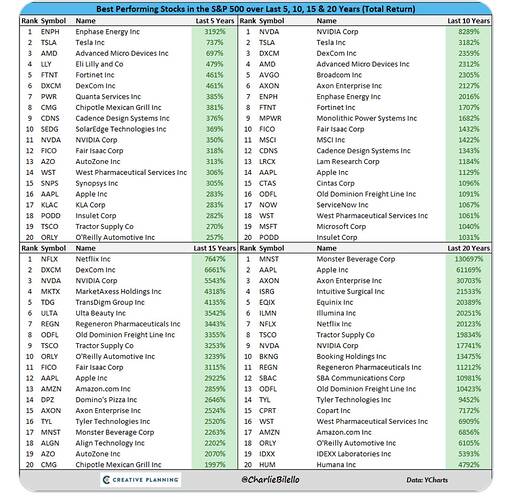

Is PLTR at TSLA 2019 moment? PLTR is expected to be included in S&P by 2024.

2019 to now: About 7x. to peak: about 19x.

I have 4000 PLTRs ![]()

Man, these PLTR bros remind me of all those TSLA uber bulls…

.

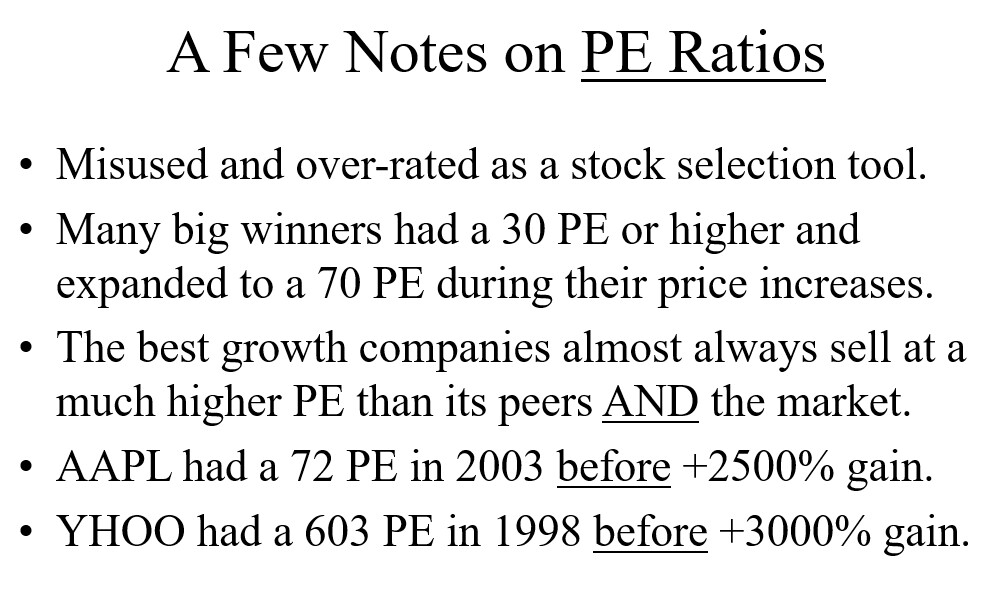

Are you that young? This type of behavior has happened to Dell, MSFT, SUN, YHOO!, … If PLTR and SOFI did hit $1T, they would be as popular as Dave Lee, MeetKevin, CG, …

Dreaming…Not in our life time !

You’re that old? When Apple was only selling iPod (not yet iPhone), I told my friends it would be a $1T stock, everybody laugh.

I said “Not in (our) life time!”.

Regarding Apple, it is mother of computers and operating system like IBM. The birth of MSFT started from AAPL. Do not compare with AAPL (NVDA or TSLA…etc) with Junk PLTR company. You will be feeding your money to Peter Thiel, the most crooked billionaire!

Focus financially strong companies.

Do you even know how to read an income statement, cash flow statement, and balance sheet? You regularly make inaccurate and crazy claim about multiple companies.

Garbage in results garbage out in stock market too.

It is your money and your wish, feel free to donate whatever you like !

People deserve believing news media like this

.

You will be feeding your money to Peter Thiel, the most crooked billionaire!

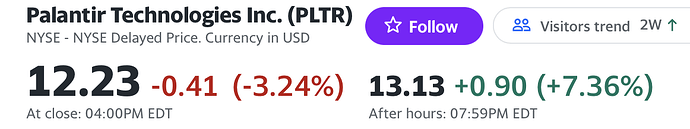

Alex Karp says keep the world safe! I see you only interested in making money ![]() I am supporting PLTR’s mission

I am supporting PLTR’s mission ![]() and making money is only incidental

and making money is only incidental ![]()

Previously, there are three red flags in PLTR…

- Alex Karp talks philosophically instead of business (he has since engaged a professional speech coach, is improving

).

). - Excessive SBC (last few quarters are reducing, so moving in the right direction).

- Not easily scalable because of consultancy-like implementation (not like software)… hmm… this one, I am not sure whether got improvement or not… need some boots on the ground to tell me.

AAPL: Btw, the $1T market cap is not based on any financial, business and fundamental analysis. Read it from a private blog… during that time, can search any blogs, nowadays blogs are blocked… according to the blog, late SJ said he would transform AAPL into a top internet consumer electronics company.

I am supporting PLTR’s mission

and making money is only incidental

Good luck !