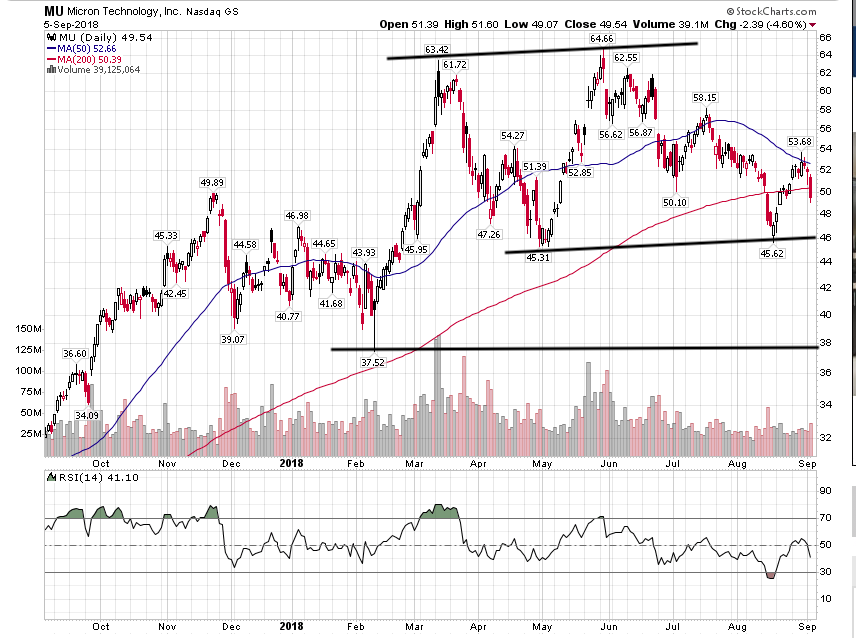

Back below 200-day SMA ![]()

I think we need to be open to the idea maybe we were wrong about MU.

8x in 6 years is not entirely being wrong now is it?

or 25x in 10.

Wrong on the timing is also wrong. Maybe in a few months it will be correct to bet on MU again.

Manch,

You’re correct from a trader’s perspective. I don’t know what Mr Market might do in short-termd but long term prospect is good.

Market is saying Micron is a cyclical stock, we are betting it’s not. The earnings report coming out in two weeks will shed some light on which side’s right.

Peter Lynch said the right time to buy a cyclical stock is when its PE is high, and sell when its PE is low before fundamentals turn for the worse. The market collectively is doing just that.

I sold my MU and NVDA as they are mostly importing from China and tariff will eat away some profit.

No, MU and NVDA are not importing from China at all. Tariffs have no effect on them.

NVDA is actually in much stronger position than MU. MU is one of 3 DRAM suppliers, but NVDA is the only one supplying CUDA-compatible GPU’s.

Most of the companies make core chipsets and entire design here, but PCB assembly, testing and dispatches will happen from foxconn or similar contract manufacturers. When Trump increases scope to 200Bln, it will affect profit margin inlcuding costco, Home depot etc.

Some semiconductor manufacturers with U.S. headquarters make some chips within China that would be subject to import tariffs as well, including Intel, Micron, and Texas Instruments.

That’s correct for cyclical stocks, no need to learn from Peter Lynch, just observe natural resources you would know ![]() I knew that in Singapore observing palm oil and tin mining stocks.

I knew that in Singapore observing palm oil and tin mining stocks.

Are you saying it is indeed a cyclical stock?

Some said is a bad thing. And people are trying to move to the open AMD ![]()

Despite all the scary talks about MU by manch and Jil, the technical picture is unchanged. If $45 can’t hold, then is $37.50. Already show up in technical picture moons ago.

MU: 44.60 USD −4.94 (9.98%)

USA decides to screw its flourishing hi-tech companies to pay for his supporters in agriculture and auto. Wait… they are also affected but got subsidy… guess is ok. Pay for their subsidy.

10% on mu. damn.

Trump has the carrot and stick policy.

Carrot is tax reduction to all companies, encourage worldwide investors to bring money to USA.

stick = Hire locally, make locally or pay some penalty.

Otherwise, tax reduction will be counter productive to US economy.

He is changing the equation which no one came forward to do last 20-30 years.

It is not about hi-tech companies, but everything about manufacturing and local jobs, and ultimately the vote bank.

If successful, he would be called THE US president. And professional politicians would lose favor to business politicians

Until there are signs that DRAM supply growth is set to significantly outpace demand growth – and there aren’t any for now – Micron’s tumble into the mid-40s arguably has a strong element of panic-selling to it.

You see here DRAM production and prices (dropping again)

source: https://www.dramexchange.com/Market/market_activity

MU chart is almost following this price trend

MU has at least one analyst fan:

• Bank of America Merrill Lynch reiterates a Buy rating on Micron (NASDAQ:MU), advising investors to use the dip because of the “favorable” chip market.

• Analyst Simon Woo: “We believe the recent share-price correction is mostly based on concerns of a downturn. Our research indicates record-high revenue/profit.”

• The firm expects “good/in-line” Q4 results with positive guidance on the call.

• Price target reiterated at $100, a 124% upside to yesterday’s close.