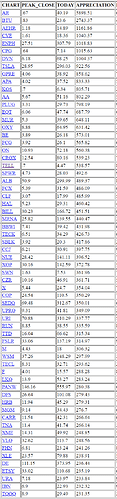

Companies exceeded TQQQ since Mar 23, 2020

.

![]()

Already have PLUG SPWR RBLX COIN BE SNOW TQQQ. No need any more ![]()

TSLA is low market cap?

Have TSLA PLUG BE SPWR DE

Energy and ESG stocks. Don’t think want to chase. Usually turn out to be below par return.

A quick shortlist is RBLX COIN SNOW TQQQ.

I always monitor those 510 stocks/etfs in my system and try to see which one exceeds TQQQ.

All I have posted are the list, it does not have any checks whether the companies are good, bad or ugly…etc

It is just a post, never asks blindly buy or sell. It is up to investors what is best for him/her.

I do not own any of the stocks.

My top four 10-100 baggers (over 10 years) hopefuls. All except U are in multi-day uptrend.

Daily Chart: All except SHOP are above 50-day SMA and ichimoku cloud, but below 200-day SMA. So according to stage analysis, is still in stage 1, not in stage 2 yet.

Conclusion: Still in multi-month downtrend ![]()

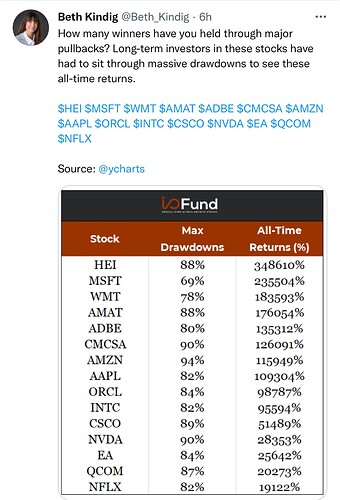

Whoever wants to get in individual stocks needs to review this kind of stock and buy at deep recession bottom. There are brighter chances of good growth

BTW: This is not stock advice, you need to do research.

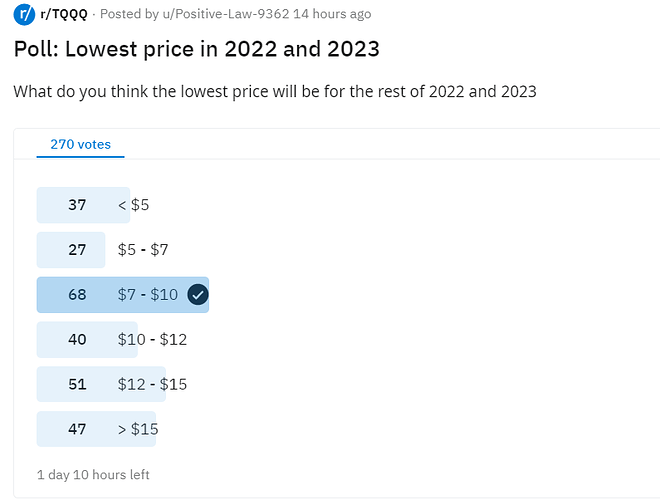

Start date: Oct 1, 2022

End date: Sep 30, 2042

Which stock would give the highest return?

On Oct 11, 2022: AEHR COIN MRNA

For easy reference…

Current market cap

RBLX $22.7B

U $9.4B

COIN $18.3B

NVDA $287B

NET $17.3B

SNOW $52.6B

BNTX $34.7B

MRNA $52.3B

AEHR $404M

UMC $14.4B

To reach $1T market cap and 100x over 20 years mean less than $10B market cap now.

Only two stocks are below $10B, U and AEHR.

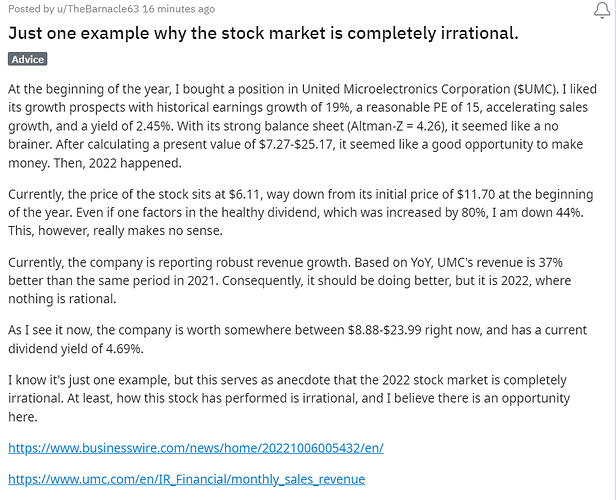

For those who like to focus on ST financial performance, WB has this to say…

13. On big-picture thinking

When Buffett was asked whether today’s companies are too short-term-focused, he said, “We don’t ignore yearly earnings, but we don’t live by them.”

Buffett added that he is looking for businesses to be “widening their moat,” or improving their competitive advantage. Essentially, while earnings are important, he wants businesses to be constantly improving, and that doesn’t always immediately translate to bottom-line results.

Quarterly results are too ST, even yearly earning is not sufficiently LT. Is why I am surprised some investors can deduce that a company is a secular compounder from a few quarterly financial results. IMHO, that is a wild bet… success doesn’t mean correct judgement, failure doesn’t mean bad judgement… merely random events.

When you listen Warren buffet, he also said read intelligent investor through which he made his fortune.

If you read that book, all answers are there.

His old method doesn’t work. The book should be updated. WB has changed his approach. He bought IPO and tech stocks. Book is for buying stocks like JNJ PG MA V KO… might as well buy S&P.

Hmmm, your conviction !

That Book is kind of bible of investments, never change !!

Even after 100 years, that will work with out change!!!

Since because he purchased IPO, do not think it is broken etc.

That shows he is true investor with open mindset. He will buy anything that will return him money !

I had read many financial books, intelligent investors is one of those. Already forgot everything, also forgot everything I learn in BEng(EE) and MBA. Not interested to revise my knowledge. If want to invest long term, just DCA purchase of S&P, no brainer, no effort. Nowadays, everything that require too much brain power is worthless… past the age of spending so much time in learning… better just watch TV serials and blogging.

IPO has no track record. WB did mention he has changed some of his philosophy. Too lazy to search the web for that.

Completely understand you forgot!

The answer is in that book!

Are you referring to the moat theory, high and growing margin, and high revenue growth? All these can change in a flash in today’s highly competitive market.

No answer! Read it and you will know !!

Glance through the book. Guess you are referring to margin of safety. That is a good concept but can’t be computed reliably. Many online calculators for computing that using well GIGO data. If need more than 30 seconds to read and another 30 seconds to compute anything, can’t be bother ![]() Better just watch TV serials and DCA purchase of S&P (effortless). I have past the age of reading these type of books unless you can tell me over 90% chance of making 1000x if I read it. Time is precious.

Better just watch TV serials and DCA purchase of S&P (effortless). I have past the age of reading these type of books unless you can tell me over 90% chance of making 1000x if I read it. Time is precious.

True, same here. Let us Enjoy the precious life !

.

Actually I have enough money, my priority now money can’t help.