Title is click baited. Content is fairly accurate though some choice of words are intentionally provocative.

Microsoft CEO Wants New AI PCs to Revive Mac Rivalry

Satya admitting that Windows PC is not as good as Mac ![]()

Apple focuses on optimizing performance per watt and across Apple products. So it is possible that Satya 's claim that ARM chip in Windows AI PC has higher performance than that on Mac could be true, albeit hot (use more power) and noisy (fans).

Even Elon Musk thinks highly of Apple product.

Mehdi also suggested Copilot+ PCs are 58 percent faster than M3-powered MacBook Airs (though it’s worth noting Apple has more powerful M3 chips in its laptops already and M4 chips on the way very soon).

![]()

Comparing with the slowest Apple laptop.

![]()

![]()

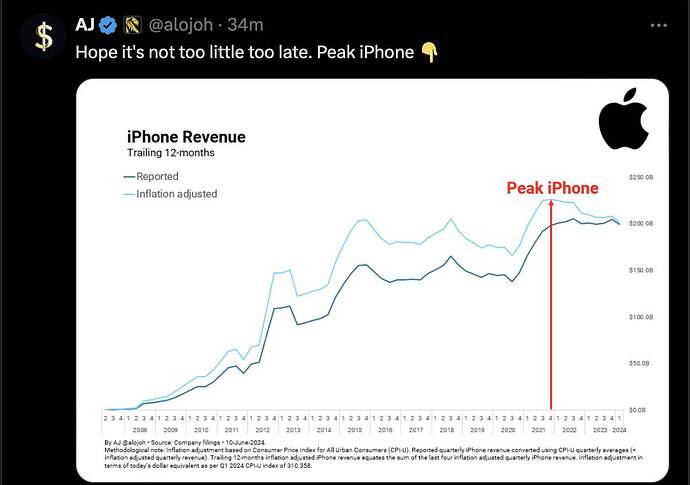

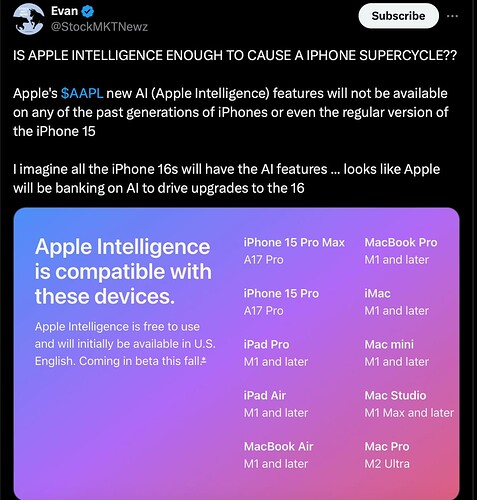

Just a newbie wants to establish a strong following talking about AAPL…

What if a super cycle occur?

What if is a judgement call decision.

Investing is about making the right judgement call.

Basing your decision on mainstream media, social media and financial articles do you no good.

There are many “no revenue growth” stocks that return very well through the years. Revenue growth is not as relevant as what many believe in influencing share price. Revenue growth reasoning is a concept invented by growth stock founders and analysts to pump their share prices.

Apple’s China Business Is Booming and Other Tech News Today

The tech giant’s iPhone shipments in China surged 52% in April, Bloomberg reported, citing data from the China Academy of Information and Communications Technology. Competition in the Chinese market, and softening demand for iPhones, has been a major concern for investors as the shares have fallen 1.3% so far in 2024.

WWDC Jun 10 ![]()

https://twitter.com/LastCallCNBC/status/1795596532806201824

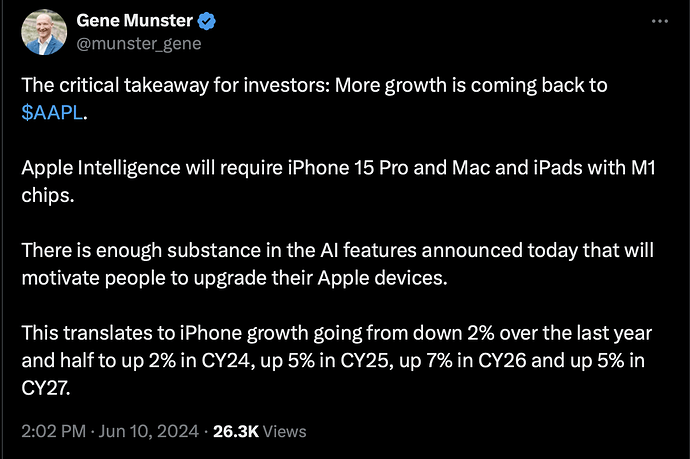

Gene Munster thinks AAPL would outperform NVDA over the 12-18 months.

