Since Oct 13, 2022, metaverse stocks perform slightly better than data processing stocks.

Assuming market bottoms on Oct 13, 2022. Below are the leaders so far…

SHOP NVDA NFLX AEHR MRNA

I own 500 NVDA and 3000 SHOP ![]()

SHOP implemented a huge price increase. If they have that sort of pricing power, then they could become a cash cow.

Return from Oct 12, 2022. Picture is different from Jan 1, 2023. Many stocks e.g. TSLA, start rallying hard around Jan 1.

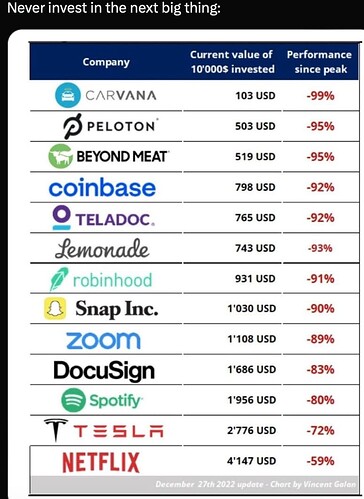

Don’t FOMO into next big thing. If you happen to be lucky to get in early, SELL when everybody is uber bullish.

Daily price charts of clear-cut leaders in this new bull market.

NVDA SHOP AEHR NFLX MELI TOST TSM BABA ![]()

Selected e-Commerce and Semi ![]()

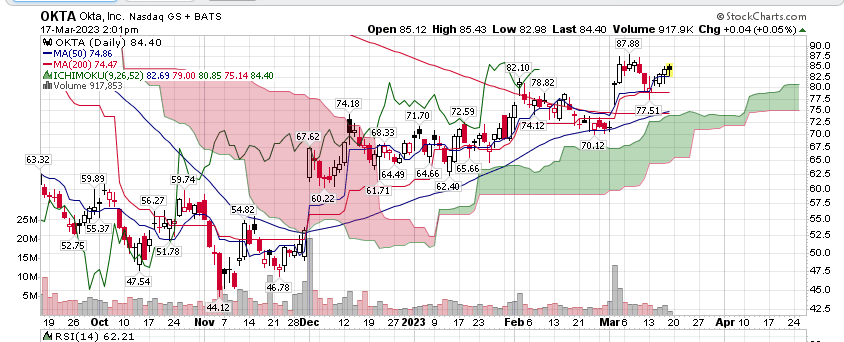

Golden cross (50-sma above 200-sma), stage 2 (price above 200-day sma) and higher high higher low.

Relative performance of leaders in this new bull market since Oct 12, 2022.

AEHR SHOP NVDA NFLX TSM MELI BABA TOST

Selected e-Commerce (SHOP MELI BABA TOST) and Semi (AEHR NVDA TSM) ![]()

Golden cross (50-sma above 200-sma), stage 2 (price above 200-day sma) and higher high higher low.

Bot 1000 because most restaurants I eat at use TOST ![]()

Wondering why it didn’t partner with Apple Maps? Later?

Added:

Oliver Kell, 2020 US Investing Champion.

Own 400 shares ![]() Almost every mom & pop stores use SQ for payment processing.

Almost every mom & pop stores use SQ for payment processing.

Almost golden cross (50-sma above 200-sma), stage 2 (price above 200-day sma) and higher high higher low.

Golden cross (50-sma above 200-sma), stage 2 (price above 200-day sma) and higher high higher low.

Added 200. Now own 600 SQ ![]()

Since you bought AAPL now you are getting dividends much more than purchase price!

Similarly, when deep recession get strong dividend stocks like PFE or OGN or even buffets OXY, you get both growth and nice dividends.

Growth stocks you can buy when market deep bottom, like when we get circuit breakers!

I do not know when, but market won’t touch the bottom without circuit breakers, May be 6 months or one year - do not know time.

Good luck!

Hold 600 shares. However, didn’t monitor at all, need to support a SG ![]() -based company.

-based company.

Golden cross. Price above cloud, 50-day SMA and 200-day SMA.

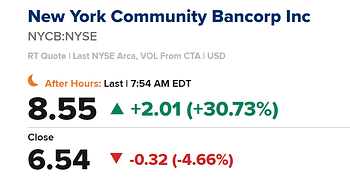

This is after the fact: WAL - regional Bank went down to $8 or below recent times, but same day jumped to $30 and stays around that level.

There may be someone who would have taken WAL at $8 (lowest I see $7.46) and he/she may reap 20% dividend return for life (as long as WAL exists).

Anyway, it is after the fact.

My avg price is $7.50 ($6 was 20 year low price) and has - as of now - 10% dividend. The dividend may be reduced in future. If not, this exceed S&P long term return.

Same way, got PACW for 10% dividend return at low price.

@Jil When a stock price goes down due to an actual issue, it may affect the future yields as well. So you need to be careful when computing potential yield perspective and it does have its own risks (that one should be willing to manage).