I already bought the dip at $200 in June. No more buying. Waiting for the next growth spree (epic AV S-curve moonshot).

Unbelievable. Telling people to sell at a market bottom? I still remember the time when you told me to sell all my Tsla position back in 2018 because Elon is a “playboy” ![]()

It is not at bottom yet, but in middle like this…!

However, you hear this story. During 2000, my friend bought $30000 SIFY at $120.

When it came down to $60, another friend was telling him to sell at $60, he did not.

When it came down to $30, another friend was telling him to sell at $30, he did not.

I asked that another friend why are you telling him to sell at $30, he replied at least he will get $7500 now.

Finally, it came down to $0.50 delisted…

L O L !

Seriously : With the way market is going now, anything is possible for any company.

Until FED stops raising rates, market is no mood to go up.

If market goes like the same way for few more weeks, then we will get circuit breaker mode (guessing it)!

What about another friend of yours (aka @hanera) who bought $30000 AAPL at $0.10 during 2000. Would you mind telling everyone here how that went?

Thankfully no example given of Pets.com - Wikipedia

Pets.com was a dot-com enterprise headquartered in San Francisco, US that sold pet supplies to retail customers. It began operations in November 1998 and liquidated in November 2000. A high-profile marketing campaign gave it a widely recognized public presence, including an appearance in the 1999 Macy’s Thanksgiving Day Parade and an advertisement in the 2000 Super Bowl. Its popular sock puppet advertising mascot was interviewed by People magazine and appeared on Good Morning America.

Although sales rose dramatically due to the attention, the company failed to become profitable and became known as one of the victims of the dot-com bubble in the 2000s.

I knew about TSLA & AAPL. Just wanted to get your response mainly. It was LOL, ignore it.

There were plenty in dot.com period, leading from Enron.

However, bay area famous was Sun Microsystems, Netscape…etc now no more!

On a historical incident in December 1999, the shares of a private firm skyrocketed from just $30 to a whopping $239 within just a day of its IPO .It traded with a symbol LNUX and gained around 700 percent on its first day of trading.

One of my project managers started working, after IT lay offs, in Frys Electronics as salesman.

Those were horror stories of 2000!

The sellers expected to capitulate is not referring to buy n hold (hopefully forever) investors. Is referring to weak hands e.g. traders and ST investors.

We are all testing how resolute you and Wu on holding !

I’m not that resolute at all. My goal from here on is to splurge my wealth and enjoy. However, I will sell real estate first before touching any stock.

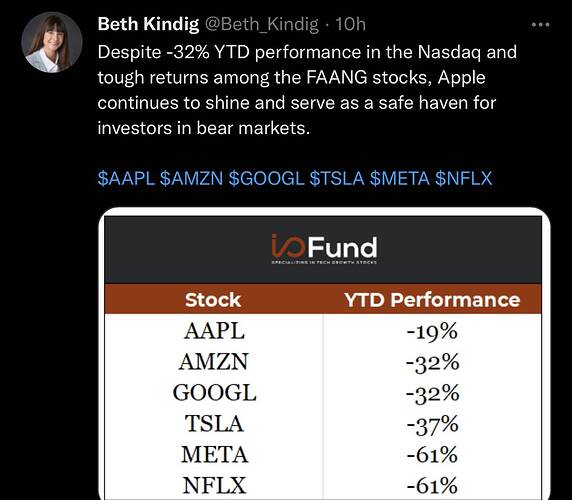

If true, Monday would see AAPL and TSLA gap up.

WS just doesn’t give up.

The fight on metaverse commerce continues.

More bashing ![]()

This has taken the company to a multitrillion-dollar valuation, which shareholders appreciate, but is somewhat disappointing for users who keep waiting for that “one more thing,” as Jobs would say when introducing a new product.

“One more thing” = Another high margin $100B product like iPhone?

Satellite-to-cellphone connectivity in remote locations is suddenly the rage in telecom again, some 23 years after Iridium and ICO Communications fell into bankruptcy. Will satellite-based smartphone services from Apple (AAPL), T-Mobile US (TMUS) and potentially others prove more commercially viable this time?

Aside from commercial services, there’s good reason for satellite firms to pursue smartphone links. For one, nearly 20% of the U.S. is not covered by terrestrial mobile networks, noted a Morgan Stanley report.

“Unfortunately physics will make this a challenge, if not impossible,” Williams said. Technical challenges include Doppler shifts — radio frequency changes created by fast-moving objects. Starlink satellites, for example, fly over the Earth at 18,000 mph.

Putting big antennas on smartphones isn’t an option. But next-generation low-Earth-orbit satellites might improve performance.

Farrar told IBD that providing voice calls or high-speed data to smartphones might work if LEO satellites are equipped with much bigger antennas.

![]()

First step towards reducing dependence on hardware.