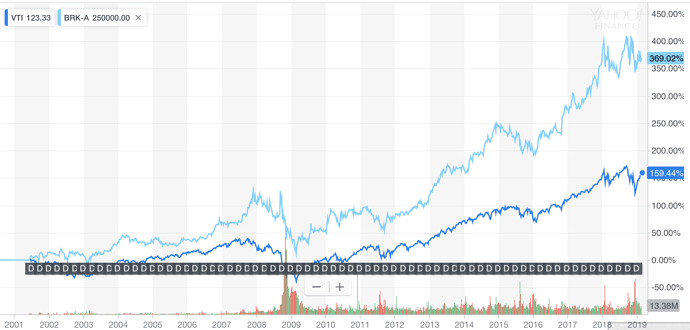

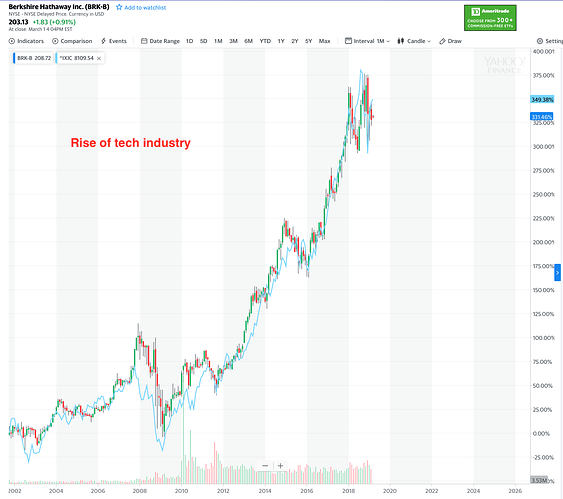

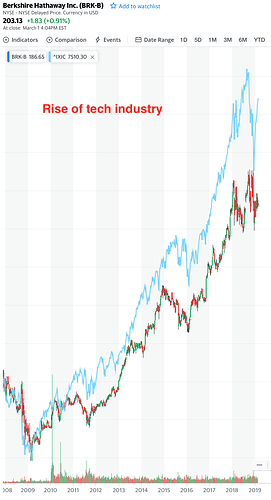

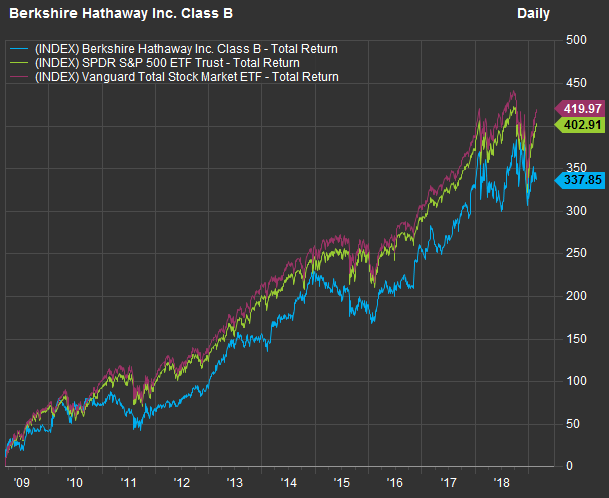

Investors should no longer bet on Warren Buffett

But one thing jumped out at me in his annual letter and a subsequent extended interview with Becky Quick of CNBC: his acknowledgment that his best stock pickers hadn’t beaten the market and his tacit admission that investors couldn’t expect Berkshire Hathaway BRK.A, +0.88% BRK.B, +0.91% to do so in the future, either.

Bogle’s unwavering advocacy of passive investing has given him a posthumous triumph over the man many people regard as the greatest investing genius the world has ever seen.

I was reading that piece yesterday.

Nobody should pay attention to him, he may be saying things that can expedite the sale of any other company or corporation he wants to buy. These people thrive on speculation. You know, like the stock market is all about, based on “fear and hearsay”.

I hope Buffett doesn’t become the second Bill Gross, who ascended coincidentally with the 36 year bond bull market. As soon as the bond market turned, Gross fell from grace. Buffett has been great, but maybe it’s time for him to retire.

