JBK gets it.

No. He doesn’t.

The key driver for Apple was and will be financial engineering. Keep buying back shares and stock price will grow without valuation growing at the same rate or at all.

Since it is so easy, how come not many companies do that?

Not easy. Have to have steady cash flow and a brand that lasts. Apple is like a luxury fashion brand.

Luxury fashion is not a must-have. Look like you don’t get it.

Wondering Aloud: What do GS does with this money?

Anyhoo, I have topped up to $20k ![]() … eventually will top up to $250k, currently not enough spare cash

… eventually will top up to $250k, currently not enough spare cash ![]() Ofc, setup Daily Cash to automatically deposit into the account. I use Apple Card fairly often.

Ofc, setup Daily Cash to automatically deposit into the account. I use Apple Card fairly often.

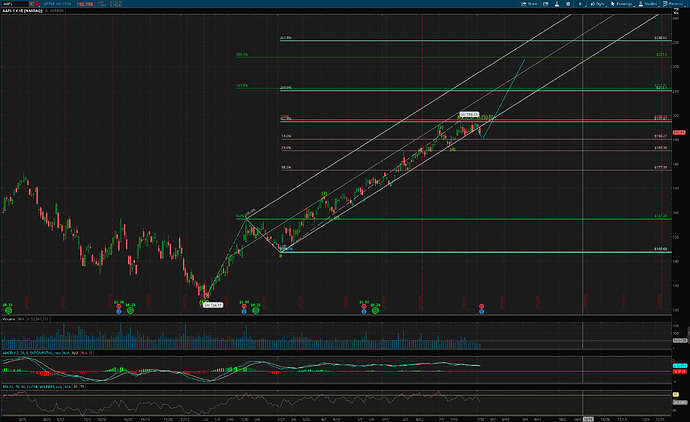

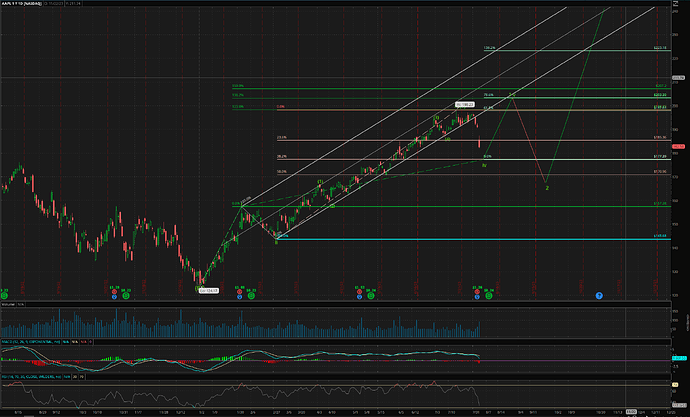

EW: No change in count.

Still not sure whether is in wave iv or is in wave iii.(5).(ii) ![]() Ofc, could be that bearish alternative count

Ofc, could be that bearish alternative count ![]()

An über bearish take.

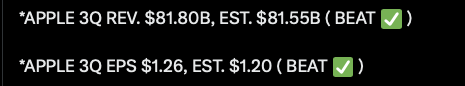

AAPL results after market close. So what is the correct count? We’ll know post-earning… don’t know how to assess probability, my crystal ball is fuzzy… Price action after earning would tell us which is the correct count. The possibilities are:

a, in wave iii.(5).(ii). - At this moment, this is the highest probability… hard to believe AAPL is so strong.

b. in wave iv

c. in wave 2

Post-earning AH, AAPL breaks below $190 so AAPL is in either wave iii.(5).(ii) or wave iv. I am leaning to AAPL is in wave iv.

