Phil Fisher… 15 points for buying…

.

Look like is an even bigger mistake to buy back.

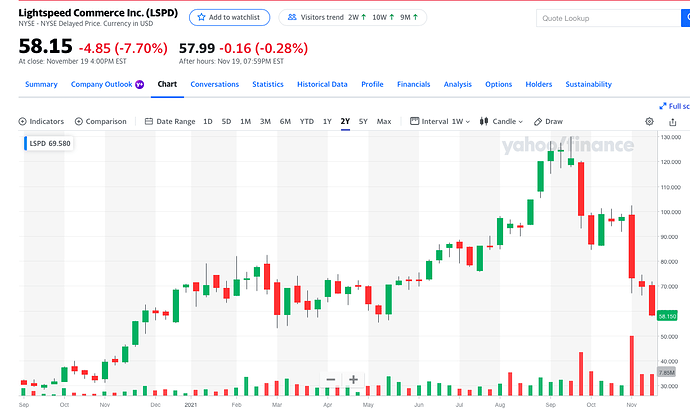

Huge mistake to sell NET and ABNB to buy the above two too.

See why he is so bearish now?

NET

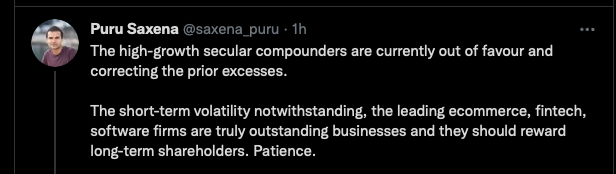

Puru gets too emotional sometimes and likes to get into arguments with random strangers. I said before and I still think he made a mistake shorting Rivian. Not that Rivian won’t go down and his short won’t be profitable. It’s just a random move out of spite. And I don’t get why he shorted ARKK. As a hedge against his longs? But how similar is his portfolio with ARKK?

.

He claimed that he had backtested to verify that ARKK correlates with his portfolio. Frankly, I don’t think so. ARKK has lots of TSLAs, COINs and Us. Whatever correlation existed previously, no longer exist because the market has changed.

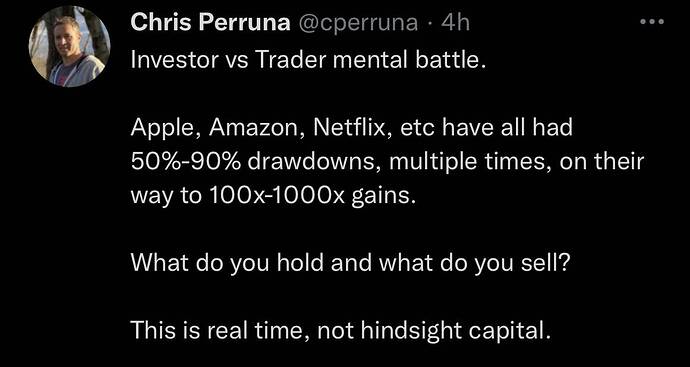

Chris and Puru had bad fights on Twitter in the past. Wonder if he wrote that with Puru in mind…

I didn’t bother to read back, Puru keeps tweeting bad things about Chris.

In the above interview, Puru articulates his hedging strategy in detail. Why I post about him here? Because his CAGR of his portfolio is 50+%… so would 100x in 12 years. There is something to learn from him… stock picks and portfolio management, not his ranting ![]()

![]()

My attention span is not that long.

What is best way to watch a vidoe this long without spending 1+ hours?

I think clicking on the timeline will show the content discussed, or if you want to listen to hedging only, go to the middle of the video. Usually I browse and listen at the same time.

Another FA guy realizes the importance of the CEO and the top leadership team.

