Potential 100 baggers only if leadership is competent and visionary.

YTD performance of PLTR is almost on par with NVDA.

Disclosure: My $ allocation to PLTR is about 1/4 of that in NVDA. May have underinvested in PLTR.

Other stocks favored by Finance Junkies are absolutely decimated. Eg. ENVX, ENPH, PYPL, and DIS. So much for FA.

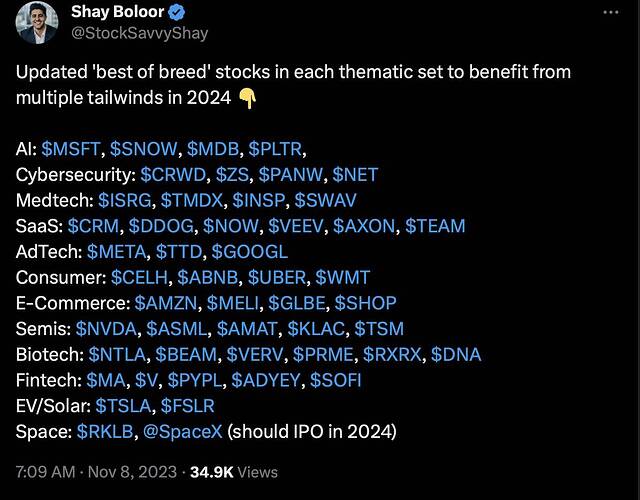

What I have:

AI: SNOW, PLTR

Cybersecurity: CRWD, NET

e-Commerce: SHOP

Semi: NVDA

FinTech: SOFI

EV: TSLA

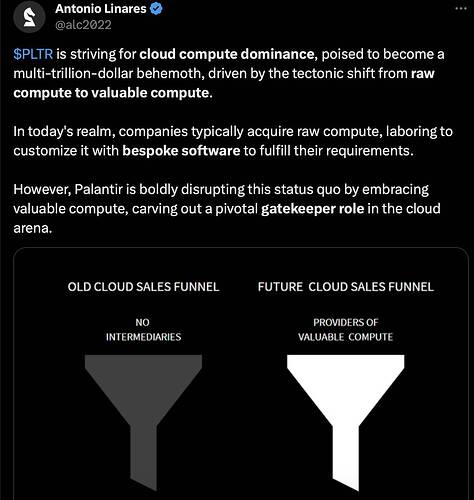

I don’t understand PLTR. If you do good for you.

So many Fintwitters brag about their high Ytd returns. Ytd return of my growth portfolio is 200% yet is 50% below the ATH achieved in 2021 and two year return is still red. I really want to know what is the two year return of these braggers.

https://twitter.com/pakpakchicken/status/1731845149133816195

Ken 100 bagger: OLAS. Just read it. So didn’t do any reading up or buy any. Just sharing. Not financial advice. Not your babysitter ![]()

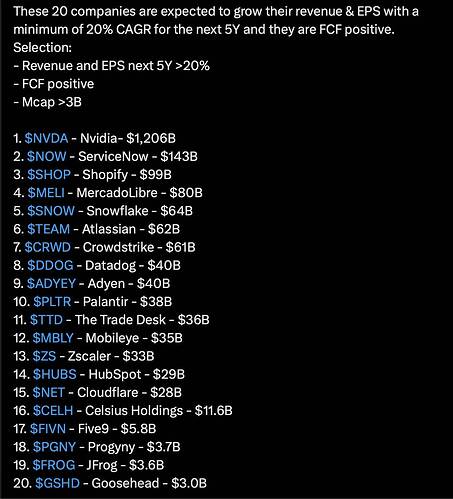

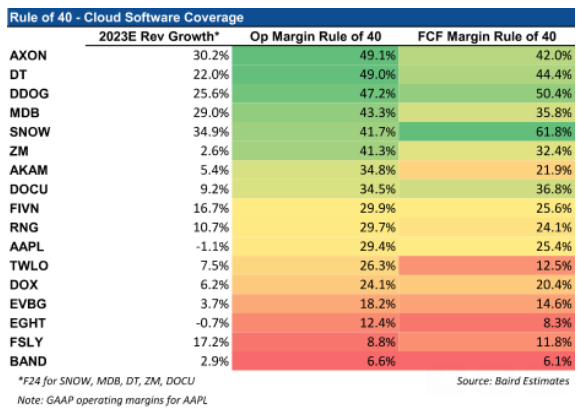

Here’s a list based on rule of 40

Above list has four data stocks that comprises the data stock sub-portfolio of my growth portfolio.

SNOW, CRWD, PLTR and NET.

Buy n hold (hopefully forever) ![]()

CAGR since 2017 is 22%, can’t make it to 10x over a 10-year period. For that, requires CAGR of 25.9%.

Out of ~130 stocks that have gained 100+% ytd, below list 20 stocks that have gained 250+% ytd… mostly crypto related…

Disclosure: Only have COIN ![]()

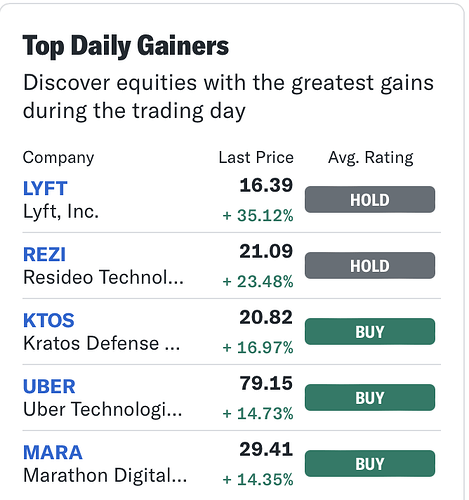

Some investors think UBER is into logistics while LYFT is into ride-sharing. Yet LYFT gained more than UBER after earnings…

At least we’ve moved past people thinking they are software companies. ![]()

.

Josh Brown opines that UBER is a potential $1T company. Agree?

I think it would take autonomous cars for that to happen.