NVDA is a Omniverse stock, which is a superset of Metaverse.

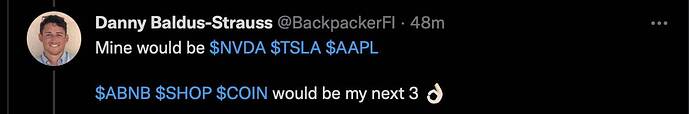

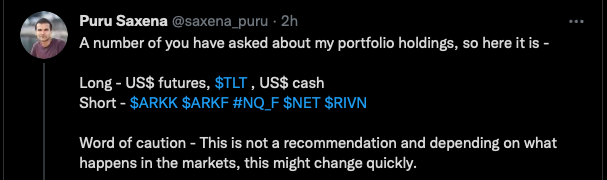

Puru is short one of @manch’s favorite stock, NET…

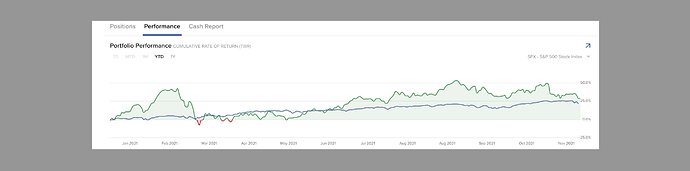

Month of Nov is brutal to his best hyper growth stock portfolio,

Hardly above S&P, Nasdaq and AAPL. The main reason is his portfolio comprises mostly e-commerce and fintech stocks, many are recent IPOs,… he doesn’t believe in FANGMANT, thinking they no longer in hyper growth phase which is true ![]() …

…

I like this guy’s portfolio:

| Symbol | Percent Allocation |

|---|---|

| NET | 33% |

| DDOG | 28% |

| SNOW | 15% |

| ZS | 12% |

| CRWD | 9% |

| TWLO | 2% |

| YTD Return | 69% |

Updated November 26, 2021 after Market Close

Pretty good, without hedging too. His winning formula is not the selection of stocks, is his actively managed size of each stock… dynamic changing. Need to read up on his past postings and detailed analysis, so much things to read, not enough time, have to blog less.

I think it is important for investors to consider not just the historical financial performance of the stock, but the future potential for the company’s products within the evolving market for software services. This is why I spend significant time in stock analysis on product offerings, the total addressable market, emerging technology trends and competitive positioning. I think successful investing, particularly in software, is as much about anticipating how a company’s products will line up against future market dynamics, as it is about viewing past financial performance. Deeply understanding the “why” around the software space is just as important as the “what”. This often requires tedious scrutiny of the technology underpinnings of a company’s solutions and how those create a competitive moat.

Agree but don’t have the skillsets to do these kind of analysis.

Only 6 stocks, perfect! Less is more. Something for @manch to learn, guess he already knew, 6 is great, 1 is the best.

Peter is the opposite of Puru. Peter really knows his stuff. Used to be CTO of some company. His posts are super long though. Takes lots of time to read and understand. His post on the accelerating product release cycle of NET was one reason I made a concentrated bet on NET.

.

Concentrated bet ![]() 20% of portfolio?

20% of portfolio?

I own those six stocks in different time, now only have SNOW TWLO. Sucks, own his lowest allocation. I am watching closely NET DDOG CRWD, was doing so before his post, I think they are doing something right… from the way the stock behave.

After reading his way, I think I have to learn to cut holdings to 10% instead of to 1/3 once I detected is completion of wave 1… retracement of wave 2 is pretty deep ![]() Now I feel foolish to hold so much U MTTR to ride wave 2.

Now I feel foolish to hold so much U MTTR to ride wave 2.

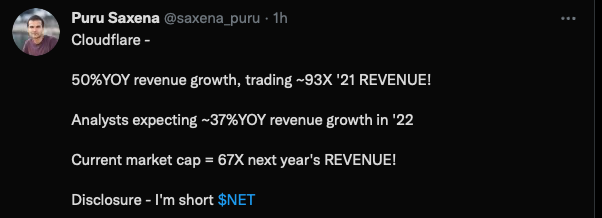

Mostly cash + short!

No stocks.

Kevin Praffath. Worthwhile listening his non-financial advice. He is a buy n hold stock investor + RE investor + occasional swing trading. I didn’t follow him for long, too time consuming to view his earlier videos, I think he is 80% buy n hold and 20% swing trade.