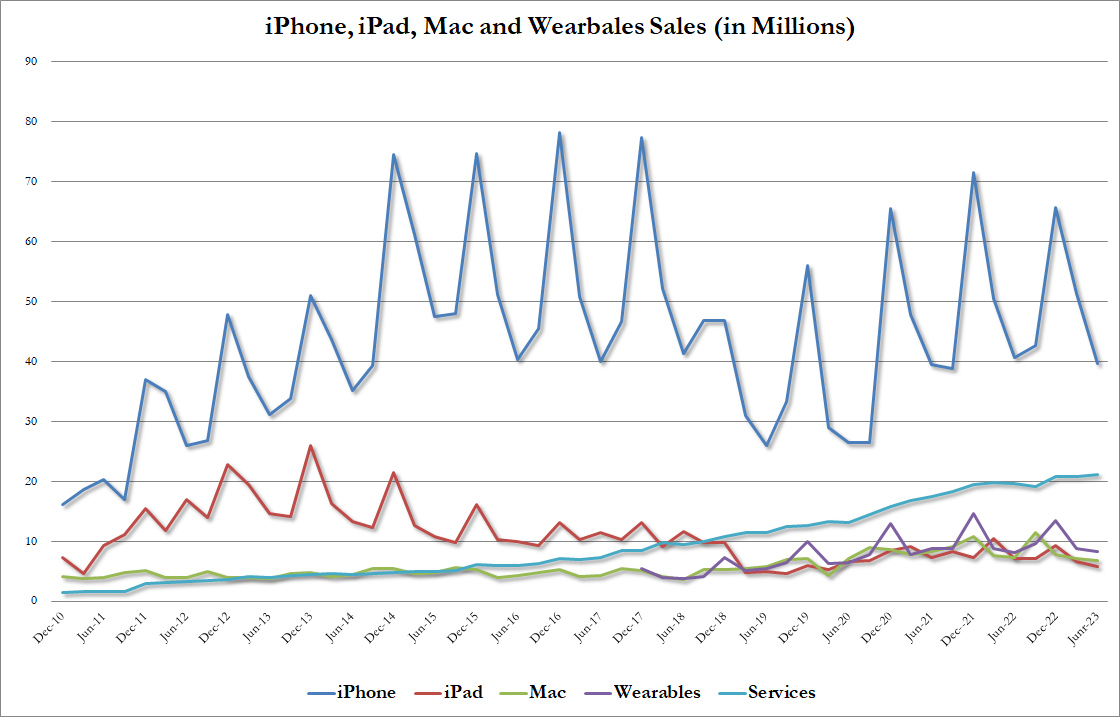

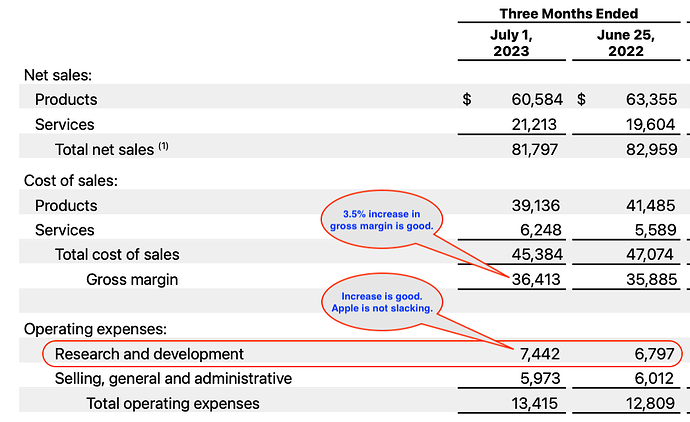

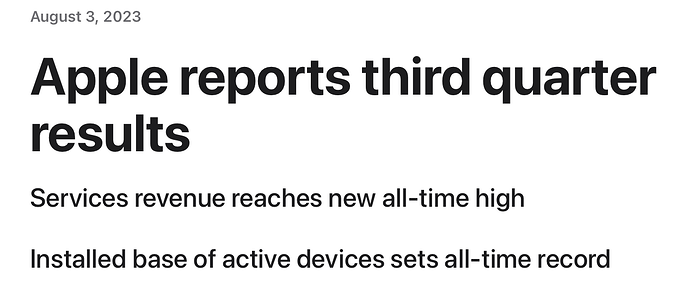

Apple revenue down 3 quarters in a row. First time in history I heard people say. iPhone sales weaker than expected. Stock dropping after hour.

.

Their history is pretty short. I have shown you a chart here before… 2016. Nowadays, when people say history, historical, … I want to know from when.

Knox has been bearish throughout this bull market rally from Oct 2022… performance of I/O fund can’t even beat QQQ… whereas retail investors such as Kris and Jesse has few hundred percentage gains YTD. Even newbies such as Amit has more than doubled his return YTD.

