There is only one whale here → @wuqijun

I feel unique

Which stock are you referring to? VUZI?

Looking at a few charts, beginning to think buying even 10 baggers would be very hard because…

previously e.g.around 2017, companies IPO at less than $1B e.g. TTD, nowadays, companies IPO/ DPO at multiple $B e.g. PLTR. You would be lucky it won’t decline after IPO/ DPO immediately or after a few months… PATH did that.

Chart of TTD, 44x over 4 years, can only dream now…

Chart of PATH, IPO/ DPO at multiple of $B, declines immediately…

No AAPL, not interested. I will focus on metaverse.

Picked up some CLOV for Dec $7.5 call.

They are killing the options every week. I would recommend buying shares. I have 13k shares.

YOLO

13k shares of CLOV?

They seem to have beaten their last revenue guidance by quite a bit

https://seekingalpha.com/symbol/CLOV/earnings

What’s the prediction? This is an undervalued business? @mcp or @pastora ?

Mgmnt has announced they will be profitable only in 2023. Earnings on Nov 8. Last ER it went up 18% from what I read. They are slowly expanding and revenue is increasing. Recently they got upgraded from 3 to 3.5 star. I more believe in Andrew Toy to implement AI in a proper way. Price prediction is 12-14 short term. But it’s also treated as meme stock so if you are lucky it may go to $30!

I’m perfectly fine with losing it. It’s a yolo options call for $5k pretty close to the money. Any spike to 9-10 range before December, I’ll sell quickly.

This guy interprets what Alex Karp said as share price would 20x. He is talking to investors in the public but is speaking to engineers that excessive SBC can be sustained. He meant market cap would be 20x.

Market cap = Number of shares x share price

So market cap can grow 20x and with the same share price, plenty of SBC to be issued.

He is using Cathie’s target for TSLA. 3x over 5 years is not that great. DWAC easily trumped that.

Genius who know everything, @manch

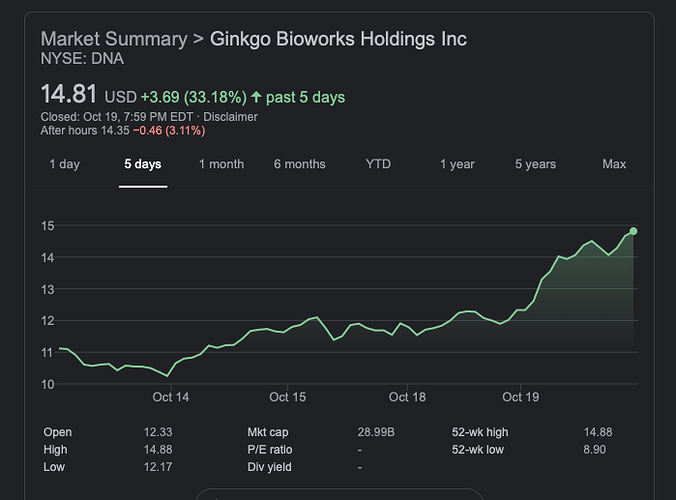

What do you think of Ginkgo Bioworks, DNA, which could realize a Jurassic Park  A 1000 bagger potential? DNA has a similar business strategy as PLTR, take a stake of companies that use their products. Product wise, just like PLTR, is highly configurable. So we have a potential Jurassic Park (DNA) and a potential Skynet (PLTR)… should I be worried about human existence?

A 1000 bagger potential? DNA has a similar business strategy as PLTR, take a stake of companies that use their products. Product wise, just like PLTR, is highly configurable. So we have a potential Jurassic Park (DNA) and a potential Skynet (PLTR)… should I be worried about human existence?

Status of holdings: Sold half, left with 1000 shares.

Have no clue about biotech. May need to kiss many bad frogs before finding a prince.

Companies like Cloudfare is much more understandable for a layperson like me.

This article is super long. But the gist of it is this. Cloudfare has an insane and accelerating development cycle. They are releasing new features that expand their TAM by billions every month. And the speed is compounding as their software is composable like Lego blocks. So more blocks mean faster speed into creating these software blocks, and the flywheel feeds on itself.

There is no way to do any quantitative financial analysis on such a thing. So maybe just ignore valuation and accumulate blindly. Their current P/S ratio is a nose-bleeding 106X.

Kicking myself for not buying on the recent dip when they announced object storage.

I’ve now started selling puts twice a month aggressively to capture any drop.

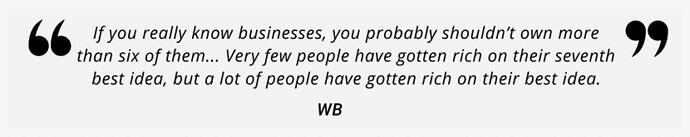

If you own more than 6 stocks, you are too diversified ![]()

I have AAPL and S&P index fund, so need four more ![]() U MTTR RBLX COIN NET FSLY PATH PLTR SNOW… which?

U MTTR RBLX COIN NET FSLY PATH PLTR SNOW… which?

SandP index is as diverse as you can be.