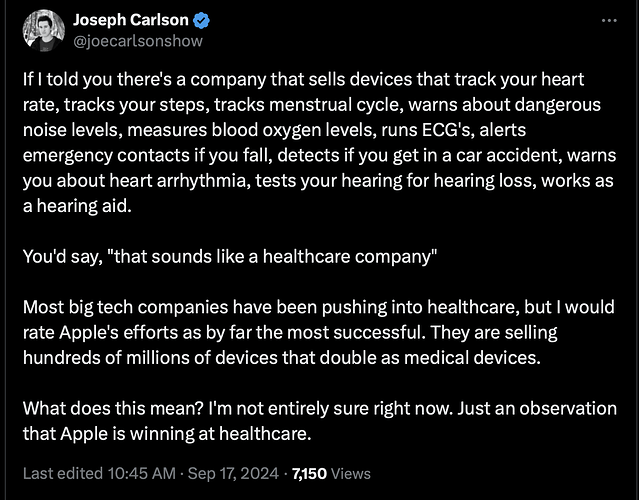

Zuck always want to sound noble to cover up his heinous profit making.

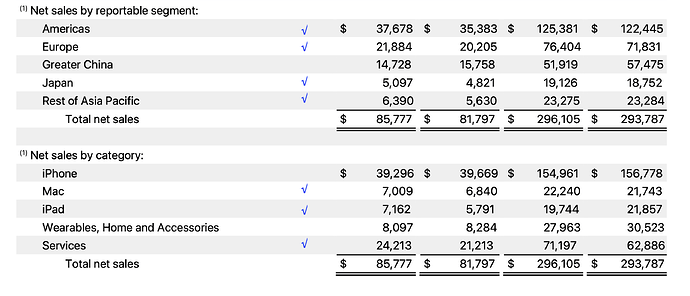

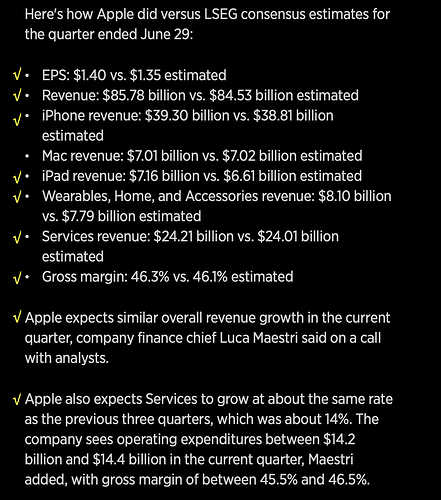

Apple today announced financial results for its fiscal 2024 third quarter ended June 29, 2024. The Company posted quarterly revenue of $85.8 billion, up 5 percent year over year, and quarterly earnings per diluted share of $1.40, up 11 percent year over year.

11% growth ![]()

“We are also very pleased that our installed base of active devices reached a new all-time high in all geographic segments, thanks to very high levels of customer satisfaction and loyalty.”

ATH installed base ![]()

Growth of Services = 14%

iPhone = $39.3B, Services = $24.2B, Rest = $22.2B

M4 iPad boost sale by nearly 24% over last year, ending up higher than Mac sales. Splendid.

.

Beats estimates easily…

If services can grow at sustained rate of 14%

.

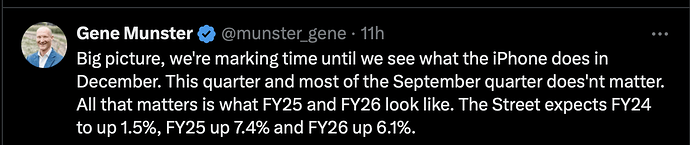

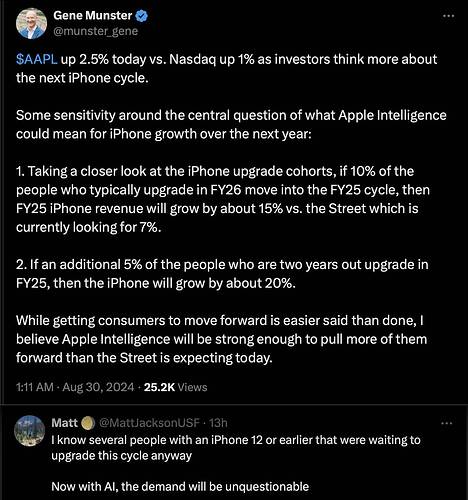

Agree that the only event that matters is whether there is an iPhone super cycle. For me, I would like to see an iPad Super Cycle.

