That’s the problem with FA… about the past… what we want is to see around the corner.

ST $20-$24 is where it is most likely to have a significant pull back. LT, wait for the fireworks when Johnny come late institutions rush in…

Does it translate to good stocks to invest?

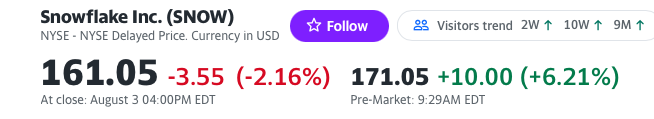

@manch is celebrating that, with the diety AMZN rising to heaven, his chicken and dogs, SNOW and NET are rising too.

Disclosure: I have NET and SNOW too. However, avg purchase is still lower ![]() than current trading price. So much for buy n hold

than current trading price. So much for buy n hold ![]()

Do you know how to read financial statements?

Please point out what I got wrong.

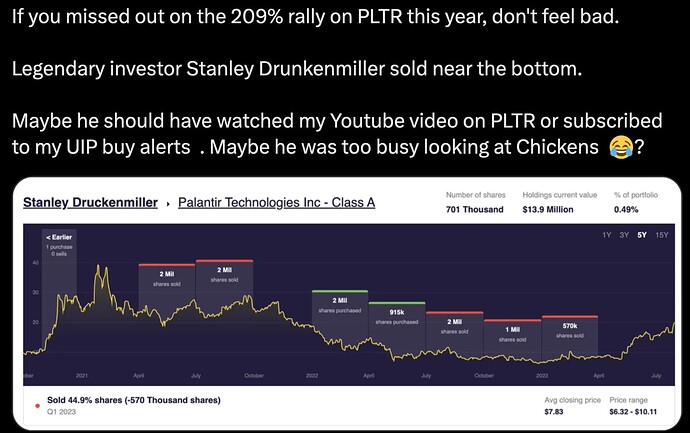

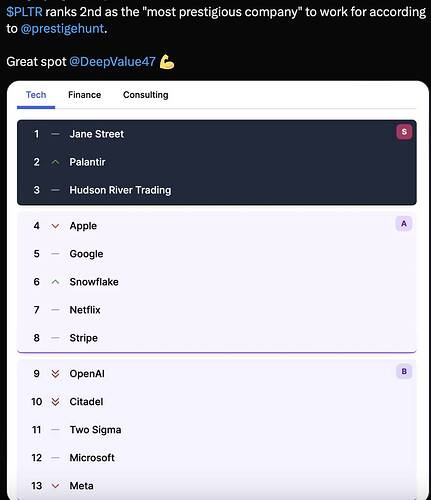

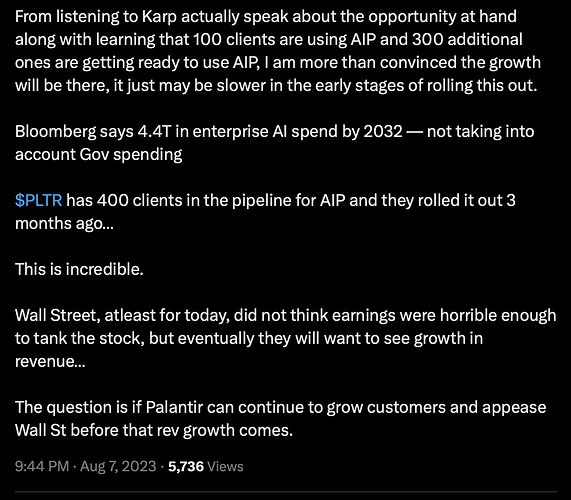

I am just being turned off by the PLTR cultists on X and Youtube. People just foaming in their mouths repeating talking points that they don’t really understand themselves. Reminds me too much of TSLA. If Karp has the star power of Musk maybe their stock will do well. Not my cup of tea.

ST, some stocks are driven purely by sentiments ![]() For these type of stocks, shouldn’t care much about fundamentals, just monitor for any change in sentiments.

For these type of stocks, shouldn’t care much about fundamentals, just monitor for any change in sentiments.

This Twitter thread is a good look back at what happened with the tech leaders of 2000.

