That is a good question. How for ahead does one look at when valuing a company. Amazon would get valued in 2004 what investors at time thought amazon would grow in next 3-5 years. I do not believe investors look at what a company will be in next 20 years. Else stock price will be traded at valuation 20 years into future, but that is not how stock market works.

.

I remember nothing. Is all about iPhone iPhone iPhone for next 10 years after iPhone launch. Everything is ![]()

I am not one of those. Doubt any tech investors are.

Bullish thesis for PLTR.

Bearish thesis.

Excessive SBC. Doesn’t matter how much revenue, so long SBC is more than revenue, can’t make money.

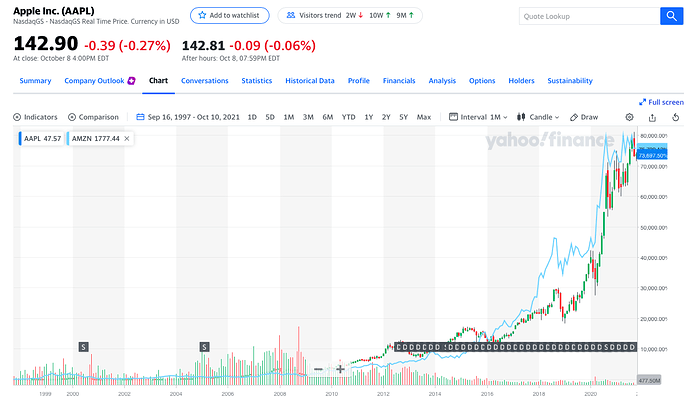

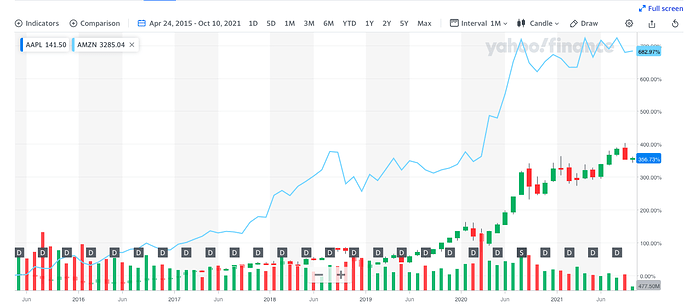

Comparing two 1000 baggers, AAPL vs AMZN,

Since late SJ became interim CEO on Sep 16, 1997, neck to neck performance,

Jeff Bezos pulls a rabbit on Apr 24 2015, letting the world know AWS is printing money, AMZN was underperforming AAPL since return of late SJ until then, moon after the news,

Buffett wrote in 1967:

So the really big money tends to be made by investors who are right on qualitative decisions but, at least in my opinion, the more sure money tends to be made on the obvious quantitative decisions.

That is the reason why WB is no longer the richest man. Elon Musk who he loves to ridicule, beat him hollow. He has since learned his lesson, he started investing in STNE, SNOW, etc. F… the quantitative…

Wondering aloud: How come WB has moved on yet some1 still quote his old saying? Must I tell the old and young monks, and a pretty woman story again.

Sure money? Invest in S&P index funds/ ETFs. Everybody should do so. But allocate some doles for moonshots. Still don’t understand? Never mind. SMH.

https://seekingalpha.com/article/4459384-3-investment-books-have-shaped-my-investing

3 Investment Books That Have Shaped My Investing

- Common Stocks and Uncommon Profits - Philip Fisher

- 100 Baggers - Chris Mayer

- One Up On Wall Street - Peter Lynch

| Growth per year | Years to 100-bagger status |

|---|---|

| 14.1% | 35 years |

| 16.6% | 30 years |

| 20.2% | 25 years |

| 25.9% | 20 years |

| 35.9% | 15 years |

| 58.4% | 10 years |

Need to find something that grows 60% a year.

.

A TSLA? A TTD? A SHOP? A HUBS? Familiar? Yes, always hot stocks. If nobody talk about them, don’t bother.

Bitcoin.

Actually is NFT. Hyper growth phase of BTC is over.

I believe NFT of tulips is the right NFT.

Anyhoo, I like the Fisher book a lot.

Fisher insists on deep research. In his days, that was through the scuttlebutt method. Later, it was also called the mosaic theory. It means that you collect as much publicly available information that if you put the pieces together, you see something that other investors don’t see, the bigger picture as it were.

Problem is so many stocks to do deep dive, insufficient time. How to quickly select 4-5 potentials?

Pay that SA guy $35 a month and he will do it for you.

Every week, he will tell you one. All I need is one (e.g. AAPL or AMZN) for 25 years.

Selling these great companies has cost me much more money than all of my losers combined.

Not many investors realized above. In fact, no traders realize that.

I think in general valuations are very subjective because they start from certain assumptions that are very uncertain and the best companies can make great moves that completely change their trajectory.

Did he follow this forum? Anyhoo, I am hoping that MTTR has just did that move ![]() U has done that move (AR/VR) years ago. U and MTTR, the two metaverse stocks are my highest conviction 100 bagger stocks atm… subject to change… bad habit is back

U has done that move (AR/VR) years ago. U and MTTR, the two metaverse stocks are my highest conviction 100 bagger stocks atm… subject to change… bad habit is back ![]()

$GTLB anyone?

Based in San Francisco, not Austin.

.

I presume you are persuading your inner self to ignore valuation.