WB claims that he doesn’t interfere with management so how reliable is below rumor?

I believe the blogger added salt and pepper to/ misquoting/ misinterpreting whatever his friends tell him/her.

Be a Bank: Buying Treasuries is not being a bank, Apple has being doing that already. Be a bank would subject Apple to many restrictive regulations… don’t seem wise.

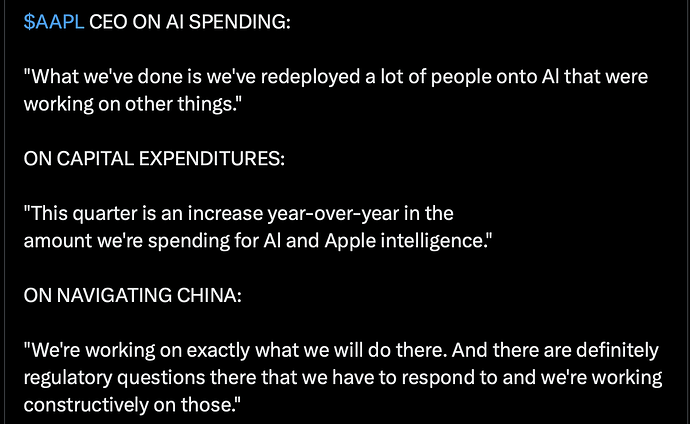

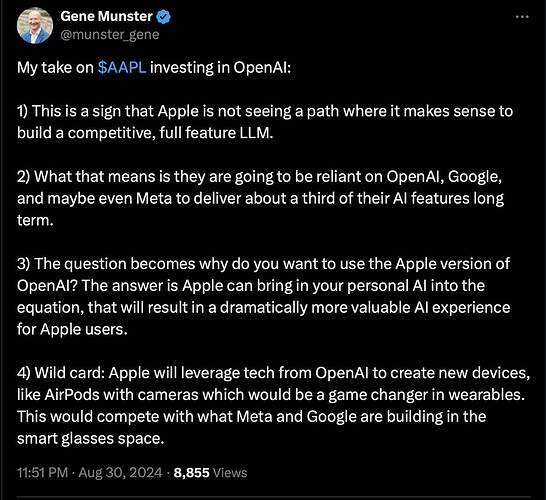

AI: Apple didn’t outsource AI at all, it merely didn’t want to create another chatbot based on public data… there are so many around. Apple built its own chatbot and AI agents for propriety data. During the earning Conference, Tim Cook said that he has moved many engineers into AI work, so has to cancel or outsource their previous R&D work to vendors.

Vision Pro/ Apple Glass: Likely follow the growth path of Apple Lisa/Mac. Initially, mainly for corporate and professionals. Apple plans to replace iPhone with Apple Glass (yet to be launched) by 2034.

.

If WB bought into AAPL is because he thinks iPhone is a “forever” business, selling AAPL because of Apple’s plan to replace iPhone with Glass is reasonable since his bullish thesis is broken.

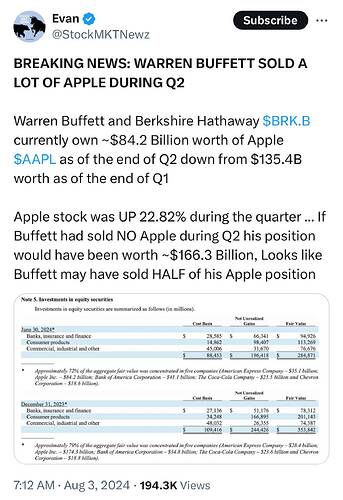

Aug 2, 2024

“We argue that the best way to think about AAPL’s valuation, pricing power, competitive advantage period, and barriers to entry is through the lens of AAPL’s installed base of more than 1.25 billion of the wealthiest consumers in the world using more than 2.2 billion active devices an average of 5 hours per day,” said Needham analyst Laura Martin said in a note this morning.

