I try to avoid updates here as I feel that I may be wasting my time esp during holidays. I am programming and programming endlessly until I get the depth of the subject. I am unable to update here as I am alone programming (not sharing with any one).

FA is backbone of any investment, be it real estate or stocks.

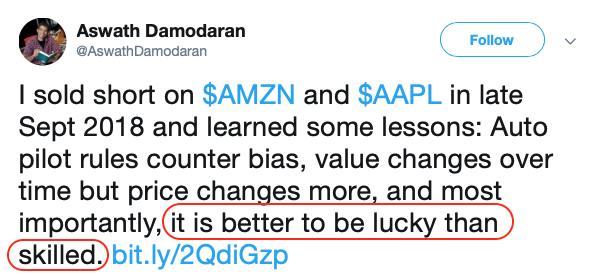

Various degrees of assessment happens like no two appraisal brings the same value. Similarly, aswath or fisher or graham or buffet may vary on their assessment. They use the similar tool what big banks or hedge funds are using.

Again, fundamental analysis is too big subject and essential for any long term investment.

Here is my last update about FA and TA:

For me, both TA and FA work and benefit overall. They both use past data to analyze future potential. One uses earnings and profitably trends and the other uses price trends. TA in its simplest form looks at patterns in past stock price movements to predict future price movements.

Two sides of the same investment coin, buy low and sell high. TA is a short term (swing trading) outlook while FA is long term (investing) outlook.

TA doesn’t work while big market makers forces driving share prices (UP or DOWN) using algorithms, esp during the last 30 days of 2018 (down swing) and 2019 (up swing).

FA, works Over a longer time frame, is generally a result of new public information about a company being released, e.g. a company beating earnings expectation over the year and increasing its stock price by an amount relative to the earnings beat. DCF analysis one of the best to guide us future growth.

When you look at stock price movements to determine stock price movements, you’re not looking at the underlying cause of those movements and what actually moves the stock price in the first place.

The accurate way to predict future stock price movements is to predict the new public information being released that will influence the stock price (i.e. the cause). This is why fundamental analysis works.

Markets are probabilistic in nature, and it is more about knowing the probability distribution of future price movement, rather than trying to define a deterministic function and make concrete predictions.

I used to monitor 580 stocks (while I focus my core 100 stocks) using my own proprietary algorithms. By using my own algorithms (TA and FA combined) I see my gain is increased.

Good Luck and Happy new year to you all

and enjoy the holidays

and enjoy the holidays