Both roku and shop crashed so much it will take some kind of a miracle to turn them around. I don’t even know who the CEOs are behind these companies and that says a lot about them already. Avoid both.

.

I was asking @manch ![]()

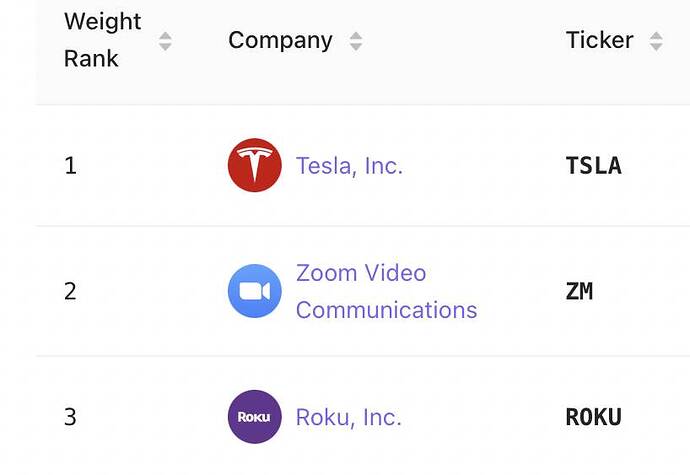

Was the initial bull case wrong or the market has changed? Or the market is wrong as claimed by Beth and Cathie. ROKU is number 3 for Cathie. Surely Beth and Cathie did the proper research, right? Can you see investors can come up with different conclusions with proper research.

I don’t know whether is true or not but I was told by many friends and ex-colleagues of this axiom.

Exactly. Tricky and difficult. Not many people can do it. They are better off investing in S&P ![]()

That’s where CEO comes in ![]()

You can’t borrow other people’s convictions. If you doubt ROKU or SHOP that means they are not for you.

.

You are correct. Now can you please answer the question ![]()

Btw, from here, it is highly possible that TQQQ would outperform most “high growth” stocks for many years.

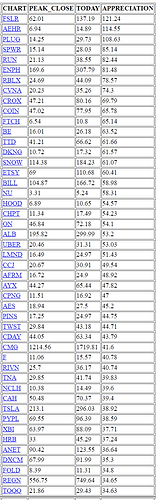

Tag: Jun 16 2022 ![]() Will monitor for 3 years. TQQQ vs RBLX U COIN NET TEAM

Will monitor for 3 years. TQQQ vs RBLX U COIN NET TEAM

All I can say is none of the following:

![]()

Talk so much, no conviction. Anyone can talk concepts and philosophies.

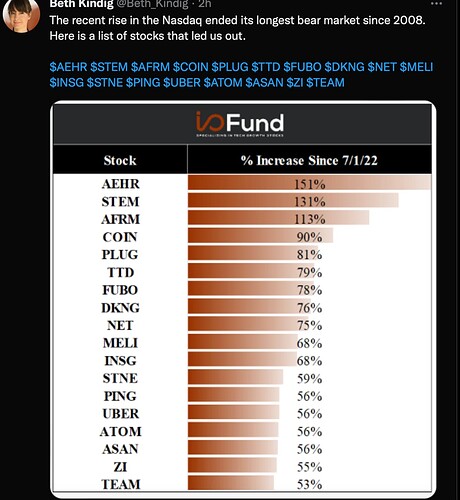

Hmmm…. You missed the boat AEHR clearly, good semi conductor testing company, long future.

I used to hold 5000 AEHR appx at $12 sold it to $22 later when I decided to go for my own way on ETFs only. I used to nicely trade this stock.

It has to be year or before as I do not look at stocks.

Do your research and buy it bull when you get a chance again at $8 or near by.

Or simply follow the stock like AAPL and buy it when you are comfortable.

My research was very as old as my MRNA, BNTX times and I do not know the prospects now.

You need to do your own research and mandatory too.

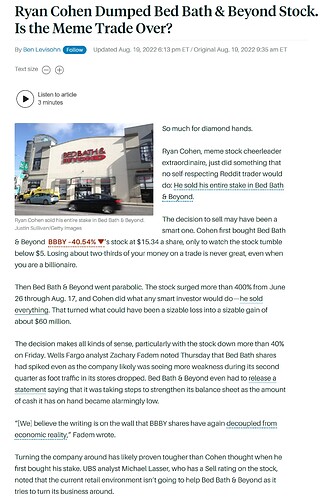

This is the example why fundamentals are important and do not follow stock price jumping without real fundamental value behind it.

Reddit retailers are crushed by Billionaire here !

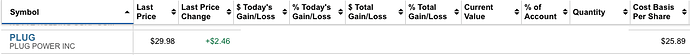

@hanera add this PLUG in your 100x company list and watch for break through. There are two companies in Fuel Cell, PLUG & BE.

Fuel cell is still not commercially viable. If it makes breakthrough, it is 100x easily.

BTW: This PLUG was less than $1 few years before, looks like EV revolution bringing up its price higher.

Now, see this news

Powell said today he wants to be Paul Volker not Arthur Burns

Not good news for bulls. Test the June lows. September and October are bad months for stocks. 1987 repeat?

The best thing about the latest downturn is that it exposed all the lies about crypto. Number 1 is not digital gold. Has no safety net value

Cryptocurrencies are still so new that it’s next to impossible to take much from their history. And with little backing them up besides the faith of other crypto traders, they’re even more subject to shifts in mood. It wasn’t so long ago, after all, that the standard case for crypto was that it could be a hedge against inflation or falling prices in traditional assets. Now it’s looking like just another speculative bet that works when investors have a taste for risk—and goes deep, dark scarlet when they don’t.

.

MRNA.

Those break below Jun low, sell.

I read posts like this one

.

Insights are? From OP or replies?

Knowing and doing is two different activities. Many people know need to control emotions but can’t control emotions. Need lessons on how to control emotions and be patient ![]() Most people regardless how much you teach them, they can’t do it, is why…

Most people regardless how much you teach them, they can’t do it, is why…

DCA purchasing of S&P

is the right way for most people.

Only this post from OP. I do not follow them.

Now is the time to analyze all IPO for fundamentals and grab good ones.

QQQ is best one for DCA.

.

![]()

This is what prompted me to look at the price chart of AAPL. AAPL goes nowhere for more than 20 years after IPO. However, have you bought at the low, price is always above that price.

AAPL started the multi year climb from the introduction of iPod. So IMHO analyzing fundamental means verifying there is an iPod product (iPhone would be ![]() ) that would lead to an iPhone product and not the financials only. Without which is not worth the risk.

) that would lead to an iPhone product and not the financials only. Without which is not worth the risk.

Correct, investor needs to look at every angle for long term growth. This is where CANSLIM principles comes handy. Google CANSLIM.