• Micron (NASDAQ:MU) announces a $10B share repurchase program.

• The program was announced in conjunction with plans to return at least 50% of FCF to investors beginning in FY19.

• Micron shares are up 2.9% aftermarket.

To invest in AI, just read the first paragraph of this article…

Back to FAANMG?

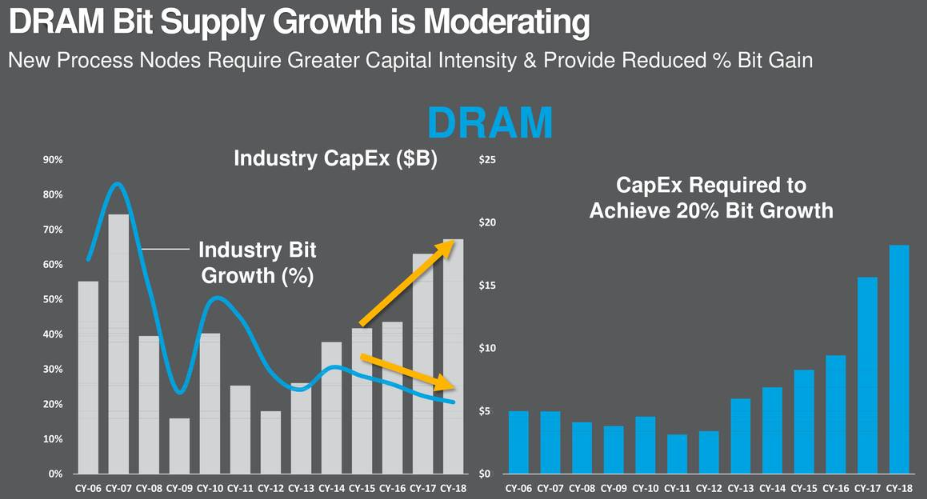

Slide from yesterday’s micron investor day:

Read the texts on the top carefully. That’s the “slowdown of Moore’s law” I have been talking about, and clowns like Cramer don’t get. Each new shrink of the process is taking longer and far more expensive than the past. Corollary is that supply growth will get slower and slower.

Even Cramer, who used to be bearish just a month or so ago, is changing his tune:

Stop that. I sold 1000 shares of MU a couple of weeks ago when there is widespread panic in this forum that the market is going down down down. I got proof if you want. I bet the farm based on your recommendation but I thought in a democracy, majority should be right.

Only an elite few reach the upper echelon of wealth. Democracy is just the lowest common denominator.

I am still buying micron everyday. It’s never too late.

Micron’s 3D XPoint Could Revolutionize AI $MU

The next wave in AI:

More or less.

Most of AI in large scale is really linear regression

More pumping of MU by Jim Cramer.

Jim Cramer: For Micron, Call Me a Believer

Me? I am a believer. I think the uses are secular, not cyclical, the difficulties of production real barriers to entry, not gateways to hell, and the buyback and cash production are significant, not illusory.

Cramer is a born again believer. Just two months ago he was a bear.

Micron Technology Inc. (MU) shares fell Tuesday following a report that a Chinese court blocked the sale of memory products from the chipmaker in China . Micron shares fell 6.6% to $50.87 in recent trading, after touching an intraday low of $50.10 . On Tuesday, Taiwan’s United Microelectronics Corp. said the China’s Fuzhou Intermediate People’s Court issued a preliminary injunction against Chinese subsidiaries blocking sales of “PRC 26 DRAM and NAND-related items”, including certain solid-state hard drives and memory sticks. Micro said it had not received confirmation of the move. “Micron has not been served with the preliminary injunction referred to in the statements issued by United Microelectronics Corporation (UMC) and Fujian Jinhua Integrated Circuit Co. (Jinhua) dated July 3 ,” a Micron spokesman said in an email Tuesday. “Micron will not be commenting further until the company has received and reviewed documentation from the Fuzhou Intermediate People’s Court of China .” The development comes following a probe from Chinese regulators (http://www.marketwatch.com/story/micron-earnings-china-probe-poses-wild-card-for-highflying-stock-2018-06-15) into memory chip makers like Micron concerning the high price of memory products. China accounts for about a quarter of global memory chip demand. Micron stock has soared amid rising memory costs, with shares adding 74.2% in the past 12 months as the S&P 500 index has gained 12.3%.

You posted it in the wrong thread. This belongs to the trade war thread.

I said many times China has many dirty tricks to play. Don’t just look at the headline trade numbers.

hanera is right on the information.

China accounted for more than 50 percent of Micron’s revenue in fiscal 2017, according company data.

China can tilt the field to the Koreans and turn the knife in MU.

Nobody wins in a trade war. This is not some kind of carefree goddamn video game. People’s livelihoods are on the line.