Installed base > 1.25 billion

People like to crap on Buffett but he was almost always right when he sold. His mistakes tend to be the opposite, that of omission. He should have bought Google or Amazon years ago but did not. He himself admitted as much.

Aug 5, 2024

Preferred count is still valid. Below $191 would invalidate the count i.e. no longer in wave (iv). LoD is $196.

Below $191, $237.23 is likely the completion of a Primary (multi-month) degree impulse ($164.08 to $237.23), wave I. That is, in wave II retracing Wave I.

Conclusion: Either in wave iv or wave II.

Jul 17, 2024

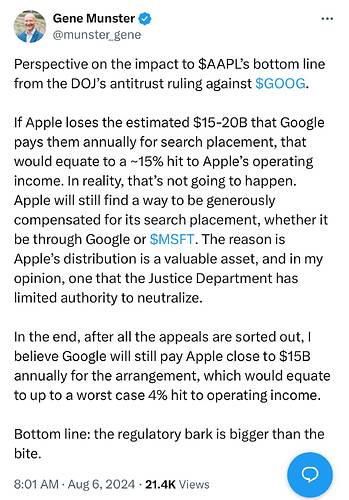

Biggest loser of the Google antitrust case could well be Apple.

In 2022 Google paid Apple 20B for the privilege. It’s now ruled illegal.

There are many ways to conduct business.

Apple is so giant — it generated nearly $400 billion in revenue last year — that even a $20 billion deal may not seem like that much to the company. And that number likely won’t go to zero. Whether Google gets replaced by a competitor like Bing, or if it keeps working with iPhone but under different terms, Apple will still likely be able to get very good money leasing out real estate on its phones.

LoD is 7.4% below ATH $237.23

AAPL is in consolidation (less than 10% from ATH).

![]()

George Soros bought what BRK sold.

Apple is now Malik’s “top AI pick” in a shift meant to “align with our AI investing framework.” He sees three stages of the AI rollout, with the first two being infrastructure plays. First there’s chips and servers, then networking and storage. Finally, there are devices that bring “consumer-ready smaller AI models” to the masses in a regulatory-compliant way.

He rates Apple shares a buy with a $255 target price.

Tim Cook explains why Apple chooses China for manufacturing.

Lots of labor capable of advanced tooling skills.