WB and CM are trying hard to renew themselves by learning tech. Given BG is their good friend, a bit surprised that they took so long to start realizing they need to understand tech. Another flaw in his investment principle is holding too much cash for too long.

WB has been in the “tech” business for a long time. For that, I mean he has been in the reinsurance business big time.

Those are the guys who believe that contributing $100 so they can have $80 in their hands and another $80 being invested by the insurance companies without losing them is the way to go.

I read this year’s WB letter and watched all his interviews with Becky Quick. It’s no surprise WB is behind in the last 10 year period when we had a raging bull market. When a bear market hit WB will come back on top no doubt. So don’t count the old man out just yet.

It’s hard to be a value investor in a bull market.

The thing I admire WB the most is that he’s always learning. Go watch the CNBC interviews and the almost 90-year-old can hold his own on every contemporary topic from cloud to blockchain. He himself bought Oracle and later sold it because he felt he didn’t fully understand cloud. I need to learn this attitude from him.

Not good enough. Jim Cramer lost tons of money initially when the dotcom bubble burst because he was long big time. He quickly switched to short big time and made tons. In short,

Fast response to changes is more critical than making accurate forecast! Learn ![]() from Cramer.

from Cramer.

Cramer never published his investing record. Playing with real money is different than just talking bullcrap on TV.

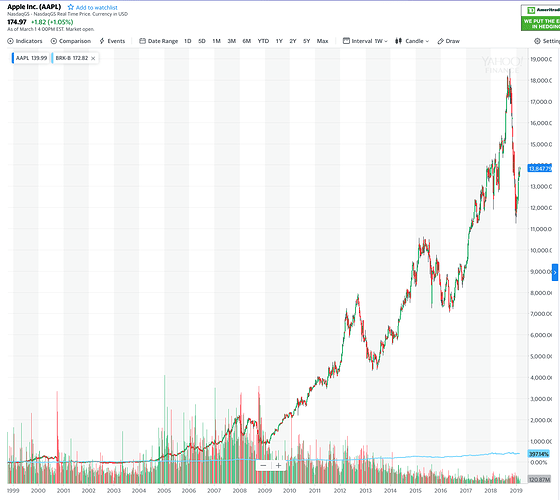

Well performance delta is very small, but keep in mind nasdaq was starting from a very depressed base after dot bomb. So WB is actually performing pretty well without any tech names in his portfolio except Apple in the last 2 years.

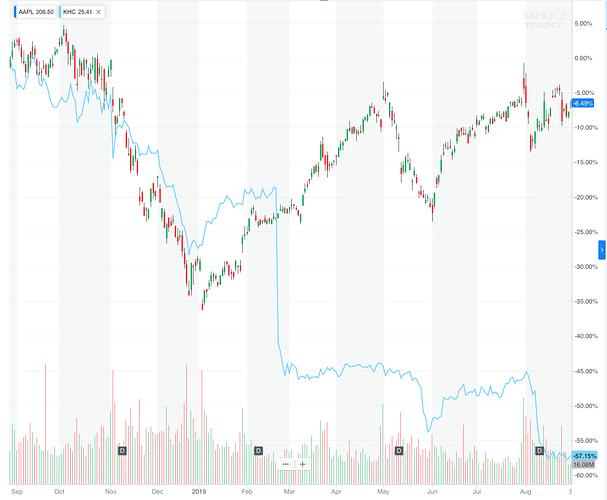

Watch AAPL come crashing down in the next 10 years. ![]()

4 Warren Buffett Stocks Tumble to Near 52-Week Lows

Buffett has been silent lately on the events causing turbulence in the market, such as the inverted yield curve, chaotic presidential tweets and a protracted tariff war.

Old man is confused.

As of Tuesday, the four Buffett stocks that have collapsed to near their lowest prices in a year were: The Kraft Heinz Co. (NASDAQ:KHC), Bank of New York Mellon Corp. (NYSE:BK), American Airlines Group Inc. (NASDAQ:AAL) and Wells Fargo & Co. (NYSE:WFC).

Warren Buffett is losing it. He is better off buying AAPL.

WB decided not to follow his own advice and panic sell when his blood is in the street.

.