Well, I am going to talk to the no believers here. I know there will be negative people berating me, but I don’t care.

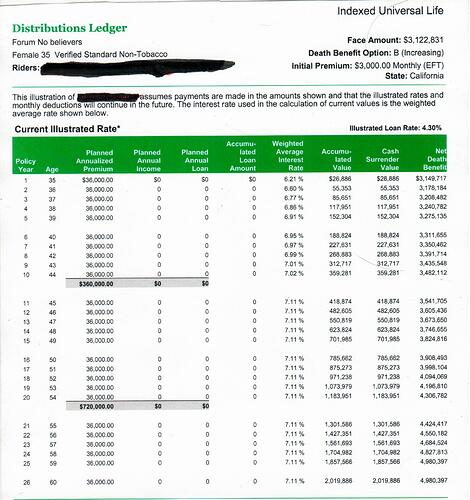

This is the type of policies we open in my office. This is nothing, we have people with premiums of $10K a month, $200K a year and so on. Basically, they use their money as a temporary bank. Then they loan it out.

Why? Because they only leave the cost of their premiums and pull the rest to invest. Still, their $200K or whatever their payments are will be there earning from 0 to 12.5%.

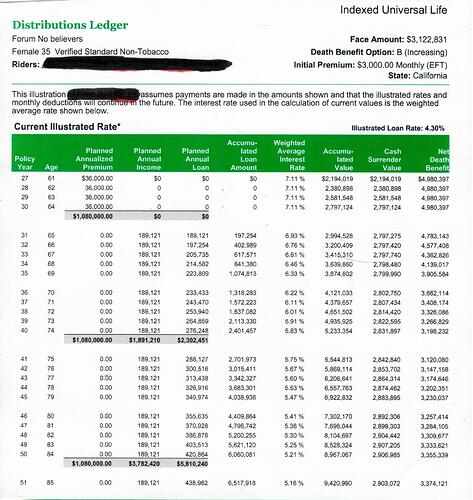

Assuming this couple can get rid of their 401K, and instead they use money after paying taxes on an indexed universal life policy, their retirement would be generous. They can also loan out about 75-80% of their premiums and never pay back the loans.

This is an illustration, just for educational purposes.

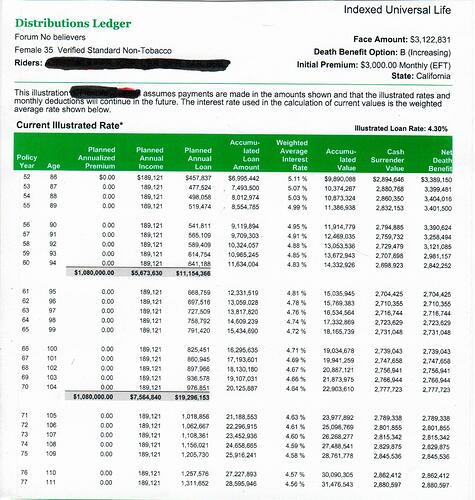

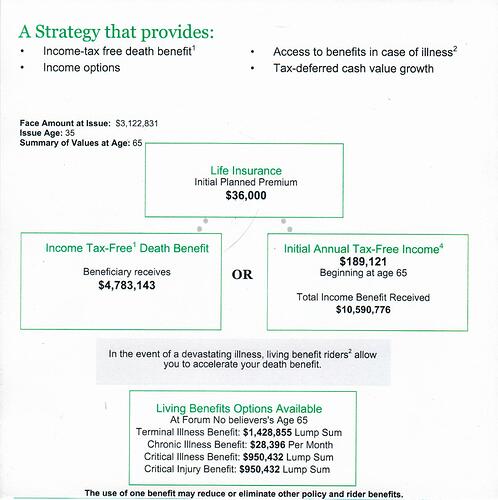

$3K a month which is nothing (with a cost of insurance of $760 a month) will give them the peace and tranquility to know that if anything happens to the wife, which I used as an example because women pay less on their premiums, the spouse would be covered for any future expenses the absence of his wife provoques. $3,122,831 death benefit. This can happen a month or less after they paid their first $3K.

So, the premiums for the entire year would be $36K.

From this amount they can loan $26K year after year and their $36K yearly premium would be earning from 0 in scenarios like 2008, or 9% as of last year. History of this type of policies tell that in 10 years or so, depending on the returns, you put $36K, you loan $36K. Look at Cash surrender value column, year 10, age 44.

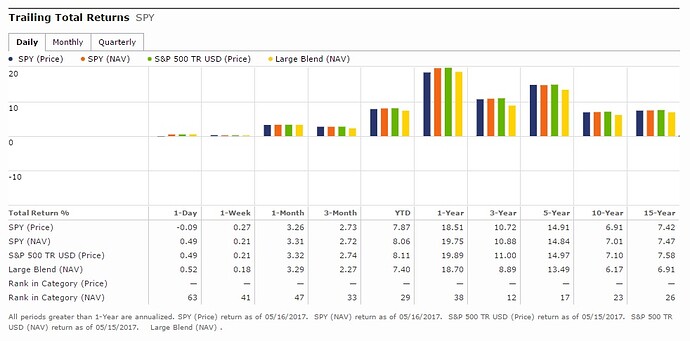

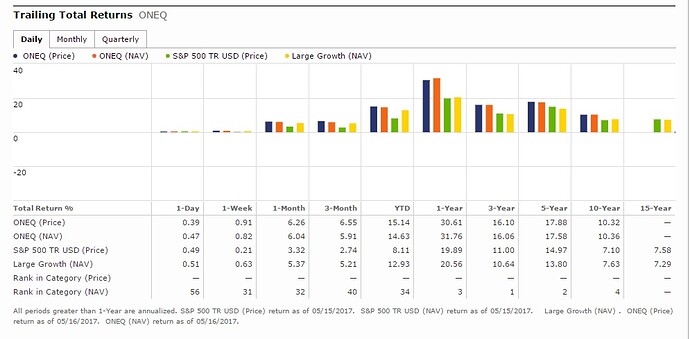

Prior history tells it’s been 8% return from the S&P 500 in the last 20 years.

She would stop paying premiums at age 65. From there, she starts pulling income.

Income would be $189,121 a year. Until age 120.

Loans are tax free, anything within a life insurance is tax free.

Death benefit, which is increased by an option within this policy pays for the loans at the end of the life of the insured.

So, look at the illustration.