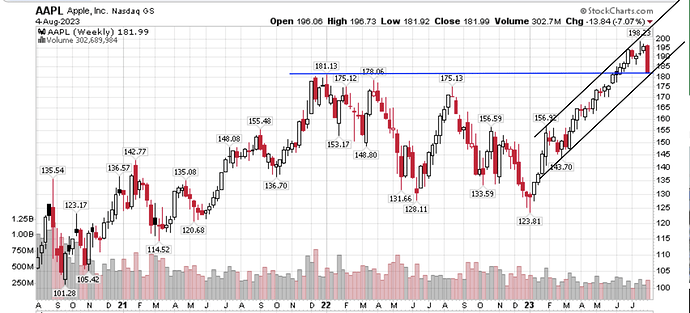

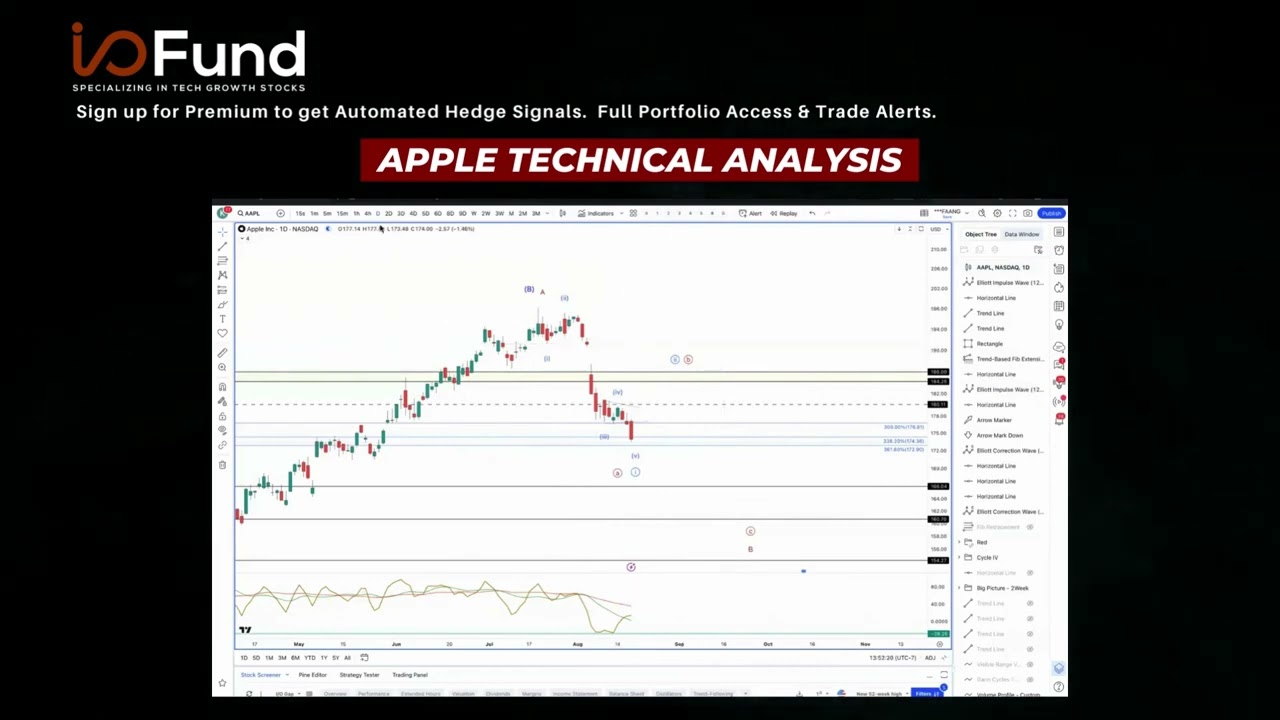

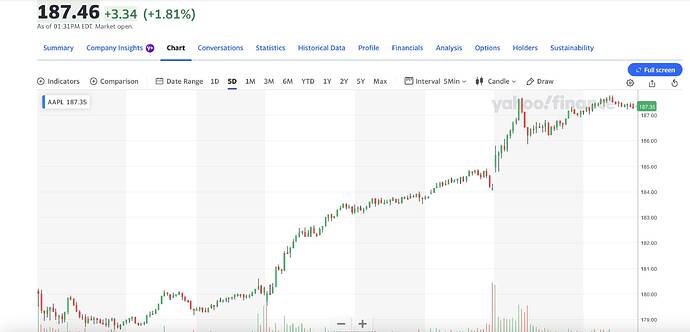

Trend line broken.

