Isn’t the VR device that takes a Samsung phone a joint project with Facebook?

gear vr? forgot about that. sure.

TSMC’s guidance for the quarter is between $7.8 billion and $7.9 billion, versus Street consensus of $8.8 billion.

Crashes AAPL, NVDA, MU…

- Wearables, smartwatch

- AR, VR devices

- SmartHome, smart speakers

Tons of hype, sales are not that significant. Would all of the above ends up like PDAs? Or like iPods? No evidence yet they can be an iPhone type blockbuster.

- Smartwatch interestingly took off among some people. My wife likes it, and i saw on the arms of a bunch of people, but this might be bay area thing.

- AR/VR Super bearish you cant’ even imagine.

- Smarthome is becoming a thing slowly. Chromecast from google is great, and people love alexa. Others need to up their games (including google). I expect other smart features to emerge, but it’s not one thing - there are different products from companies for different pieces of “smart home”. Lights/door control/voice assistant/etc.

Haha, I intentionally leave out AirPods… selling like hot cakes. Is a wearable that can control any IoTs.

Just for info, AR APIs are built-in to iOS  iPads and iPhones are powerful enough to run AR apps… waiting excitedly for more AR apps to roll out

iPads and iPhones are powerful enough to run AR apps… waiting excitedly for more AR apps to roll out  Yes, no need for customized AR/ VR devices.

Yes, no need for customized AR/ VR devices.

• The selloff in chipmakers over concern about iPhone weakness is overdone, says analyst Vijay Rakesh, noting even those names with little exposure to Apple are being punished.

• He suggests buying ON Semiconductor (ON -6.9%), Cypress Semi (CY -4.5%), and Autoliv (ALV -1.3%) - each of which have less than 5% revenue exposure to the iPhone.

• He’s also still bullish on Intel (INTC -3.2%) and Micron (MU -5.2%) - each of which have less than 10% exposure.

• Broadcom (AVGO -3.3%) could be far more affected than those others, but Rakesh is even bullish on that name. “One of he best-run companies we cover,” he says, and notes July quarter guidance could see a positive impact from iPhone 9/iPhone XX builds.

Your posting of news is not actionable. Market is closed!!! Next time be more timely.

You can always buy in after hour, no?

No option trading AH/ PM.

Amazing story about Amazon’s push in socialbots, chat bots capable of carrying out banters about nothing and everything with humans. That’s extremely ambitious, miles ahead of Siri.

I lost million following his advice to buy bitcoin, no way I will buy Box now.

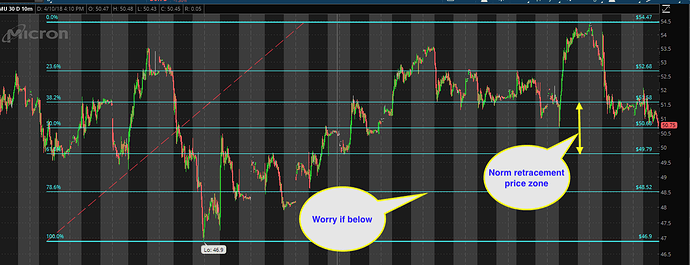

Down to precisely at 78.6% this morning and bounce back. Now is trying again ![]() Look like is time to say good bye too.

Look like is time to say good bye too.

time to say good bye as in time to get out and close position?

Exactly… want me to buy at this high price from him. I got fooled once, I bought tons of expensive bitcoin from him. Now, I paying tons of interest on margin borrowed money… don’t be surprised that you won’t hear from me soon and the next time I will make news in the paper.

Yes. If it breaks below $48.52, 78.6% retracement.