EWT says the same.

From fundamental’s perspective, it depends on what were announced during Jun 10 WWDC.

Now that Vision Pro is available to China, Japan and Singapore, I will buy one in Q4.

I will upgrade my iPhone 14 Pro Max to iPhone 16 Pro Max in Q4.

Staying around here is good enough. Better to be stable here for many years than to be roller-coaster e.g. one year very high, one year very low. I would like to see more sales in Macs and iPads.

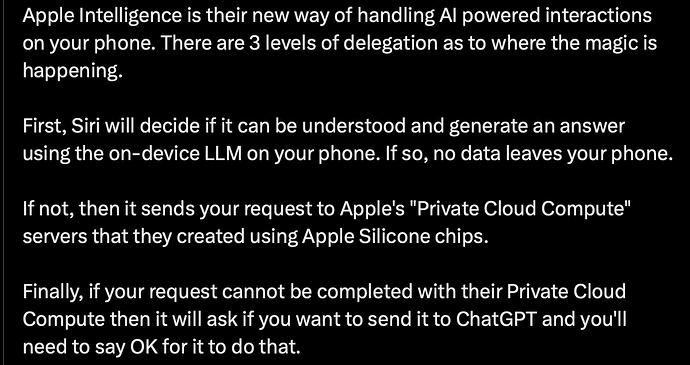

Apple Intelligence requirements: iPhone 15 Pro or better; Macs and iPads with M series chip

For those who didn’t watch the event,

Most of the Apple Intelligence is done on-device using Apple neural engine as inference engine.

Max capability would need a Mac or iPad with a M series chip, and an iPhone better than iPhone 15 Pro.

MBA with a M1 chip released in 2020 is currently selling for $700 in Walmart.

https://twitter.com/CNBCFastMoney/status/1800275299541643666

.

.

![]()

Should I trust a person who con his wife to sign a post-natal agreement?

Should I trust a person who hold shareholder ransom even though it is his fiduciary duty to do his best to protect shareholder’s interest?

Anyhoo, Elon is a Bozo. More fruitful to listen to Joe Carlson and …

…Marques instead…

Almost every AI stuff is done on-device by Apple. Occasionally when you’ve queries that require non-personal data to complete, it would be sent to Apple Private Cloud Compute or ChatGPT (you would be prompt for agreement). For ChatGPT, IP would be hidden, OpenAI can’t form a profile on you.

Views of commentators are worthless. Holding my breath for how average consumers would vote with their wallets. I bot a M1 MBA in 2020 so I don’t need a new Mac. Would upgrade my iPhone 14 Pro Max to 16 when it is available. Btw, Apple SuperCycle is a 3 year cycle… quite often I read in social media that imply a 1 year cycle.

Your logic is since Apple is a hardware company, software updates are not innovation?

Did you watch the event? You don’t really need ChatGPT. Anyhoo, in future, I expect you can select any Gen AI chatbot for those queries that need non-personal data to complete.

.

Apple is adopting similar strategy as for Spotlight and Web Search.

Spotlight search personal data.

Web search for public data. Btw, Google pays Apple for providing this service to Apple customers.

In the same vein,

Apple Intelligence for personal data and done mostly on-device.

Where public data is necessary, use ChatGPT. In future, expect other alternatives, and whichever give Apple the most favorable terms will be the default.