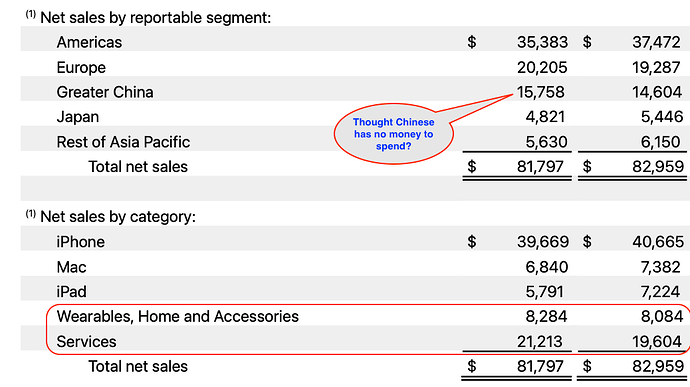

Apple sales by segment. Every segments falls except services aka the App Store tax, which is at risk of being shaved off by governments.

Apple not a growth company no more.

.

Sure?

The segment that decline the most in % is iPad revenue.

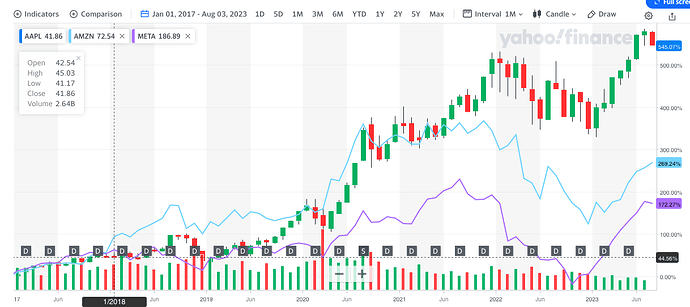

That’s what you said in 2017… refuses to buy and claim that AMZN and META would overtake AAPL in market cap.

Performance of AAPL, AMZN and META since Jan 1, 207.

Growth by product vs growth by taxing.

Apple has two big threats. First is its reliance on taxing App Store transactions that doesn’t sit well with every regulator in the world.

Second is its reliance on China. Geopolitics and China’s slowing economy posted a threat to Apple that no other big tech company faces.

What you said is what market has said for ages… go and read the history… always the same concerns. After a few years, dust and post again. Why don’t you read what you’ve said in 2017. Please don’t repeat what you’ve said in 2017 again.

Services has been increasing because the installed base has been increasing… not because AAPL has increased the charges… in fact, has been reducing the fees. Btw, services is not just App Store.

Revenue from China has increased YoY. The revenue has decreased in the strong resilient economy of USA.

Gross margin increase ![]()

That’s fine. I was early and thus wrong in 2017. Let’s see if my thesis fares better 6 years later.

There is a difference between creating new products and making money off those new products, vs milking existing customers. People may say money is money what’s the difference? It’s like asking what’s the difference between Jobs’ Apple vs Visa or Mastercard. If you are not pushing forward with new products you are not making offense. Just a defense company resting on old glory.

App store revenue is like 30% of Apple service revenue? Unlike Apple TV or Music, App store revenue is almost pure profit. It’s a tax. Only expense is paying reviewer salary and server costs.

China is a big country of 1.4B people. Its top end of 7% or so population is First World, with income similar to Western Europe. That’s 100M people right there, similar to the entire population of Japan. Slowing economy is affecting the bottom 93% of Chinese population first and foremost. But rest assured, those top 7% won’t do well after too long.

.

Should I call that stubborn or perseverance?

Apple didn’t reveal the details.

Many app developers don’t pay anything.

You could be right. I am not into forecasting.

This one is hard to decipher because Apple didn’t reveal details.

There are three categories of Apple service users.

a. Existing Apple users

b. Migration from Android

c. 2nd/3rd/4th… hand Apple users

Replacement sale by a. is less than the new users from b. (deduce from sale decline).

c. is a growing group (deduce from increase in service revenue).

![]()

Growth of installed base is more important than unit sales.

Unit sales fluctuates with economy and new product launches.

Installed base uses Apple services and will replace their devices eventually (sale).

Growing installed base mean people view Apple products as useful and relevant to their life.

MH: LoD so far is $183.35 … in wave iv territory. Is either completed or … after completion, should pass $200, this should follow by a very sharp drop to… the real drop… should be below wave iv.