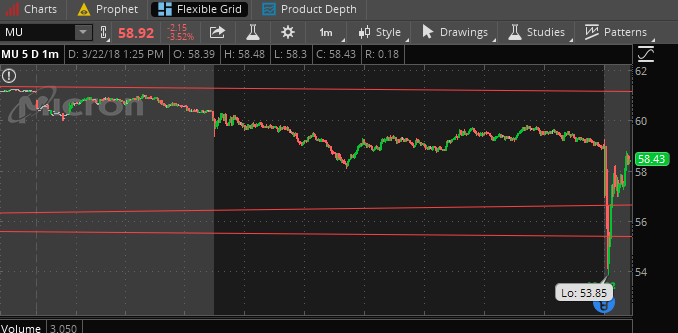

Micron tanked after hour.

Look again. I am expecting it to hit $66 in short order, so please don’t jinx it ![]()

Ok. Wrote too soon. Did you exit your spreads?

Closed Jul DITM calls (not today, yesterday at higher prices).

Bought back Mar 23 short calls.

Holding Apr 20 $65 calls for a gamble!!! Help me please ![]()

Effectively cut delta by 75%, less gain less risk.

The company reported fiscal second-quarter net income of $3.31 billion, or $2.67 a share, compared with $894 million, or 77 cents a share, in the year-ago period. Adjusted earnings were $2.82 a share. Revenue rose to $7.35 billion from $4.65 billion in the year-ago period. Analysts surveyed by FactSet had estimated $2.71 a share on revenue of $7.25 billion.

What is adjusted earning? GAAP? Adjusted for dilution? Haven’t read the report yet.

Using adjusted figures, beats Factset’s consensus ![]() So expect to rally tomorrow

So expect to rally tomorrow ![]()

Consensus: Revenue $7.25 billion, eps $2.71

Result: Revenue $7.35 billion, eps $2.82

Adjusted = excluding 1-time events, and they are non-GAAP. Almost all tech companies exclude stock comp from their adjusted earnings, and they are required to include it in GAAP. There are some other differences in revenue recognition for subscription or contract based businesses. That’s why subscription businesses also report other revenue metrics.

If you sell a $1M subscription for 12 months service, GAAP only lets you recognize 1/12 of that revenue per month even if the contract is paid upfront. It’s a change since the dotcom bubble when hardware vendors sold equipment to startups on credit. They were able to book the full revenue of the sale, even though the customer received 3-5 year payment terms. When the startups failed, companies had to issue massive revenue and earnings restatements. They were no longer going to collect all the payments for the equipment.

GAAP uses accrual accounting, not cash accounting.

Ok, adjusted mean exclude extraordinary items.

MU tanking.

Micron Technology Inc reported a better-than-expected quarterly profit on Thursday and raised its revenue forecast for the current quarter on higher pricing for its memory chips amid tight supplies and demand from cloud and automotive customers.

Any bad news or just sell the news?

Down with the rest of the market. I sold MU before the earnings, but everything else still tanked.

After yet another earnings beat Thursday, Micron MU, -3.52% announced that it would build out manufacturing capacity at facilities in Singapore and Japan for its two core products: DRAM memory chips and flash memory chips known as NAND. The company said its capital expenditures would be at the upper end of its projected range as a result, which was $7.5 billion plus or minus 5%.

The effort costs not just money but time: Micron expects the extra clean-room space will be online next year, near the end of 2019 in the case of its NAND facility in Singapore. That creates a danger that the heightened demand for memory will ease by the time Micron has put the cash and effort into expanding its production capabilities.

There is a danger that MU invests at a wrong time.

The secular trend is still more demand for memory because of AI. How much percentage growth would that be?

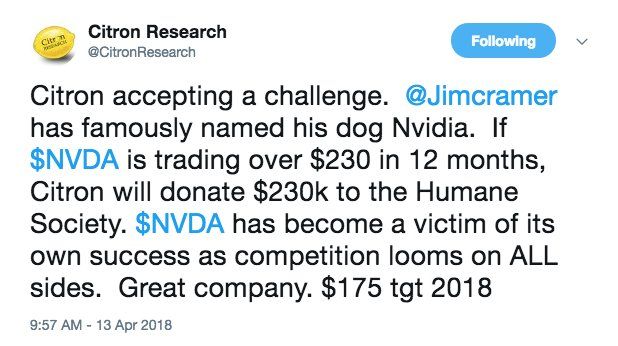

Citron doesn’t even write reports nowadays? Just tweets? ![]()

Micron, Nvidia weigh as chip makers hamper tech gains - MarketWatch

should have bought heavily into PANW, mu wipes off my gain

should have bought heavily into PANW, mu wipes off my gain

I bought some MU LEAPS today. May buy more in the next few days if prices stay depressed.

Did you go to their website and look at the “research”? The quality is embarrassing. It looks like something off a click-bait website.

> The Biggest Movers: Navient Gains, Micron Slumps

Micron Technology (MU) sank to the bottom of the S&P 500, hurt by an insider sale and downbeat analyst commentary.

Micron lost $3.55, or 6.7%, to $49.84.

Filings with the Securities and Exchange Commission showed that Director Mercedes Johnson sold 25,000 shares of Micron on April 2 for an average of $50.50 a share, in a transaction worth roughly $1.3 billion.

In addition, UBS’s Timothy Arcuri initiated coverage of the stock with a Sell rating and a $35 price target, highlighting “cyclical memory concerns and big estimate cuts.”

Do journalists need to pass simple arithmetic?

Jim Cramer: Micron Is Not as Cheap as It Looks

Now, I have traded or followed Micron for 25 years and I have a lot of contextual analysis of the stock. I know that it’s at its most vulnerable point when it sells at its lowest multiple on future earnings because that’s the market telling you that it is actually expensive because those earnings estimates won’t be reached.

manch,

Do you agree?