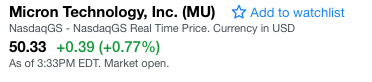

I just started buying more MU again. Maybe I need to accelerate. But I am also buying more AMD as well, mostly because of intel weakness.

I have the “triangle” of AI mentioned in that video: CPU, GPU and RAM.

I just started buying more MU again. Maybe I need to accelerate. But I am also buying more AMD as well, mostly because of intel weakness.

I have the “triangle” of AI mentioned in that video: CPU, GPU and RAM.

Why CPU? Robots use custom CPUs, right? Even if not, shouldn’t it be RISC-based rather than CISC-based?

Ain’t Google, etc are developing AI specific CPU/GPU?

After MU, should be NVDA which I think is still too highly valued.

Google has tpus, yes.

I have MU and NVDA. Servers need a CPU too. AMD started to fab their server chips at TSMC and that’s an extremely significant development. I think Intel will never get their process leadership back ever agin. Fabs are notoriously expensive and process development even more so. TSMC has the volume therefore the money to play the game. Intel’s volume is shrinking.

TSMC’s 7nm is already in volume production. That’s roughly equivalent to Intel’s 10nm but slightly better. Intel has been delaying 10nm year after year, and now says it will enter volume production end of 2019. So TSMC and therefore AMD has more than a year of process leadership over Intel. I suspect the gap will only grow from here.

Strong Buy Stocks: Micron Technology (MU)

He estimates servers now account for ~25% of total DRAM bits consumed, compared to 15-20% a year ago. This matters because DRAM makes up 70% of MU’s overall revenue.

potential for sustained beats/raises helped by a consistent buyback program as we get into FY19,” the analyst concluded.

Just realized Nvidia had ATH last Friday.

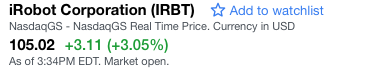

Irbt also ath. Why is mu still mooing?

Not sure. Maybe we are wrong about MU?

Nvda is higher risk, higher reward. Mu is not sexy despite constant pumping.

NVDA is bigger scale, wider with AI, Cloud, Gaming etc. NVDA is different animal than MU.

MU is too good to buy and hold with good P/E as a value company.

Here are some notes a student posted about MU.

Nvidia is much more dominant in its market. MU is much less so. Its most advantage is probably the joint product with Intel, 3D Xpoint. However, I don’t see MU markets it extensively. It has huge potential though, if there is a new architecture to fully utilize this.

Current pe(ttm) is 5, 15 implies $150

I agree NVDA is actually a safer play than MU. It has some sort of monopoly in its CUDA platform. Only NVDA platform runs the whole gamut of AI packages. Google TPU for example only runs Google’s.

Everyone buying MU today is betting that the previous price volatility will not happen again. On the economics side we are down to 3 dominant players, and demand is ramping up fast. On the technology side Moore’s law is slowing down drastically and costs of new fabs going up exponentially. Samsung etc simply can’t afford to overbuild capacity.

Well those are good reasons. We could still be wrong though.

The ‘New Micron’ - An Undervalued Beast

… positive catalysts one should watch for include further 3D XPoint development and the planned buyback in 2019…

IMHO, is a bet on AI.

Technically, broke above 200-day SMA. Let’s whether it would be above 50-day SMA by the end of the week.

Earnings date is 9/20. Bet the farm?

Layout strategy a few posts prior.

Owned 1500 shares.

If decline to around $37.50, then long calls.

Otherwise hold.

Thesis: should 5x over 10 years presuming AI remains hot.

Short term could be choppy due to macro issues.

GlobalFoundries drops out of race to develop next-gen semiconductor technology

https://finance.yahoo.com/news/globalfoundries-drops-race-develop-next-220715127.html

AMD will move all its 7nm and beyond chips to TSMC. This is huge. AMD will forever have a process lead on intel, and will likely steal big market shares from intel.

Intel’s woes can be traced all the way back to its refusal to fab for iPhone. Without the smartphone volume TSMC would never have caught up and overtook intel. Now AMD will put the final nail on intel’s coffin.