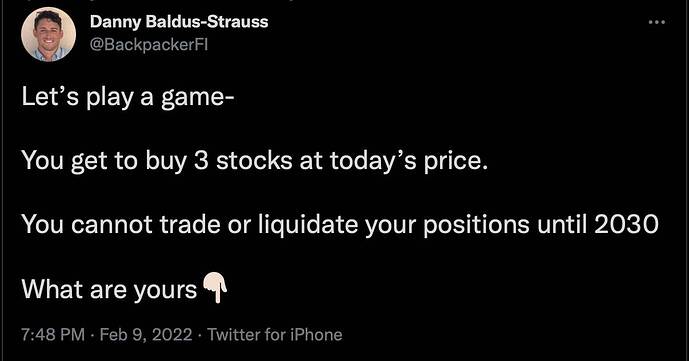

May be a few of these would be 10x to 100x? over 8-10 years ![]() That is min CAGR of 25% (of note is CAGR of AAPL is above this since 1/1/2019.)

That is min CAGR of 25% (of note is CAGR of AAPL is above this since 1/1/2019.)

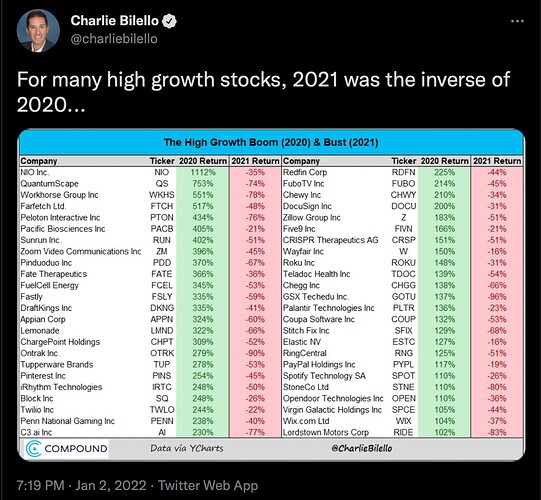

How about High Growth Boom (2020) and then some (2021):

TSLA (70% of my portfolio): 822% (2020) and 56% (2021)

AAPL (20% of my portfolio): 82% (2020) and 35% (2021)

Own the right stocks please…

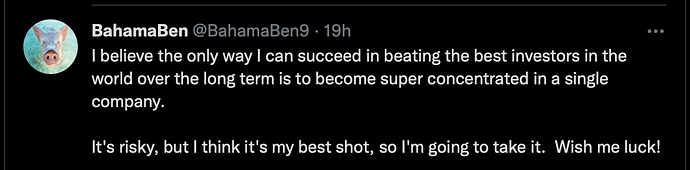

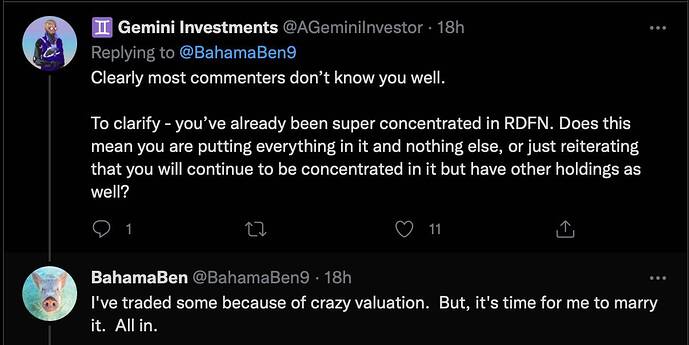

Another one is enlightened. Btw, not a financial advice. Don’t own RDFN. Doubt RDFN is a good long term investment.

RBLX or COIN is a much better investment IMO. I’m waiting to load up…

I continue to catch these falling knives, hand is bloody now.

Tell me about falling knives.

My PayPal, CRM, U, Mndy are at 15 or 20% loss.

I am waiting to buy COIN as well.

But if there is one I would go all-in is SpaceX. There are some spacex shares available in the secondary markets but I’m going to wait a little bit before the stock market euphoria is over to pick up at a better price. I’ll try to buy at least $20k every year for the next 10 years.

My journey is relatively new and started late ( and got beaten down out of gate- not a good start). If I have to make suggestions based on what I read recently:

Gme

Upst

Coin

Ionq (Quantum computing)

Beam and Ntla (gene editing)