$100,000 invested in this portfolio 48 years ago would now be worth $42.8 million – an increase of $30.6 million over the S&P 500 index.

This is the main reason, power of compounding, early 100% filling of retirement is very essential. If everyone is filling 18k between 20s and 30s in Roth 401k and 5.5k in Roth IRA between 20s and 30s, calculate what they get it at the age of 60 or 65?

I am lazy. If I were to build a portfolio like his with low cost ETF’s can someone give me a list?

VTSMX, VBMFX, VGTSX

?

SP500 funds are VOO, IVV, IVW…etc

ITA is one of the best defense, growing faster than SP500

etfdb.com is the best source.

BRK.B is too good a stock, better than SP500

His last portfolio: Portfolio 8 (lucky!) has 9 asset classes in them. I’d expect at least 9 ETF’s?

Rubbish. Increased diversification will only result in even more diluted returns. To aim for a higher return than the S&P, you need a more concentrated position in a successful stock, or a few successful ones.

There’s no such thing as free lunch. You want diversification and reduced risk, you’ll get lower returns in the long run. Placing a few risky bets is what is needed to achieve market beating results.

Tha’ts why it’s called lazy portfolios.

You are 100% right on this.

However, This needs lot of research to beat SP500

SP500 is just blind investment, no research is required, and can be done periodically.

Best commission free ETFs are VOO, VTI and IVV…etc

I think I will build something similar and gradually move more and more of my money towards it. You can say it’s lazy. But I’d instead say it’s “humble”. People should be well aware of their own limitation.

One thing I would do is replace the emerging market portion with something pure China. Maybe the Hong Kong H share fund.

It’s very interesting idea.

I have a diversity portfolio of VTI, IWN, VEA, and VWO. 25% each. Plus minor positions in a china ETF and a REIT. Basically it’s what that guy is promoting. I held on to that since 2007. As of today it is anything but market beating.

On the contrary, my singular bets on Aapl, googl, bidu, Tsla, and fb have yielded much improved results.

To start with, I make every week automatic transfer to vanguard, then buy VOO when I have sufficient money and when the market dips (negative, even 1%). I get commission free. I do not look at it selling, just keep buying whatever I can. This is although small account, but accumulates over time.

When I use fidelity, I buy IVV, again commission free.

Is it MCHI?

I started with FXI but later replaced it with ASHR.

Thank you but no thank you.

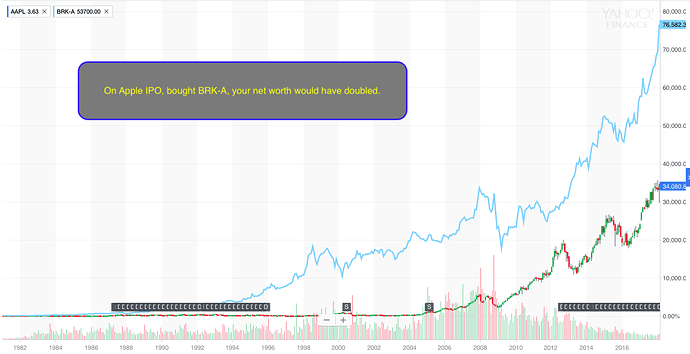

Looking backwards, BRK beats the author’s portfolio by a mile.

Annualized return of BRK is 18-20%

If exist 48 years ago, $100k becomes $282M (18%) to $632M (20%)

Looking backwards has not much meaning.

Investment is about the future.

Tell me what would happen in the future.

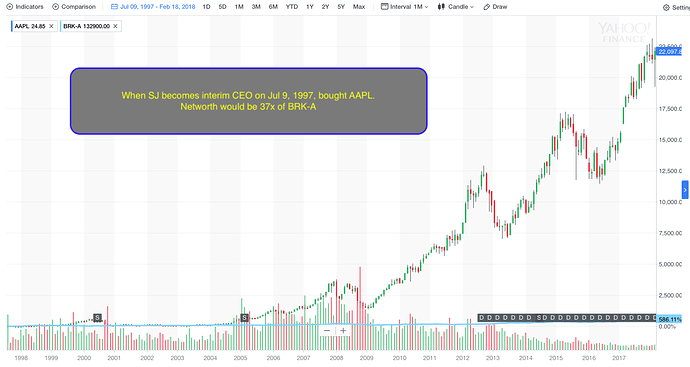

Investing is indeed about looking out to the future. Then why are you always looking backward at AAPL?

Your question presumes that I’ve looked backward ![]() Proofs?

Proofs?

Err ain’t your charts historical charts? Can you show me charts from the future?