Health? Longevity?

Action: Monitor closely ![]()

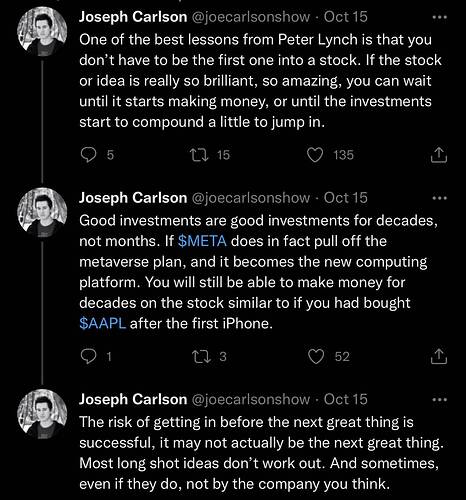

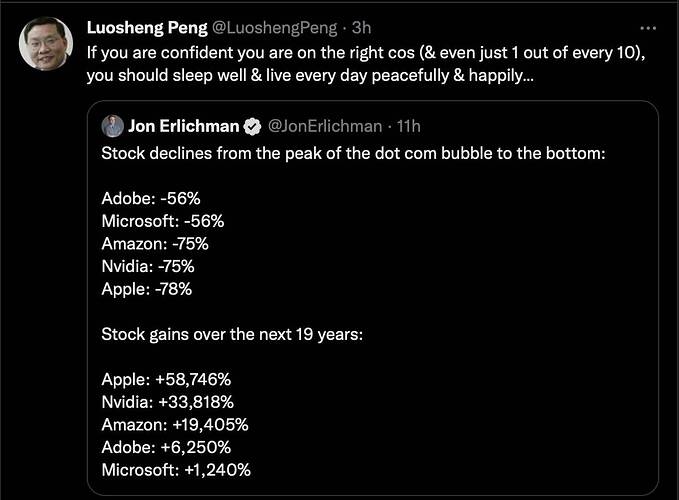

Frankly I am not sure this type of reasoning is correct, sound logical, that’s about it.

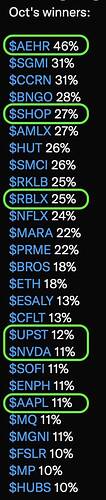

Potentials that are in stage 2 (above 30-week EMA)…

AEHR

RBLX

Is Cramer still short NVDA?

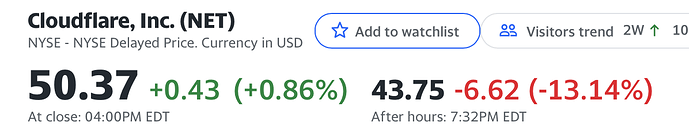

https://finance.yahoo.com/m/b964845c-2cf8-33e3-99c7-38bcb9e83e03/cloudflare-shares-slip.html

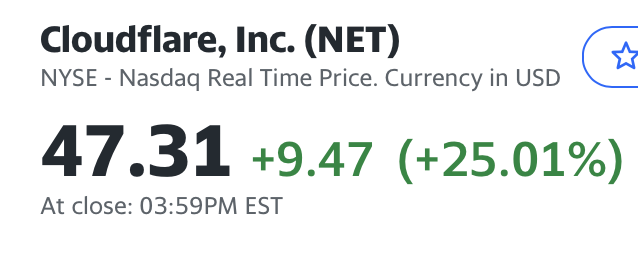

Cloudflare shares are heading lower in late trading Thursday, after the internet infrastructure company posted strong third-quarter earnings, but provided operating metrics that hinted at moderating growth

Too much competition.

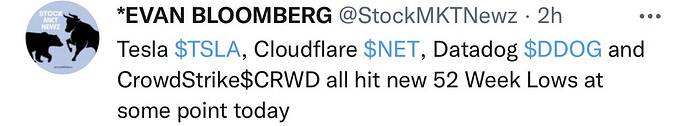

RBLX is competing with NET as worst performers.

Somehow ABNB is escaping this growth carnage. Stock is still not at 52 week low.

@manch is laughing to the bank.

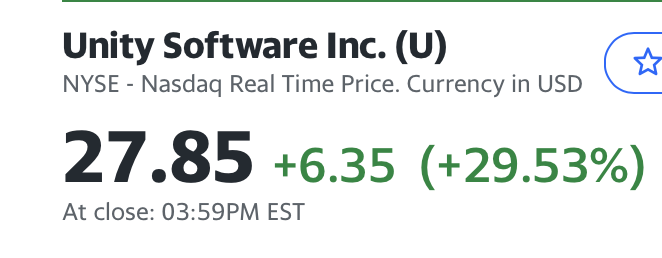

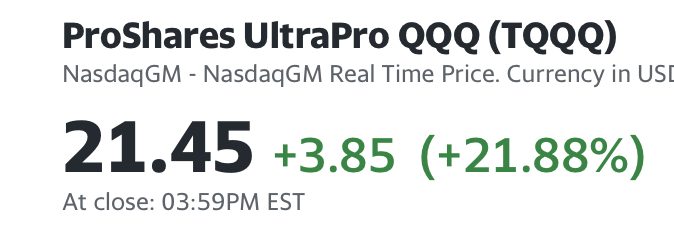

NET U UPST are competing for who has the highest day gain, almost touching 30%.

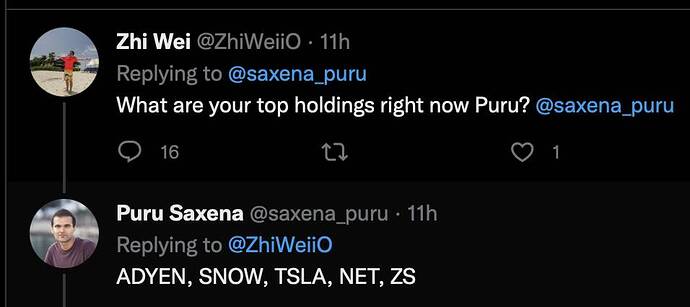

SNOW and NET are still the most expensive cloud names out there. SNOW is on a different plane though compared to others:

The multiple compression has been very intense. EV/NTM Rev is at its lowest since 2015, and largely tracks treasury rates. If rates were to come down, expect cloud names to skyrocket.

Warren Buffett famously said “Only when the tide goes out do you discover who’s been swimming naked.” And now it’s clear.

Which ones are not swimming naked?

Actually which ones are naked now? Many if not most of the names that fall 90% are real business with real revenue. Examples: Redfin, Upstart, Affirm, Twilio etc. Even Paleton is still around.

Do you expect these companies to go bankrupt?

Naked = Can these companies ever become profitable? After accounting for SBC? I see silly comments by twitters that they can after reducing marketing and customer acquisition expenses… as if, revenue won’t decline if they reduce those expenses. Revenue means zilch if you keep losing money, I can easily create a fast growing revenue company e.g. sell an apple for 20 cents with cost = 50 cents so long I have suckers to inject money into the company. I can hide the cost by giving SBC, make cost = 10 cents.

I expect many companies would eventually bankrupt or acquire. That is, zero probability of ever growing to FANGMANT size. The companies you listed have zero chance of ever reaching those size.

So far, the big bankruptcy news is in the crypto industry. I expect similar in SAAS soon.

.

History rhymes…

Plan to get rid of those decline by more than 80% stocks when the bear rally ends.

Facebook is around 300B and Netflix a bit over 100B. Never say never.

Anyway 99% of all companies never reach 100B market cap.