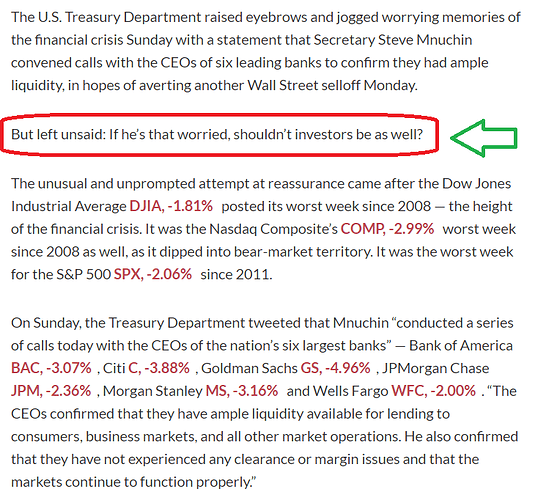

The banks are definitely fine though.

What is the justification? How do you say banks are fine?

What makes Treasury Secretary to have this meetings (and publish to media at this stage) unless he expects something going on?

What about Larry Kudlow? At this rate, need to invite Jim Cramer into WH.

Kudlow famously said everything was fine in 2007 right before the financial meltdown. No, he’s no good. But better than most of the other guys in Trump admin.

There is a alot of fear in financial markets right now. If the US economy grows at 2.5% (or higher) in 2019 all the big US banks are going to grow earnings per share nicely: top line growth, flat expenses and much lower share count.

US economic growth is expected to be 2.5-3% in 2019.

Expenses for the big banks have been flat and will likely to remain flat.

Interest rate increases from Fed moving forward. Net interest income should continue to grow nicely in 2019 as past increases calendarize.

US consumer is doing well; This was confirmed by bank CEO’s last week at a conference. Rising income is good for this part of the economy.

US small businesses are doing well. Confidence is still high .

Credit losses continue to be very low.

Regarding regulation, it might be neutral since Trump appointees might be counterbalanced by the Democrats.

Did you copy and paste that from somewhere? It’s the most you’ve ever typed on here

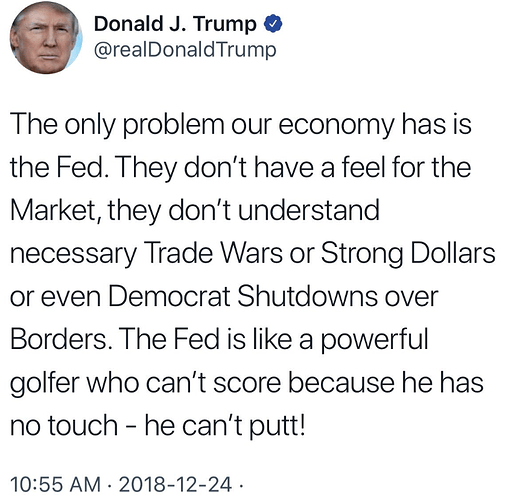

Yah as soon as the toddler in chief tweeted that the market which was recovering tanked again. Someone needs to turn off his TV so that he doesn’t watch Fox News, get riled up, then starts tweeting whatever he’s watching.

It’s a closed echo chamber of right wing noise. Powell is doing what he said he would do when nominated. If trump wanted a more dovish policy he should have kept Yellen

An ignorant fool who inherited 400 million from daddy and ALLEGEDLY made less money with it than the rate of inflation over 40 years criticizes the Fed in a tantrum…

I say ALLEGEDLY because we don’t have his tax returns

The fed’s preferred measure of inflation is CPI less food and energy. It appears they’ve been needlessly messing with rates for quite awhile.

It appears they’ve beeen so scared of 70’s style inflation that they prematurely raise rates and cause recessions. The 70’s were very unique with going off the gold standard. Irrational fear of 70’s inflation is leading to rate increases that cause recessions.

Today I sold (using highest cost method)1,000 shares of FCAU, 10 shares of AMZN, 25 shares of APPL, and 100 shares of AIG. I guess tax loss harvesting is good…

Did that help you relieve your margin duties?

Yes, for now I’m ok but if the market keeps tanking I will need to trim more. I rather sell what I want instead of InteractiveBrokers choosing for me.

I think you are ok. We’re at rock bottom and hard to get lower than this.

I don’t even have cash to transfer into the account right now. FML lol.

January can’t come soon enough. I need to some rent money!

not hard at all historically. you may be right, but it is definitely not “hard” to go lower.

We are not even down the average decline of a bear market since 1926 (not fear mongering… actual facts):

Agreed. Markets overshoot on the way up and down. It’s almost impossible to a call a bottom or top.

Bear markets are great for people in this forum. Well-(self-) employed people with money and assets, they can go shopping!

I made 2000 and 2008 study on SPY, AAPL, QQQ, the market has still more to go down.

I switched from buy to puts, seeing positive results now.

The Market Can Remain Irrational Longer Than You Can Remain Solvent.