I bought some NET on Friday…so let’s see.

Always beware of Clay and his believers, Clay said that Apple and Tesla will go bankrupt

Those who believe him didn’t invest in AAPL and TSLA.

Good primer on zero-trust security and the players in this space.

During the first nine months of 2021, PAM delivered phenomenal real-dollar Hedge Fund trading performance, the best at Seeking Alpha:

PAM’s flagship Swing Portfolio, year-to-date **(September 30, 2021)**delivered $210,179,753.12 profits on $11,172,813 margin capital.

Year-to-date performance: 1792.10%.

Ytd 18x ![]()

https://www.cashay.com/philip-fisher-lessons-investor-173813511.html

Fisher’s investment philosophy can be summarized in a single sentence: Purchase and hold for the long term a concentrated portfolio of outstanding companies with compelling growth prospects that you understand very well.

Previously, FANGMANT. Going forward still good but you should be able to do better.

…the real home runs are to be found in “small and frequently young companies … [with] products that might bring a sensational future.”

MTTR? AFRM?

Fisher’s answer to the question of what to buy is clear: All else equal, investors with the time and inclination should concentrate their efforts on uncovering young companies with outstanding growth prospects.

Unfortunately, such companies IPO or SPAC at multiple tens of billion of dollars market cap e.g. SNOW IPO at $36B, U IPO at $15B and ABNB IPO at $43B. Compare to in 1997 I invested in AAPL when it is worth a few $B market cap. That is nowadays investors are willing to priced in many years of high growth, 100x becomes a 10x, 10x becomes just a double, over a period of 1 decade. The performance of the latter is even worse than S&P index.

Following the crowds into investment fads, such as the “Nifty Fifty” in the early 1970s or tech stocks in the late 1990s, can be dangerous to your financial health.

UPST?

On the flip side, searching in areas the crowd has left behind can be extremely profitable.

Something like AAPL in 1997. Hmm… TDOC FSLY?

Obviously, he didn’t mean contrarian for contrarian sake. You are supposed to do the DD i.e. check against his 15 points. I did that for AAPL in 1997. However, the work required is tremendous, which ones should I work on? TDOC ZM FSLY ROKU PTON… very indecisive. In limbo again.

I know Ken and Sherri Fisher well. His father made some money buying stocks. Ken makes money managing other people’s money. He became a billionaire managing billions. He doesn’t invest in stocks. He invests in RE. I look at tech stocks like the gold rush. Most gold miners went broke. Vendors like Levi Strauss made all the money. I made my money building houses for tech millionaires. Now invest in stocks for safety long term. Chasing 100x is a fools game for youngsters.

Ken took $250 and turned into $6 billion using his connections. His big break was getting the San Mateo county pension fund account

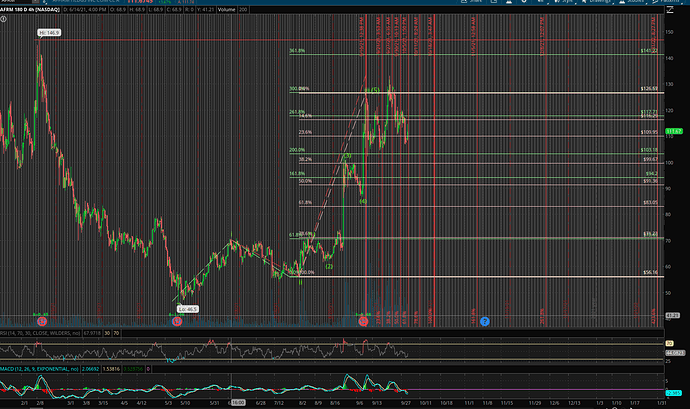

AFRM is wild. Is almost like crypto. I think should belong to meme stocks. Wait… is a meme stock. Can it 100x? Hard to say. 5x seems very possible.

AFRM is in wave iv. Wave v should be above $147 but I am not sure how high it will go or whether it will immediately turn around and drop all the way back to $60. In no mood to momo- or swing- trade, so just watch with a puny sum invested.

I just watched gambling generation. Sorry but I take this personally. 100x meme stocks crapto are all on the road to hell.

Don’t be jealous of those guys that make millions to hundred of million dollars.

Watch the show. Most gamblers loose. The American economy will loose if we just become a casino where no one works and everyone just gambles. It will end civil society. It is beyond evil. In fact we see it every day. Millienials refuse to work. Try to find someone to work on your properties or in a restaurant. This is a dystopian nightmare. Until 2018 internet gambling was illegal. We now have opened up a new world of insanity where doge coin and nfts have value. What a crock of shit.

From what I gather, shortage of labor occurs in almost every developed nations. People are just afraid of getting Covid not because they are trading. NFTs do have some value although I personally don’t appreciate art doesn’t mean I will call them worthless.

If all money goes towards worthless speculation then money, labor and the whole economy goes down the toilet

.

As you pointed out in the first half of the sentence, “if”, is not “if”, so is ok.

Not ok with me. This insanity will lead to a major crash. Lots of bears out there

It won’t crash so long as Fed is printing money. Fed refuses to let the stock market crashes or the economy to go into depression. So we have no choice but to join the game. Anyhoo, because we don’t know how long will the “kick the can down the street” will last, have to join in, meanwhile just buy some REs for protection.

Kiyosaki said to invest in crapto to protect against crash by crypto???

When Joe Kennedy’s shoe shine boy gave him stock tips he sold all his stock in 1929. Now 18 year old idiots are becoming instint millionaires. Time to sell stock and buy RE.

.

Is not what Kiyosaki said. He said sell RE and buy crapto.

Kiyoshhki is an idiot . Gold makes some sense. It is a hard asset like RE. The new insanity has created a virtual world of bullshit. Stick with fundamentals and hard assets. Millennials don’t know shit from shinola