Apple will release the first Mac with Apple silicon end of this year, and it expects the transition to take two years.

Recent reports have suggested Apple’s move to ARM has been prompted by Intel’s slowing performance gains. Apple has reportedly been testing ARM-based chips in Macs and found big performance increases over Intel alternatives.

The biggest addition this move to ARM-powered chips brings is the ability for iOS and iPad apps to run natively in macOS in the future. “Most apps will just work,” says Apple, meaning you’ll be able to run native macOS apps alongside native iOS apps side-by-side for the first time.

New ATH. $359.21 ![]()

So in future, more MacOS apps than Windows applications ![]()

MacBooks will likely be cheaper, thinner and lighter as a result. Apple will increase its market share in PC.

Apple finally backed down. Should have done it sooner to avoid the bad press.

Stock investment ![]() RE investment

RE investment ![]()

Cohen, however, admits he has a difficult time finding attractive alternatives, so when something comes along that he truly believes in, he jumps in head first. And Apple ticks all his boxes.

Right ![]() choice.

choice.

As for the broader market, he says “the single-biggest factor in determining valuations are interest rates,” and as long as they stay low, or even rise slowly, equities will perform.

We know ![]()

He didn’t get rich from Apple stocks. He got rich by selling his startup, and parked his money in AAPL.

May not apply to people who want to create wealth instead of keeping it.

You mean grow ![]()

Grow? Buy the one-rule stocks ![]() . Any cloud stocks

. Any cloud stocks ![]()

Project Titan without  involvement?

involvement?

AAPL appreciates the most from market bottom.

Also rocks yoy. 84% in one year, no trading, no options, no heavy reading like @manch, just blindly hodl. That is, has @manch puts all his investment of $1M into AAPL one year ago, that would be worth $1.84M at yesterday’s market close.

Has @manch bought AAPL instead of ridiculing Apple biz model in Jan 2019, his $1M would be worth $2.5M ![]() Including his wife $1M, $5M! his target of $5M per adult met, easily

Including his wife $1M, $5M! his target of $5M per adult met, easily ![]() Wait, did he say investing AAPL won’t grow wealth

Wait, did he say investing AAPL won’t grow wealth ![]()

Now that I am in the topic of buy n hold, need to explain to @Jil about why buy n hold is more powerful than trading. @Jil has previously said in theory his trading algorithm can make much more than hold. In theory  but won’t be true in reality because of how we invest. The likelihood is he would limit his trading $. Thought experiment,

but won’t be true in reality because of how we invest. The likelihood is he would limit his trading $. Thought experiment,

Start with $1M in a tax sheltered account, either buy&hold AAPL with 30% annualized return or trade AAPL with 100% return per year limiting trading capital at $1M.

Worth of portfolio through time

Yr…,.Hold…,.Trade

0…,…1.00…,…1

1…,…1.30…,…2

2…,…1.69…,…3

3…,…2.20…,…4

4…,…2.86…,…5

5…,…3.71…,…6

6…,…4.83…,…7

7…,…6.27…,…8

8…,…8.16…,…9

9…,…10.60…10  Buy&hold overtakes trading

Buy&hold overtakes trading

… 10 years onwards, buy&hold leads, increasing lead through time

The reason buy&hold is more powerful because always all-in while trading tends to limit capital invested.

Buy & Hold needs lot of fundamental research to identify the correct companies ahead (say AAPL, TSLA, AMZN…etc).

We never know TSLA is going to $1000 few years before. My son, who told me to buy TSLA when it was $41, still holding 110 stock which he purchased (in his account) solid even today.

Where as somehow you knew well ahead during 1998-2000 about AAPL.

If we can find such companies, it is good, but how can we know that? What if lands like HTZ or worldcom-mci route?

I did try all the fundamental research…etc, but nothing to my knowledge I could confidently put my 100% stake into it, even with TSLA (when I know company survives next 3 decades).

Finally, I came up with trading part as I do not need to deep dive on fundamentals, but just stay with market for 90% to 100% asset allocation, easy to beat the calculation.

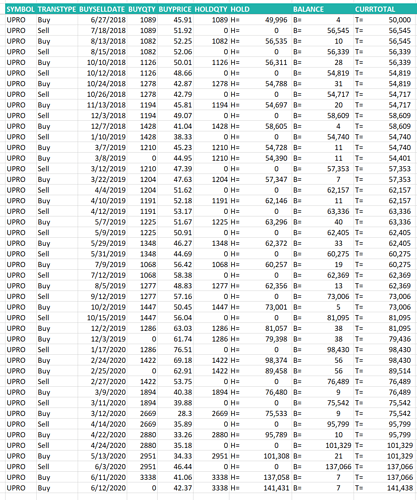

Programmed my own logic on trading VOO, UPRO, TQQQ…etc based on market swings. This gives me 182% return in just two years (still my logic needs to be refined). This is what I follow, not looking at wsj, cnbc…etc. Here are the dates , buys, sells, amount.

It works both bullish and bearish time, no need to worry about downturn…

How much research is needed for AAPL, AMZN, MSFT, FB and GOOG?

Feel like a no-brainer to acquire whenever they are brought down by macro (i.e. non-company specific) reasons like in Mar.

What??? You’re on the ground! I am in an ivory tower. Have some faith like your son!

Didn’t read my thought experiment? Did you limit your capital whenever it went up or continue ALL-IN? That is, from $1M all in to $1.82M all in, not limit to $1M even though have $1.82M.

[quote=“hanera, post:1199, topic:6690, full:true”]

My son is a starter in investment, I gave him some books and asked him to find the best for him. He has to learn, good, bad and ugly.

Yes, my experiment runs with 100% stake, 90% stake and 80% stake each buy, but sell 100%. It fairly gives good results with 80% range.

I have not achieved 100% guaranteed results, but potentially good returns better than any other reliable way for me.

The biggest challenge is future is unknown and unable to predict perfectly.

The biggest challenge is future is unknown and unable to predict perfectly.

If can predict, everybody is RICH i.e. everybody is mediocre ![]()

If can predict, everybody is RICH i.e. everybody is mediocre

Can AI/ML predict with 100% certainty when virus cure+vaccine will come??? ![]()