.

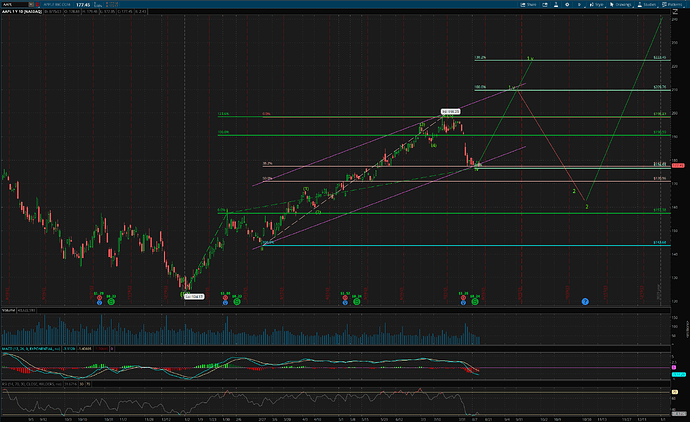

Wave iv can be obtained using fib ratio (posted previously). Another way is to draw channel ![]() Click this link for how to draw channel to establish wave iii, then wave iv, then wave v. The chart below illustrate how to use the channel technique to establish wave iv…

Click this link for how to draw channel to establish wave iii, then wave iv, then wave v. The chart below illustrate how to use the channel technique to establish wave iv…

The price target is about the same as using fib ratio.

$175-$180 is a strong support… Technically is called retesting the breakout from a double bottom.

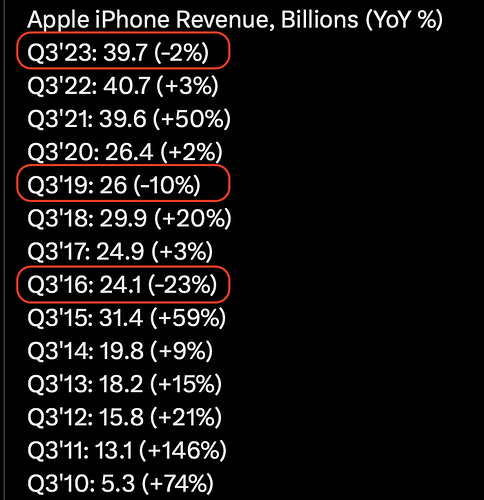

In Q2, industry side PC shipments declined 15% while Apple declined 7%. They are taking market share. The real question is do people believe PC sales will rebound at some point. (Hint: they are cyclical and will).

In Q2, smart phone sales declined 24% while Apple declined 2.4%. That’s an order of magnitude less. Unless people think overall smart phone sales are in a secular decline, then there’s nothing to worry about.

Apple is outperforming competitors in key areas. When those areas return to secular growth (and they will), then Apple is positioned to benefit.

.

In other words, good opportunity to BTFD for those who want more exposure or has been waiting to invest.

Adam wants to buy ~$140s… not this drop, wave iv won’t go that low… may be, wave 2 (the real drop)… my assessment is $165 max.

Not a financial advice. Just thinking aloud.

No value to TSLA. I feel Apple should buy a car manufacturer that doesn’t have a UAW. Any car manufacturers with an union is worthless.

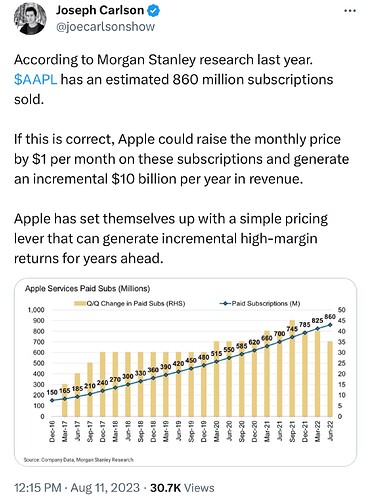

Joe is busy defending his investment in AAPL.

IMHO, so long as the installed base of Apple devices keep increasing, I’m not worry.

Who is familiar with Apple manufacturing in China?

Yuan has fallen a lot vs USD. If Apple pays FoxConn in Yuan, margin of Apple devices would increase ![]() However, if Apple pays FoxConn in USD, no change in margin. FoxConn reported increase in earnings, so it is likely Apple pays FoxConn in USD.

However, if Apple pays FoxConn in USD, no change in margin. FoxConn reported increase in earnings, so it is likely Apple pays FoxConn in USD.

