Mind as well start now with the predictions and theories for 2018…

C

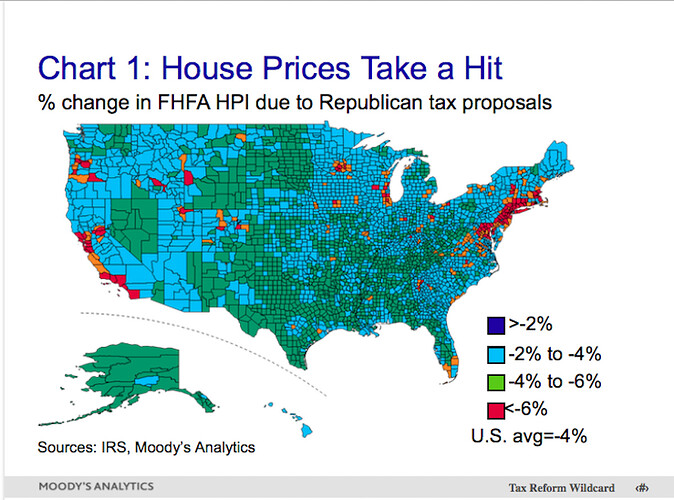

Lower house prices

The tax cuts will lower house prices in much of the country. Nationwide, the hit to house prices will be as much as 5%, and much greater for higher priced homes, especially in parts of the country where incomes are higher and there are thus a disproportionate number of itemizers, and where homeowners have big property tax bills. The Northeast corridor, South Florida, big Midwestern cities, and the West Coast will suffer the biggest price declines. Counties like Westchester, NY; Cook, IL, and Delaware, PA will see double-digit price declines (see Chart 1).

At a conference in California earlier this month, Lawrence Yun, chief economist for the National Association of Realtors, also downplayed fears of a high-risk bubble.

“Prices will not fall in the Bay Area,” he said, while speaking in Santa Clara County. “As long as they’re creating jobs, there’s really no reason why” the bubble — or what is starting to look like a bubble — will burst.

I’m not convinced that house price will decline in 2018 and 2019. These analysis is not worth much

As long as they’re creating jobs.

Why not just say, as long as people are buying houses, house prices won’t decline.

Actually Zandi says that house price will decline 5% when tax cut is passed and when the job growth is good.

If I was a prospective house buyer in the Bay Area now, I would have waited. The financial incentive for buying a $1M house is less now. I might as well keep renting.

Exactly. The reason for buying owner-occupied houses in bay area is not just because of jobs. The condition and policy are favorable to owning,

- Low 30-year fixed interest

- No-recourse

- Prop 13

- Can claim mortgage interest

As long as people keep having children, then they’ll want to buy a home. The most pro renting people in know suddenly became buyers once they started a family.

If you plan to live in the house for 30 years, definitely buy.

Canada and many other countries have no tax incentive for homeownership, house price still grows fast.

The impact of the tax reform on housing should be minimal. Home price will continue to appreciate in the next few years.

Tax reform will lower tax for many people and they’ll have after tax income to buy houses. Zandi’s prediction of nationwide 5% housing drop prediction is laughable for an economist

Prediction: South Bay prices will appreciate more than Peninsula and SF, because of the hardware renaissance fueled by AI and IoT. Already I heard some pretty darn crazy bidding wars in San Jose.

What kind of comparison is that? Canada and here have the same drivers? Also have no recourse, prop 13 and can claim mortgage interest?

Which part of San Jose? North, South, East, or West?

I think California prices will take a hit.

My friend at NAR says 18%

I think more like 5%

But all you cheerleaders for the Trump tax plan may be get bit in the butt

This tax increase for $1m plus dollar homeowners is going be devastating in the BA…houses will cost 10-20% more per month depending on whether you pay cash or not

Could affect high priced rentals too

Californians making $150k or more are going to have less after tax income…

SJ is a bubble based on Google’s new office, which is many years away

Little Saigon.

Always the same emoji? What does it suppose to mean? Agree, disagree or neutral?

I need to go there to get some pho soon…

Embedded in the realm of reality, something to think about.

Unless you are not paying attention, you wouldn’t catch the meaning: The incoming migration of new workers getting luxurious salaries of course are pushing upwards the need for housing. It is just like a used balloon with helium a few days later, in order to keep it up you need to pump more gas in it. Or pump a new one.

Then, who is speaking? Real Estate advocates. Do they have to be sincere or alarmist? What benefits better, being precise or ambiguous.

Owning a home is inflated by the fact that you need an incentive to do so. Some people with good income resources don’t give a damn about deductions, but the majority do. Specially on high prices homes where buyers are stretching their budgets too thin. Any $ counts, otherwise, why bother.

This is why, you investor should be buying lower price homes less than a $1M. I pointed out one too many times E San Jose has been neglected by investors.

Speaking of market crash, somehow, somewhere, either by design or by the law of larger numbers, something is going to deflate the balloon.

Who will be the first needle? Tesla, Uber, ??