Valuation is for seniors investing in Austin-based companies like HP.

Valuation is for seniors investing in Austin-based companies like HP.

Do your DD and tell me whether MQ is the one that matter. You only need one. I got AAPL and my return is better than B Graham for GEICO and Gardner for AMZN. So whatever he said, I know. In fact, I went 100% IN, not 50%. AAPL then failed all his value and growth metrics, haha. What drive stock performance? Founder CEO who is as good as late SJ ![]() F… the metrics.

F… the metrics.

His analogy is incorrect. Nowadays, investors pay way more than what he said they did.

Gardner ![]() He

He ![]() on AAPL and AAPL investors for many years, missing the monster rally. I use to subscribe to MF, I cancelled it because I think he is full of

on AAPL and AAPL investors for many years, missing the monster rally. I use to subscribe to MF, I cancelled it because I think he is full of ![]()

Gardner got AMZN right tho. I actually didn’t know about him before this video. What other hits did he have?

Puru’s portfolio. One big flaw of Puru is that he sometimes got emotional on Bitcoin, to the point of one time even shorting it. But Puru is great on being flexible and open to changing his minds. He realizes his mistakes early and doesn’t let his ego get in the way of changing course.

He sold UPST early but realized he made a mistake and bought back later. Puru also got in on MQ and LSPD. I don’t have much overlap with Puru actually.

![]()

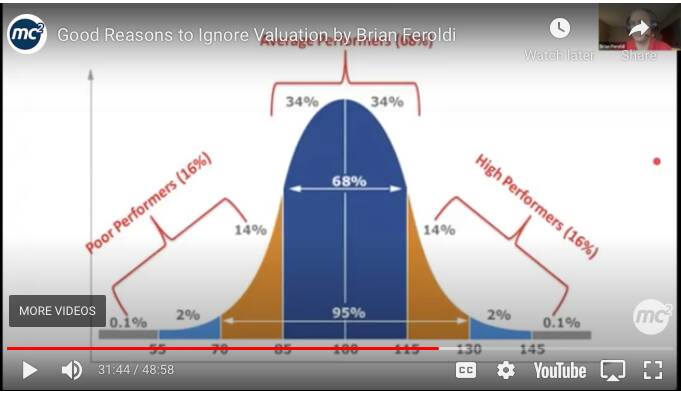

This chart is quite good.

2nd one looks like…

My investment philosophy is…

Founder-CEO 60%

Business quality 30%

Valuation 10%

But Apple is not founder led….

Number 4. Maturity already, no need for founder led. Just use valuation metrics

CONTEXT  Not obvious this thread is about 2. Launch and early 3. Hypergrowth?

Not obvious this thread is about 2. Launch and early 3. Hypergrowth?

Andrew from HK & CTO at Clover

This is something I have been saying for years - the left wants use monopoly as a ploy to kill successful companies. AT&T is a good example we discussed a few days ago. A company that bought telephony to the world was killed by jealous and envy.

Below is the price chart of VUZI, where is the equivalent place for UPST and NET?

Alternate to real 1000 baggers like AAPL and AMZN or solid stocks with 25-33% CAGR, catching stocks like VUZI once a year is even better.

Some of the stocks mentioned in the superstocks seekers’ articles are likely to be 100 baggers (ofc, easier to find stocks with 25-33% CAGR and replace whenever they are not)

Of the list, I have NVVE DOCU TDOC SE OKTA CRWD U

Roku Stock: The 10-Year Thesis

Not 100x. But 10x in 10 years from current valuation is without question IMO.

Huge run up today. It has a potential to make a meme stock like a run-up. I only have 2000 shares.

I have 2000 shares too