Also, wondering how much cash is held in Yuan.

How to assess impact of forex on Apple earnings?

It used to be USD but that was a long time ago. Most companies do not want that FX risk. I doubt Apple holds much cash in Yuan. It’s probably in their earnings slides. They hold the cash where the revenue is generated.

.

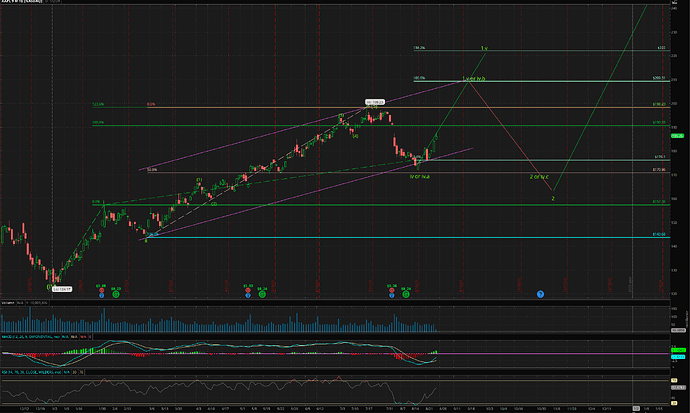

Assuming market correction is over i.e. AAPL has completed wave iv, the expected target of wave 1.v is… using the channel technique mentioned 12 days ago…

Updated EW picture with expected price target of wave 1.v… btw watch out for wave 2 if you’re a trader…

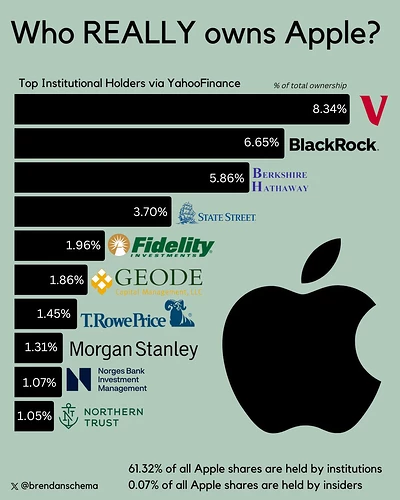

Tesla and Apple are the most underowned companies right now, says Jefferies

![]()

Alphabet, Meta and Microsoft rank among the most overowned companies…

Not a surprise. Current generation of investors love asset-light software companies and avoid capital intensive hardware companies.

Thought so ![]()

Wave C is always five waves ![]()

My count from 5 days differs from Knox. Difference is due to different count of the lower degree waves.

Superimposed my count (5 days ago) upon Knox’s chart for clarity.

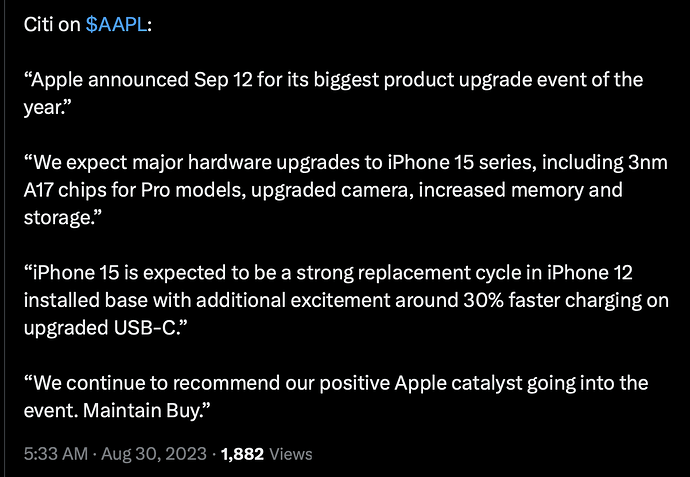

Kuo is so bullish ![]() about iPhone 15.

about iPhone 15.

No change in preferred count from 14 days ago… added alternative count for reference.

Alternative count is instead of completion of iv, is completion of iv.a.

Counted EW picture is for entertainment, no plan to trade AAPL. Is a hold (forever) stock for me. No sale. No purchase. No hedging. No option. No action ![]() essentially.

essentially.

Incredible gain over 5 days… about 5% below ATH.

I hope it ships soon. I need to upgrade. My charging port is getting so it mostly works. That means it’s getting closer to sometimes working.

.

I follow a two year cycle. Currently iPhone 14 Pro Max. So no upgrade this year. Next year ![]()

I have an 11 Pro Max…. I guess it’s been 4 years.