Why remind me so fast? Could’ve gotten a good night sleep…

HK trading in deep red!

Come on!!!

Nikkei is also down but not as much. This volatility and trump makes me feel worried.

A bull market climbs a wall of worry ![]()

You think it will go up further? I am not going to take an action, but i feel like a down market is coming soon.

After much cursing,

FB - Down from ATH, in correcton

AMZN - ATH, Should begin correction

NFLX - ATH, Should begin correction

GOOG - Down from ATH, in correction

NVDA - Down from ATH, in correction

TSLA - In correction for a long time

BIDU - In correction since Oct last year

BABA - Sideways since Aug last year

TCEHY - In correction since Nov last year

F10. Why is there one missing?

I repeat, why risking your hard earned money? I know the secret to leverage your expenses and retire with dignity.

You have to be open minded. And don’t listen to ignorance at the highest level.

One, two…

No, you don’t. You continue to lie even when your lies are proven. Your idea of open-minded is blindly trusting you when math proves you can’t tell the difference between simple and compound interest.

You ignore that your 16% is really 11% after you pay 5% to borrow the money. That’s terrible compared to the mark return of 21%.

And 3!..![]()

![]()

![]()

![]()

![]()

![]()

Some ignorant people are so predictable. ![]()

I hope he gets it this time. If he doesn’t get it, sorry, there’s an idiot in the make:

“You access the money as a policy loan to be repaid from the eventual death benefit. Since it is a policy loan, not income, you never pay income taxes on the gains*”

Let’s see the change of an individual berating IULs, then…what? Offering them big time! ![]()

![]()

![]()

![]()

I’m not talking about taxes. I’m talking about the 5% loan interest that’s compounded every year.

If you get paid 16% but pay 5% to borrow the money, then you’re only profiting 11%. If you can’t follow that math, then you have no business selling financial products.

Marcus, come on man!

My apologies for the language used, but it’s kind of typical in the American culture to say God dn…it, don’t be stupid, don’t be an idiot, I don’t use them as an insult but as a way to be mad at things you say. I also said many times I don’t get mad if they tell me such nice things, Jesus! You said it, too much PC, right?

I wrote so many times this:

By contract, a life insurance brings a death benefit to the beneficiaries of the insured, and recently, with the inception of “living benefits” “benefits” for the insured. Kind of redundant. Sorry.

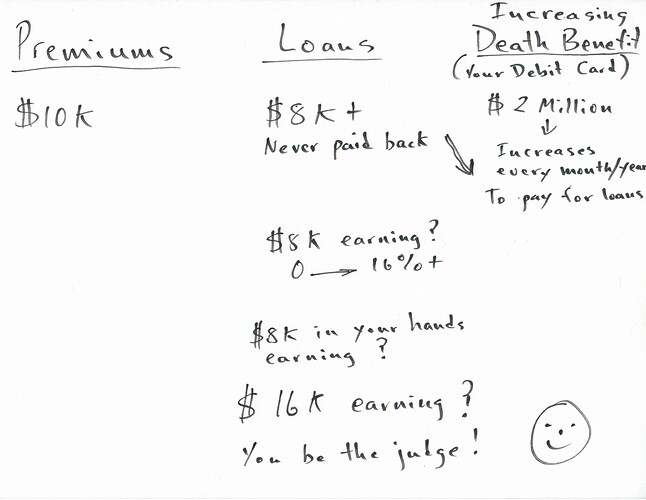

So, the IUL I described, not selling nor offering to anybody here since you guys are high tech when it comes to your own money, “uses” an option B. This option, allows the DEATH BENEFIT to increase. There’s a rider that insured pays, a few bucks every month or year. This rider allows insured to loan from the death benefit, and the returns the insured gets are his or hers. The loans won’t be deducted from the returns, it is the death benefit that is deducted since the increases help to pay for the loans.

It is easy to understand, as easy to be skeptical of such policies. They are used by the rich and business people to leverage their money. Their expenses are earning 0 to 16% or more. Of course, there’s a premium to be paid for the cost of insurance.

I don’t know where you got the “compound loan interest”. There’s not such a thing here. You make a loan, your death benefit is deducted, it is your prepaid debit card. That simple.

Too much I’ve explained, but let me assure you this: If you get 16% from this type of IUL, you get 16%. Period!

Lol, you don’t get it and no amount of me explaining is going to get you to understand relatively basic math. Just know that when you post BS and lie, that I will call you on it.

You’re still ignoring the interest on the loans. You can’t get back your premiums to spend while you’re alive without paying the 5% interest. Paying that interest lowers your returns. It’s no different than if I buy a mutual find that charges me 5% commission per year. Paying the 5% commission means my returns will be 5% lower.

You say the loan is never paid back. It is paid back from the death benefit. The 5% compound interest every year is reducing the death benefit.

Now, I believe you are just as ignorant as I have been saying all along. Am I talking to little Marcus there? Did your dad allow you to get into adult conversations?

You can’t get back your premiums? LOL…What is the $8K out of $10K called?

So, I bet you do the following:

You invest $10K on something. You get $12,000 out of that investment. What do you do next if you know is working so good? You, as an idiot, put only $10K, not the $12K…right?

“The 5% compound interest every year is reducing the death benefit.” Man! You are a genius!

**So, the IUL I described, not selling nor offering to anybody here since you guys are high tech when it comes to your own money, “uses” an option B. This option, allows the DEATH BENEFIT to increase. <----Yes dummy genius, it increases by contract to allow the payment of loans

““The loans won’t be deducted from the returns, it is the death benefit that is deducted since the increases help to pay for the loans.””

Again, and again, stop being an ignorant. Compound 5% interests? Jesus! Loans are paid by the death benefit, done! Finito!

Man! Hard to deal with ignorant people, really!

I forgot to add:

This is a conservative way to your retirement. Don’t forget that. And, as years go by, you can loan 100% of your premiums. Duh!

Lol. It’s like you’re arguing 2+2 isn’t 4 by saying the sky is blue.

spy futures are down for tomorrow.

Scared too soon…

HK trading in deep red!

Scared too soon…

i’m laughing today - it was a god damn good day  sq, nxnt, irbt, almost all green… except… jd.

sq, nxnt, irbt, almost all green… except… jd.

I love to smell defeat…