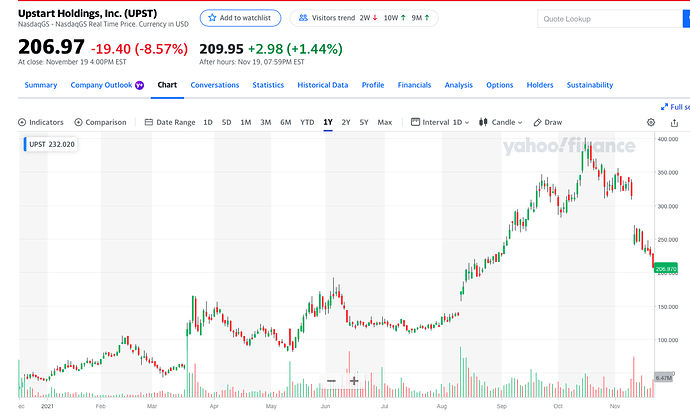

i bought LSPD and MQ based on Puru.  either way I am holding. I am bullish on fintech/payments in general and I don’t need the money right now (its in my “trading” account). and while they might not be 100 baggers, its okay.

either way I am holding. I am bullish on fintech/payments in general and I don’t need the money right now (its in my “trading” account). and while they might not be 100 baggers, its okay.

.

Didn’t have LSPD. Bot MQ at ~$23, barely breakeven. Went from very green to red now. 50% haircut in one month!

Fintech/payments and e-commerce stocks are being slaughtered recently. So the problem is not with MQ. Mr Market suddenly doesn’t like fintech, payment and e-commerce stocks.

Could be 1000x baggers ![]() Look at early day price behavior of AAPL…

Look at early day price behavior of AAPL…

Are these Puru/Chamath/etc also influencers like the Kardashian family ?

Joking…

The entire Fintwit was fintech crazy when I started following. Many have quietly moved on.

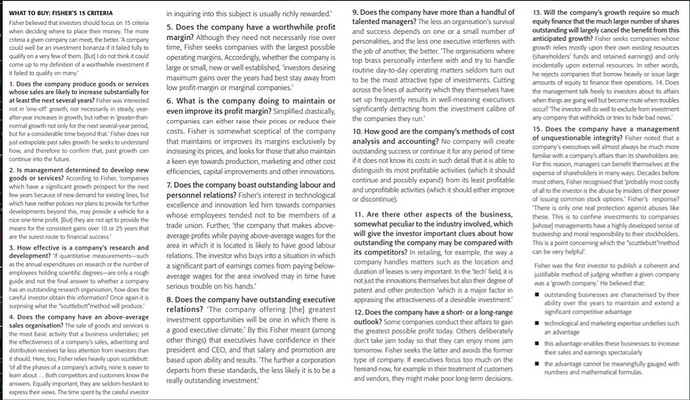

Remember the Mark guy, What does UPST do? That interview marks the peak.

Usually craze is correct in the mega trend but seldom right about the specific stock that make it. I believe 1-2 of that group would hit $1T market cap… have to use your skill (if you have it), I don’t have skill so I will use my lucky star to choose… I have chosen MQ and UPST.

He made a few assumptions:

a. He selected the correct stocks;

b. No new comers that would disrupt his selected stocks; and

c. These are the best segment to invest in.

He has ignored the metaverse, blockchain, EV/AV and clean energy trends.

Is Nvidia considered high growth? It’s been doing very well.

Most of Puru stocks are recent  IPO. He has the prejudice that businesses listed for a long time is growth to stagnant. My computation indicates that his portfolio (excluding hedging) grows at 15-20% for the past five years which is even slower than AAPL. He achieves 50+% because of hedging/ shorting.

IPO. He has the prejudice that businesses listed for a long time is growth to stagnant. My computation indicates that his portfolio (excluding hedging) grows at 15-20% for the past five years which is even slower than AAPL. He achieves 50+% because of hedging/ shorting.

Stocks doing very well that Puru didn’t own…

MTTR (Puru sold it for $20s after re-evaluating it as a loser), since then it roars to $33

RBLX

COIN

NVDA

(take note, they are all metaverse stocks)