Karp moved PLTR away from Palo Alto. That means his company is POS.

End of story.

Karp moved PLTR away from Palo Alto. That means his company is POS.

End of story.

PAin the ass is not a good place for HQ.

U Platform for meta verse.

PLTR AI in the edge.

PATH Digitization of everything.

MTTR Virtual world of all physical buildings

Bay Area companies. ![]()

Ex-Bay Area company. ![]()

Even though SE has already leaped 30x since IPO, I believe it can leap at least 10x more. What CEO U said about shopping, already happened in Singapore… SE has implemented already. I am now anguish whether I should bite the bullet and BUY regardless, FOMO ALL IN big time or not.

[quote=“hanera, post:102, topic:10078”]

[/quote

My realtor was wrong. It didn’t help sell the property and I have seen very little of this over priced crap anywhere else

we have Palantir Foundry at work (the company got in March). it is such a PAIN IN THE BUTT software to work with. So confusing and weird.

I think I am not buying PLTR out of protest.

Of the those below, AFRM is the only one that I have puny $ in.

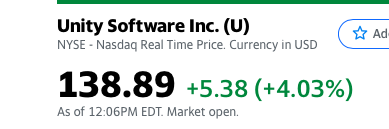

U $100k

PLTR $50k

MTTR $50k

PATH $50k

MTTR is not tracked by WSB, Cathie and JC. Who are buying? Very early investors like us?

PLTR and AFRM are stonks.

U, PATH and PLTR are Cathie’s top 3, 8 and 13 respectively.

PATH is underwater. So not all picks are fruitful.

.

Learn to use it well. Then you would be one of those rare experts and can demand high $$$ for your expertise. Every problem is an opportunity ![]()

Inadept workman blaming the tools?

I don’t think PLTR possesses anything fancy in terms of the tech. They were able to narrow down to the industry that needed big data + custom visualization + private cloud + enhanced security in the early innings. I remember a while back a lot of the engineers were basically support/solutions engineers to be deployed on site with their rack of hardwares to run hadoop/data/visualization software. I still have some stocks I bought a while back but I’m not sure about the long term potential.

I think it could be the next generation oracle though. Average software, unrelenting sales team, an army of solutions engineers to customize and sticky+closed software by making it complicated.

Have faith in Peter Thiel. He and Elon Musk are good at navigating the government bureaucracy and manage the emotions of investors and customers. Ask any TSLA car owners and investors… get it? Btw, customers of PLTR is not the end users but decision makers that make the decision to implement it in the organization. Ask @girlykick, she didn’t have any inputs in the decision.

Geoffrey Moore’s crossing the chasm remains a classic to understand the technology adoption cycle. In the early phases of a new product, only the enthusiasts and people who have no other option try out new technology. They figure out the product and drive improvements, then they make for early adopters and majority adopters to accept the product.

The question is at what stage of the adoption cycle this product is in? Has it crossed the chasm yet?

.

This is the question for investors like you.

Haha, I think they can make a consistent revenue but I think their main customers back then were government and financials. Government to me has a finite potential. They also might have problems selling it to other countries in general due to security / internal sensitivity. Many financials will catch up anyway and/or new fintech will overtake them. New fintech startups will not use Palantir. To me, it’s currently overvalued. It will take a beating on a downturn, and I’ll be a buyer then. I’m not buying more at current price.

Market timing. I am not good at it. If there is a downturn, just hedge by shorting the correct instruments ![]() Use the gains from hedging to add more.

Use the gains from hedging to add more.

Have faith in Peter Thiel.

Kind of contradictory. If it is not a good investment due to fundamentals now, lower price shouldn’t be a good investment. Unless you are talking about trading a dead cat or technical bounce or you just feel valuation is too high.

Just trading.  It has a high retail ownership (last time I checked) so it falls into my meme stock category for now.

It has a high retail ownership (last time I checked) so it falls into my meme stock category for now.

If it is a meme stock then I expect it to moon till incredible valuation  Fundamentals no longer matter.

Fundamentals no longer matter.

.

AFRM ![]()

![]()

![]()

Going forward, don’t think ABNB and UBER can do even 10x but look promising as economy re-open… it will re-open regardless of delta variants… by now, we know is just a fifth series of coronavirus, life shall continue. So ABNB and UBER are good investments, so far for me  Both are green

Both are green  today.

today.

Should also be obvious that “covid stocks” are being slaughtered e.g. ZM ROKU PTON … The million dollar question is which one is not just a covid stock? That is which one is the baby being thrown out with the bath water? That one is going to give us great return. Any guesses?