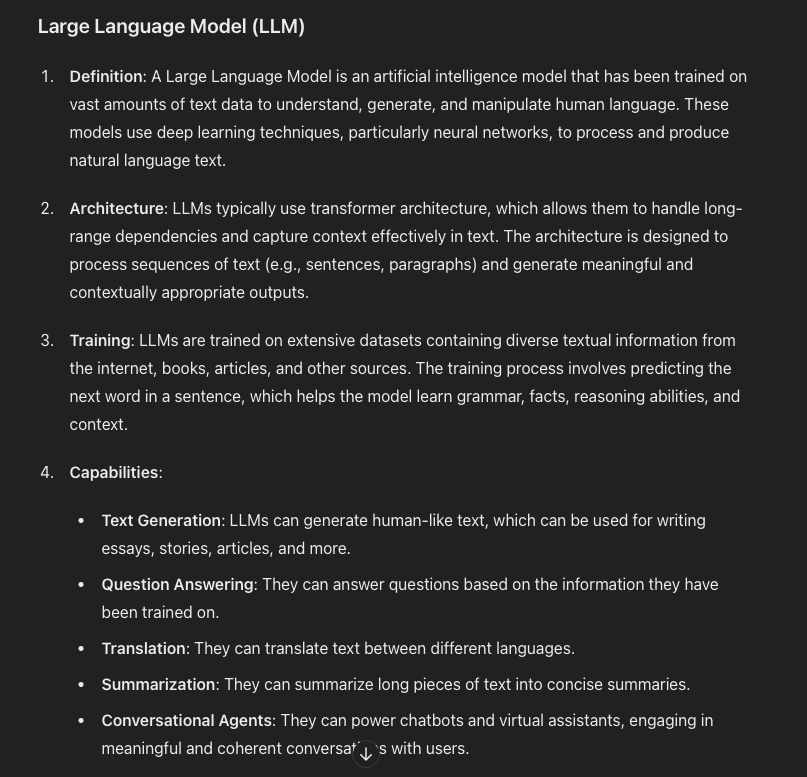

Frankly not sure what is the definition of LLM. Apple does the same modeling with much less parameters.

Btw creating a foundational model is brain dead simple. And cost of training is declining at 80% per year ie cost 80% less after one year. It is unclear what is the business terms with OpenAI, won’t be surprised OpenAI is paying Apple. Don’t see the wisdom of spending a fortune for extremely fast depreciating asset when you can get the service plus a revenue source.

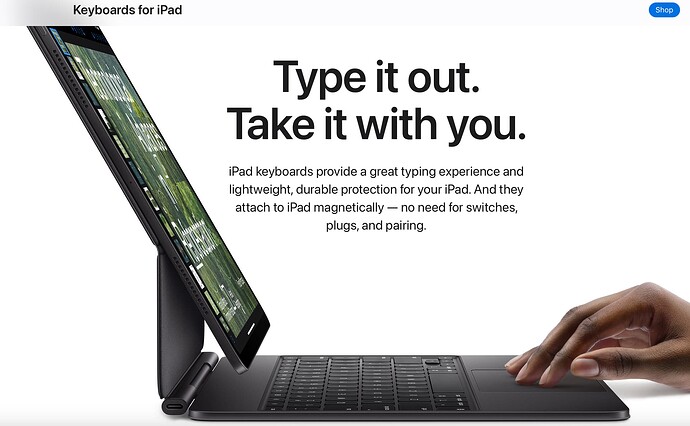

Should pay attention to iPad.

First M4 iOS device.

Calculator for iPad

I sense Apple has big plan for iPad. With a keyboard, is a laptop replacement for many…

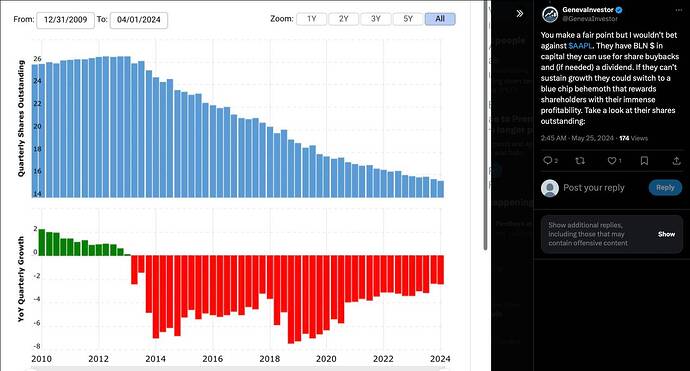

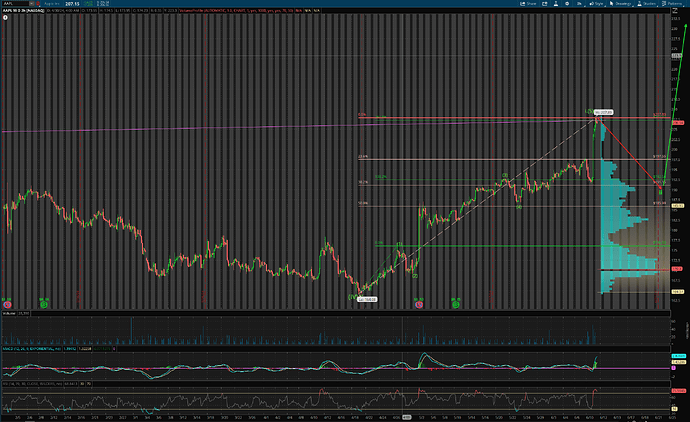

Weekly Chart

EWT: Preferred unchanged. Below is an updated chart for price progress.

