https://www.redfin.com/CA/San-Jose/1559-Willowbrae-Ave-95125/home/1554065

No way, say @Jil. Making $ in stock market is far easier and less hassle. Not for me ofc. Sell the wrong stocks (cloud) and hold on to loser stocks (semi). Thought would re-visit Mar bottom so watch the fun TV serials - turn out to be very expensive serials. Missed opportunity is driving me nuts.

Same here. ![]()

No Real estate. I am done with it !

Kudos ! Yes, stock market is the way for me…

![]() No more RE?!

No more RE?!

@Jil Given you know the area well, how much each of the unit can rent? I see similar price in Newark / Union City and those can rent about 2100-2200 for 2/1 - 750 sqft.

Here is one: https://www.redfin.com/CA/Newark/37258-Locust-St-94560/home/1821392

May be around $2250+ range. Here is the near by 3 bed, 2Bath rental, two streets away. This place is near to new google complex(that is the only attractive point).

https://sfbay.craigslist.org/sby/apa/d/san-jose-great-location-in-charming/7149376105.html

The golden decade of RE investment has come to the end. I am selling some of my rentals to put money into the stock market. We are heading towards the new Roaring 20s.

Other than selling, another option is to cash out. If you have a positive cash flow after cash out, you’ll participate in both the stock market and housing market.

Really and seriously? Welcome to crazy stock market !!

I have always been in the stock market, but most of my assets are still in RE. Time to do some rebalancing. It will be a multi-year process though.

Why roaring 20s analogy? This run-up has already been the longest on record…

Curious on which area you are offloading first.

I am also increasing my percentage on stock but I am still interested in multi-family cash flow investments though.

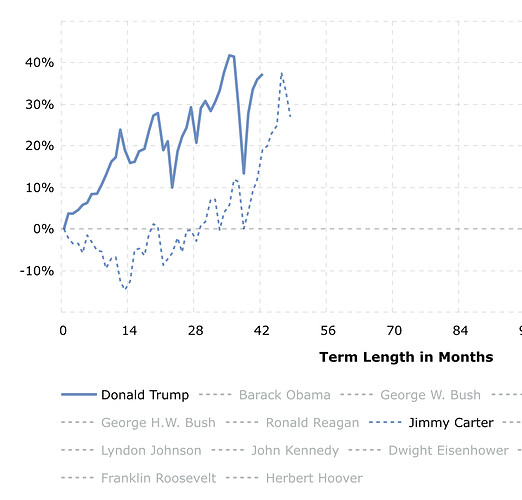

I have been saying we are in a decade+ secular bull market for a while. If you go with the conventional way of marking time, this secular bull started in 2013 when S&P overtook previous high. Trump’s term has actually been pretty meh for the market. I think it’s up only 30 or 40% in the four years. We have a lot more room to go.

Looks like we will have Biden come in next year. Don’t want to jinx it but I am feeling we are near a new dawn for America. Look at how the market did under Clinton and Obama.

I already sold one in the Sac area this year right before Covid shut everything down. I guess I will sell one every year? Will take a few more years. Won’t sell the SJ house though. I still like the core SV area.

Kind of interesting that Thiel thinks will be in a severe recession by November. Lines up with Warren Buffet’s thinking as well.

Secular bull can have many cyclical bears within. Not saying things will go up in a straight line.

This is what S&P return looks under Trump and Carter. I expect Trump’s number to go down to near Carter’s level by the time he’s kicked out.

The economic issue remains same whoever comes as president.

It will be the repeat of Obama first period.

I do not like Biden for only one reason that he firmly planning to revoke Trump’s Corp tax cut.

Revoking or increasing Corp tax to 28% is not good for this country.

Might not be good for the country too, but definitely bad for the stock market.

![]()

How/Why do u say that?