Goal: Max returns in 1 to 3 years.

Risk: Med to high

any thoughts?

Real Estate crowdfunding?These are some of them: Realtyshares,fundrise, groundfloor. Some deals offer 16% and avg of about 12%,

How easy is it to get out?

There is no getting out as such, you buy into a deal and it has a duration/maturity. This is basically funding flips.

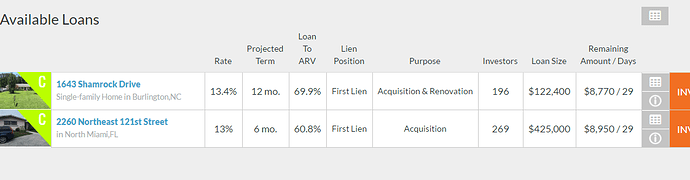

I invested in Groundfloor, because I like the fact that I know the individual property I am putting my money into. The deal I put in is supposed to return me 13% in 6 mos, we will see :). The second one below.

Once the flip is done, I get my money back.Interest plus principal as ballon payment. These loans do go out fast. 425k loan is almost filled out in a day by 270 investors. Typically they advertize the loans for 30 days.

The good thing about this is in my opinion is I can put my 25k in 5 or 10 properties so that i dont rely on one project’s fate. They do a thorough job in vetting the borrower and their experience, they also show how much networth, how much unsold inventory they have and these details.

Realtyshares is little bit more complicated I think, interms of commercial, preferred equity, etc. I havent explored it much.

Sounds good @RealEstatebull I have never heard of Groundfloor though that’s awesome to learn new things.  I have heard of Fundrise and Realtyshare, and also Homeunion but that’s a totally different model.

I have heard of Fundrise and Realtyshare, and also Homeunion but that’s a totally different model.

25K can actually lever up to buy a house in midwest like Cleveland if you are after cash flow alone. That would be really low risk but return is also low, in the 6-8% range I guess.

Another option is to lend on Lendingclub or Prosper. If you target the high risk high return group you can make north of 15%.

Low risk

ETFs like VNQ or FREL (commission free, but have expense ratio)

Med Risk:

go for NLY, NRZ, STWD or AVB (Commission free robinhood or merilledge)

High Risk:

Any good stocks like AAPL, GOOGL, FB or AMZN. (Commission free robinhood or merilledge)

All these are based on easy liquidity.

With these your taxable ROI can be 12% to 25% possible, depending on how you handle them

Do some TSLA call options. It can only go up

This is the issue with low interest rates. People reach for higher and higher risk to get some yield. It really punishes savers while debtors have a field day.

Very high risk, derivatives of those stocks.

Savers will not be punished as long as they grow their savings, to beat the inflation. This is what Sanfax is thinking, I hope.

I did not buy any stocks between 2008 and 2012, but luckily compensated by real estate. Learnt that mistake now.

See for example: We see daily Starbucks, visit often. If some one bought SBUX during 2009 at $4, they own it now at $55, simply 13.5 times. We know these hindsight.

Thinking aloud: Will near zero interest the norm? With continual advance in technology, the labor is needed less and less, and winner tends to take it all, so opportunities for investment also reduced. For example, RE in SFBA essentially takes it all. Any views?

Wonder how many are like you? Could be the reason why SFBA’s RE start to run up like mad. Wasn’t really moving before that.

Which one? TSLA, I agree 100%.

BTW: You know me, risky person ! I just purchased 20 TSLA stocks today at 7 AM. Even if it goes down, I make money after some time. This is pure speculative buy.

TSLA & FB has been good stocks to speculate, buy low / sell high  I didn’t see AAPL coming back 10% in last month. Oh well.

I didn’t see AAPL coming back 10% in last month. Oh well.

AAPL recovered after buffet magic is applied, not before. It continues to grow at normal phase.

FB, TSLA, NVDA and NFLX are volatile.

I have good amount of NVDA stocks with 12% (as of yesterday). Today, it is NVDA day, this is already up 3.5%.

NVDA is 146% up in a year.

Again, these are highly volatile, I do not recommend these. It is up to viewers risk.

It is low interest rate, QE and the stocks run that stimulated bay area real estate!!! Foreign investments are also major source of RE bull run.

has anyone played with binary options? Nadex, for eg

This is news to me. On any case, binary options is not for me. I am better of with whatever I know. I am not even using options nowadays. Just plain stocks or ETFs.

Are you planning to use 25k on these binary options?

Oh nooo… binary options just for a quick buck, once in a while. Especially the 5 minute binaries that expire every 5 mins. Very high risk though

For high risk, but calculative (speculative) risk, see here. This is real that person gave his buy/sell details.

Plenty of hot discussions over this topic. Just posting here for information purpose

(viewers stay away from this crazy speculative methods)

BTW: Someone else’s post, not mine.