2-hourly Chart

EWT: Lower degree wave count. Could be in intermediate wave ii, target $190s.

The article provides the fundamental basis for the decade long SuperCycle (V).

Within three to five years we will see some amazing things from Apple Intelligence that will boost Apple’s bottom line pretty quickly.

The best apps should come from developers. Market thinks AI (Apple Intelligence) will boost iPhone sale, I happen to think sale of iPads would increase more.

I’m not chasing the stock now as it is putting in all-time highs, but of course, would be looking to pick up a little the next time it pulls back 10%-15%.

Last chance for bears who didn’t pick up AAPL at ~$160s.

I still think AI in particular and online services in general are not Apple’s strong suits. Maybe they will develop new muscles. Who knows. But it’s not trivial.

Unlike web search, which has always been siloed off into its own thing, Apple seems to want to integrate AI deep into all their OS’es. So ultimately Apple will want to develop their own LLM. Relying on third parties for such a fundamental feature must really make Apple uneasy.

Did Apple show any demo on their AI features? Seems like it’s still vaporware? Might be great and works flawlessly but people are too eager to believe everything Apple promises. I will reserve judgement until I see working code.

Reading commentators e.g. Finance Junkies makes you laugh out loud. These guys either didn’t watch the event or sleeping most of the time or suffer from ADHD. Also, do people even understand what is a LLM? Obviously Apple uses LLM (transformer architecture). It just didn’t train on public data… plenty of companies doing that, why bother to duplicate? Apple is in talks with many other companies (yes, even X), so in future, you can decide which one to use (yes, even Grok), not a must to use ChatGPT for public data. I read some commentators claim that Apple Intelligence is implemented using ChatGPT… wtf…

Having said above, I believe Apple is working on what public datasets are bona fide that can be used for training. At this point, can’t tell because you don’t know what type of queries/tasks that Apple customers will ask/need to get done that would need public data. By being selective, Apple doesn’t need to waste resources to train all kind of useless public data.

.

Definition of LLM

.

Working with Bozos that spend a fortune buying overpriced GPUs and run a LLM on all kinds of public datasets that include worthless unsupported by evidences rumbling and opinions

Three months after an AAPL bear posted his view…

AAPL shot up by ~29% and…

… retook the crown…

YTD…

Pretty sure the bear would insist he is right, the market is wrong.

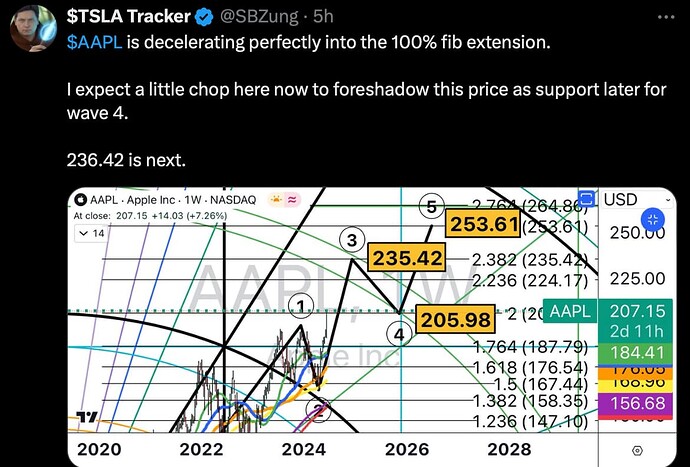

A TSLA bull tracking AAPL ![]() His EW count is the alternative count that I didn’t draw in my latest chart (was drawn in previous ones).

His EW count is the alternative count that I didn’t draw in my latest chart (was drawn in previous ones).

Difference in time frames. Stock price and fundamentals don’t tend to line up in the short run.

For example, Tesla is also up during the last 3 months.