Obama’s first term was high deficit period started (but that is already started now), extra-ordinary unemployment, steep loss in real estate (it was RE downturn). It took four years (2008-2012) to bring up the USA. Almost 250+ small/medium banks are closed/bankrupt first 4 year term.

Exactingly similar situation, higher than 2008 unemployment, steep loss in services, entertainment, consumer sector (not RE), lot of bankruptcy will continue, and it will take unlimited funding, minimum 4 years to bring up the economy. This is the only focus of next government.

This is obama+ repeat term (Either Biden or Trump), they have to solve one problem to another until their first term.

Economist John Maynard Keynes: “The market can remain irrational longer than you can remain solvent.”

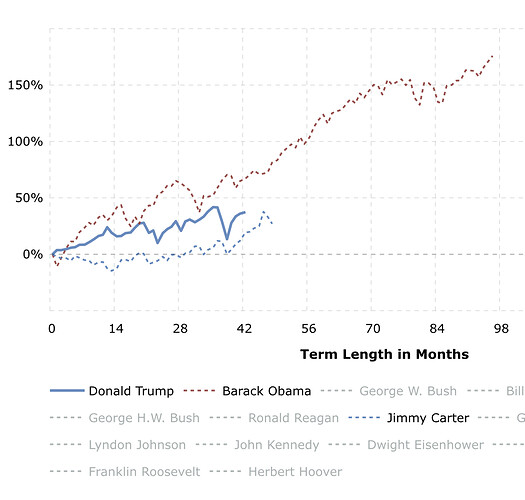

Stock Market in the long run (2 to 5 years) matches the economy, but in short run potentially stocks will be out of sync with economy. Both upside and downside, they go extreme ends like over bought and over sold position. This is commonly known as Market inefficiency and will always be there in any market and any country.

I got this message from “Margin of Safety” by Seth Klarmann. Most of the well known funds/investors use this concept to buy individual stocks/etfs or investments. Still market inefficiency theory works and people (Hedge funds/Billionaires) - waiting on sideline for opportunity - makes money.

If anyone experienced wants to know: For next 30 days, Stop reading news paper “Why market is down or why market is up”, but watch the market, you will clearly identify when the market goes up and when it comes down…like the way hanera does with EW.

Market behaves cyclically,with demand and supply, but news paper assigns some interesting news as reason which may or may not be right.