Click on link below to read the rest.

https://twitter.com/informedbyian/status/1688569898253852673?s=46&t=e2DAkaxaGRhpAWcndjTw-g

https://twitter.com/QCompounding/status/1690822360230670336

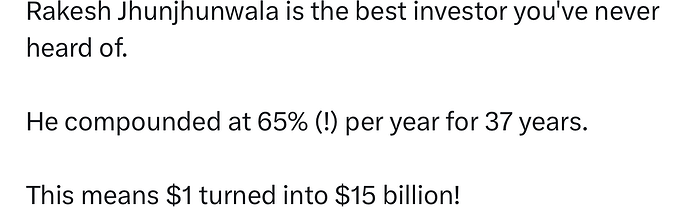

Impressive ![]()

Always more ![]()

Ignore Ian, can’t get details correct.

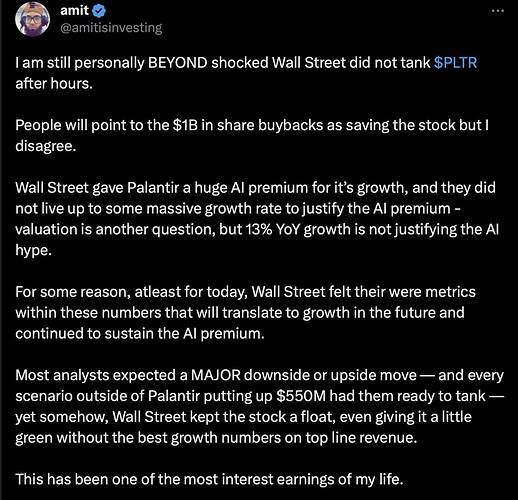

The thing I don’t get about PLTR is why isn’t it turning into higher revenue growth. Wasn’t their growth rate 17% last quarter? That’s not better than other SaaS companies who are already much bigger. Something doesn’t add up, because all the hype isn’t turning into revenue. That makes me think it’s more of a consulting company than a SaaS company, and their bottleneck is implementation consultants.

That’s ARR which isn’t 1:1 with revenue but still. Their growth rate is below the median. They’re also only 35 on rule of 40.

That website is super useful for evaluating different companies.

It’s also amazing the median S&M is 35% of revenue. The median R&D is 19% of revenue. Are we talking about tech companies or sales companies? G&A is 13% which is crazy. Software companies only spend ~50% more on R&D than they do finance, HR, facilities, and IT?

.

That’s what many said. So is either you believe or you’re not, in the future things will change. That’s what happen to TSLA… things change in 2019 and then ![]() So one could be scratching your heads for quite awhile.

So one could be scratching your heads for quite awhile.

Tesla pulled off model 3 production at the 11th hour to avoid bankruptcy.

I’m not sure what Palantir can do to scale more effectively.

I do think SaaS sales orgs will see huge job cuts over the next 5 years. It used to be SaaS was so new that the model was add reps = increased sales. More reps = more sales because there was so much opportunity there. Now the unaddressed opportunity is smaller and quotas are being lowered. Boards and C-suites are doing the math on how lower quotas means the sales expense vs. revenue growth isn’t on a sustainable trajectory. It wouldn’t surprise me to see 25-50% cuts in sales reps over the next 5 years.

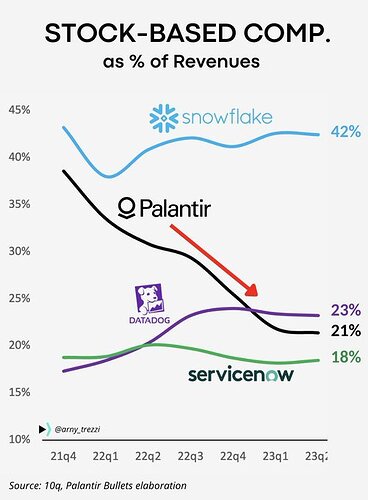

Isn’t that good that it’s declining? It’s less dilution for shareholders. It should decline as people run out of pre-IPO stuff to vest. My neighbors left Microsoft for Snowflake (100% remote). No wonder he bought a brand new 911!

They won’t 10x without growing revenue, so the question is who will grow revenue? It takes the existing business becoming popular again or entering new markets.