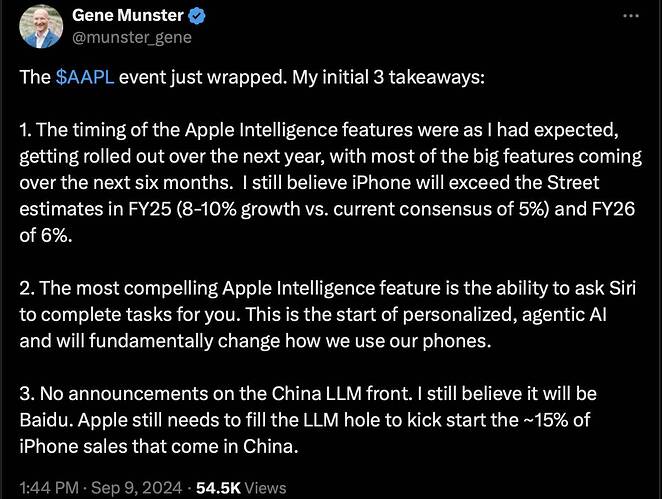

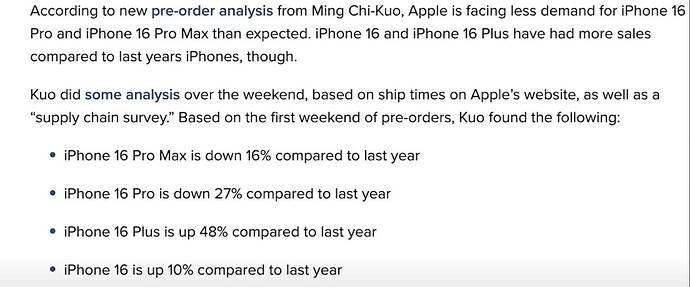

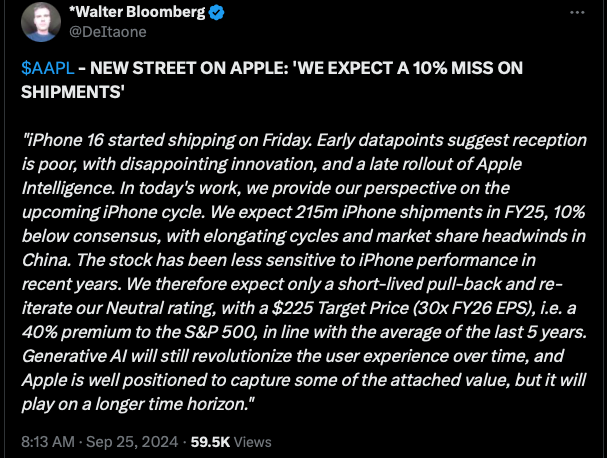

Traded in iPhone 14 Pro Max for iPhone 16 Pro.

Pro Max is too heavy for my weak hand.

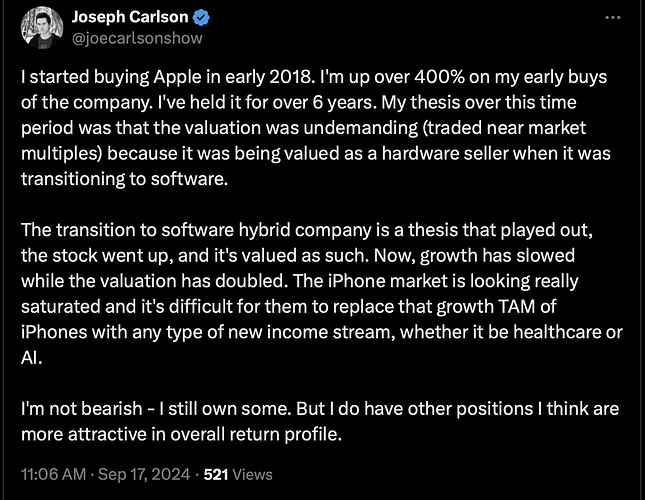

Joe sold a winner for many years and bet on turks.

Joe started to doubt his decision to sell some of his AAPL holdings.

Eventually.

That’s what I have been waiting for. I need 24hrs blood sugar monitoring.

Obvious

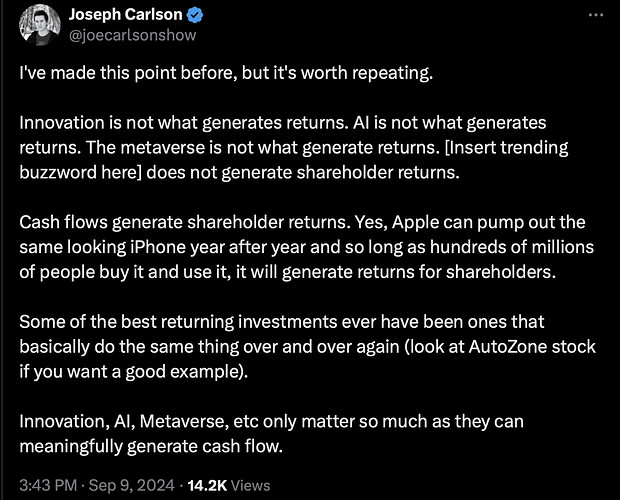

In other words, do what you’ve been doing.

Traders trade.

Investors invest. LT investors continue to hold.