How many .coms have become half the size of amazon? Pay the premium for the winner, because there’s a reason they’re the winner. They’ll keep winning.

Except that Alibaba is more like Ebay and JD is more like Amazon. Alibaba doesn’t hold any of its own inventory, JD does. JD also builds out huge fulfillment centers throughout China, with its own huge delivery teams guaranteeing fast delivery.

They are doing different things. Why choose? I own them both.

You might want to compare a historical eBay vs amazon chart. Comparing jd to eBay isn’t a compelling reason to buy it.

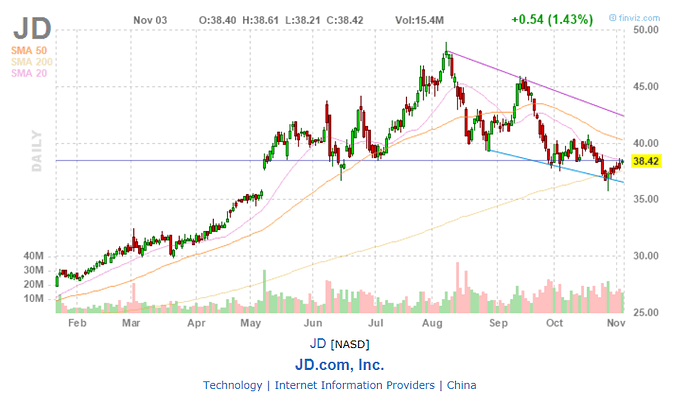

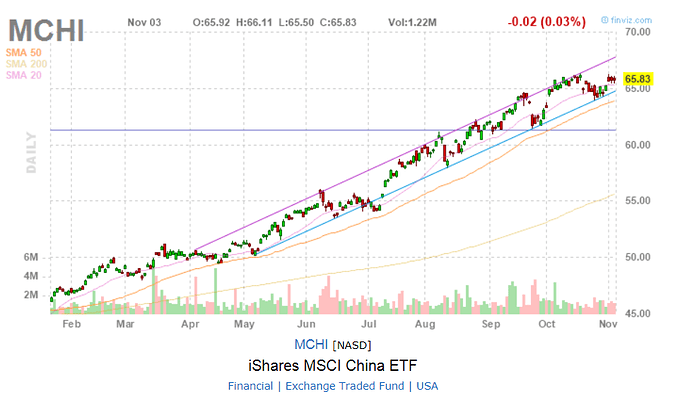

Technical, short term look, both JD and MOMO tracks the downward trend.

Better to choose something like MCHI - an ETF from iShares.

Sold previous buy (gain is enough to pay for a pair of AirPods) and now waiting for another opportunity (at e) to grab may be some calls ![]()

Really??? Only if I had a crystal ball…

The prosperous 8

UBNT - IoT

SHOP - eCommerce/ multi-channel

VEEV - eCommerce/ healthcare

SPLK - Big data analytics

NTNX - Enterprise cloud infrastructure/ HCI

PANW - Network security

IRBT - Smart home/ cleaning robots

AMBA - Semiconductor/ Smart Home/ Video processing & Computer Vision chip

Add few more, these are worth following

CGNX

ANET

TREE

NTNX is up nicely on an upgrade. I heard NTNX mentioned during a CDW commercial on TV.

I bought Jan calls in: BABA, MCHI, SMH, and XLE.

At some point, IB implemented filters on options. That’s why I couldn’t see beyond Jan-18. I’m sure they did it to reduce data and improve data load times. I just had to remove the filters and now I can see the whole options world again.

I hope chinese stocks doesn’t disappoint you. Based on quick google, they are at historich highs, and they seem fairly volatile for Jan Calls (2018?).

For interactive brokers, are you doing it on desktop or mobile? Try mobile app, it’s pretty intuitive.

For my options play, I am doing BA, COST, FB. Had pretty good luck with NVDA and still holding it. Others have also treated me nicely. For some reason Cost is my favorite, probably because i do shop at costco, and applaud their customer-first approach. I had meh luck with EFX.

I tend to buy longer term, in the money options (3-4 strike prices down, for lack of a better word)

BP is skyrocketing

Who knew… Oil is benefiting from the World wide recovery and Saudi instability … helps pay my fuel bill

Why calls on BABA, MCHI and SMH? IMO, Calls means short term speculation?

They are leading right now. Chart says higher. I usually prefer 3-4 months with options. This is 2.5 months. Similar to Tomato, I go far enough in the money the time premium is near zero. It’s a way to use leverage at a defined risk level for a defined time period. I use the 10-day moving average as a stop. If the stock goes below that, I’m out.

BP is skyrocketing

Who knew… Oil is benefiting from the World wide recovery and Saudi instability … helps pay my fuel bill

Ai yo yo… since you need attention… I owned CVX ![]() Use to have BP too when it is beaten to death because of the oil spill… sold all… now owned CVX and OXY… green despite the talks about oil is goner… reason is because bought at the peak of fear

Use to have BP too when it is beaten to death because of the oil spill… sold all… now owned CVX and OXY… green despite the talks about oil is goner… reason is because bought at the peak of fear ![]() … this thread is about 10x so I don’t talk about other stocks that are meant for dividends or hedging or big stable growth story like AAPL.

… this thread is about 10x so I don’t talk about other stocks that are meant for dividends or hedging or big stable growth story like AAPL.

Bought 200 SYNA at $36.11, AH $39.25, hope it won’t behave like IRBT, holding my breath.

SYNA would replace AMBA

The prosperous 8

UBNT - IoT

SHOP - eCommerce/ multi-channel

VEEV - eCommerce/ healthcare

SPLK - Big data analytics

NTNX - Enterprise cloud infrastructure/ HCI

PANW - Network security

IRBT - Smart home/ cleaning robots

SYNA - Semiconductor/ Voice chip & TDDI

Watching QCOM (IoT chips), INTC (full spectrum of AI chips)

NVDA can’t be 10x, long calls possible though  those who bought in late 2015 has achieved 10x

those who bought in late 2015 has achieved 10x

Bought QCOM in the low 50s. Wondering if i should take my gains and run else this might go the way of my uncollected gains on SHOP.

Bought QCOM in the low 50s. Wondering if i should take my gains and run else this might go the way of my uncollected gains on SHOP.

I sell on acquisition rumor pops. There’s not much upside and plenty of downside.

Bought 200 SYNA at $36.11, AH $39.25

Went as high as $44.68, now trading above $42, not too bad for a day work… enough to buy an iPhone X.

Today market loves my 10x

PANW + $2.60

SPLK +$2.20

SYNA +$6.00

IRBT +$1.10

Every day like today would be great

Somehow, Mr Market dislikes UBNT? -$1.50? What happen? Earning blue? That is tomorrow.

Posted below chart 1 week ago. Immediate response to earning is dropped to $58.10, didn’t drop as low as $55.02 and was short-lived too, now trading above $64. Looking good. Bought 2 LEAPS 19 ($50) while it was down… much cheaper than underlying… reduce exposure or leverage depends on development. Uh oh… jinx it…