Baseball is a 9 inning game. Late innings would be the 7th or 8th, so he thinks we are ~80-90% of the way to the end.

I don’t know how anyone can confidently conclude how long the game is gonna last and thus which inning we are in. That’s about the most useless opinion ever.

Not to mention, the game usually ends after and explosive rally due to euphoria. A large percent of the gains are at the end.

Tepper says he’s still ‘very, very long’ Micron’s stock

"The demand side is going to be good for a long time. Servers, cloud and if you have smart cars.

That’s the original investment thesis.

Tepper cited the company’s attractive low valuation, new management team and stock buyback plans as reasons to own Micron shares.

No new insights.

From inception in 1993, Tepper’s hedge fund generated gross annual returns of more than 30 percent, according to a source familiar with the firm’s returns.

25 years of annualized gain of over 30%? I will give all my monies to him to manage.

For real?

A possible additional bull case for Micron is that, even if DRAM price drops, its cost will drop even more because of more advanced process, thus expanding margins. So far nobody pays attention to this side of the profit equation. I want to see if that’s indeed the case in next week’s earnings call.

Micron is committing 50% of its free cash flow to buybacks. The 10B is just the first installment. FY2019 it should have around 8-10B FCF so it could spend 5B on buyback. Their FY is weird and starts in September. Not sure if they have started buying yet.

Why people are stampeding to buy AMD:

HUGE if true:

How come your news is always late. AMD had shot up from $9 in Apr to $34 ATH! Nearly 4x over less than 6 months. This is the kind of stocks we need to know EARLY !!!

Well is NVDA on the move again? Seems to be waking up after a long nap.

Well because I am a reckless gambler I am jumping back into AMD today. Wish me luck.

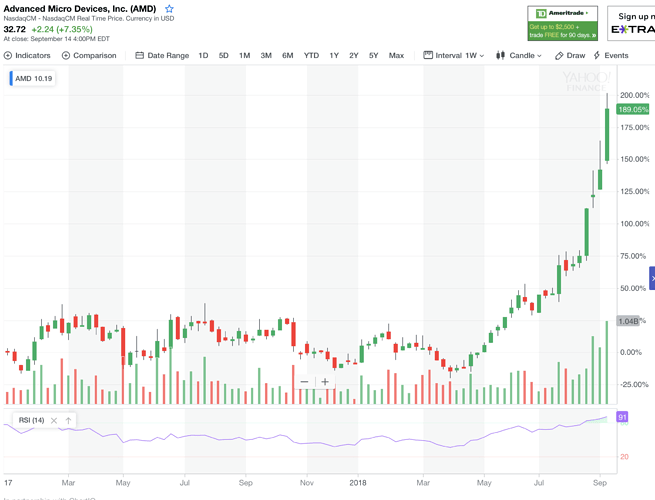

2 year chart of AMD:

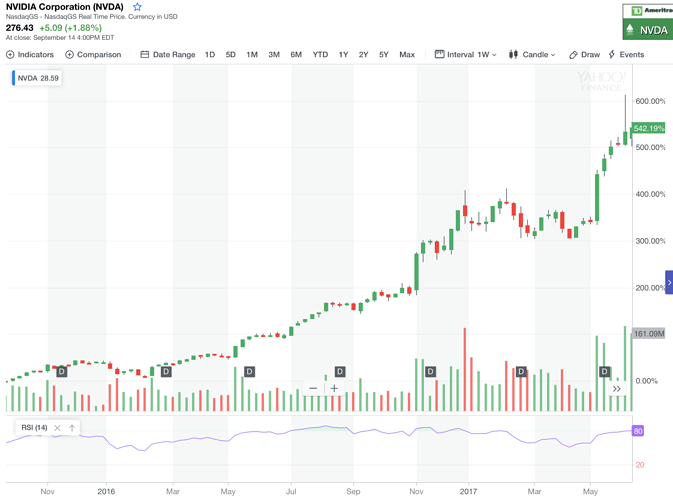

Yeah, it looks hyperbolic. But same could be said of NVDA. By Nov 2016 it had already risen 200% in a year. But it kept going up into early 2017:

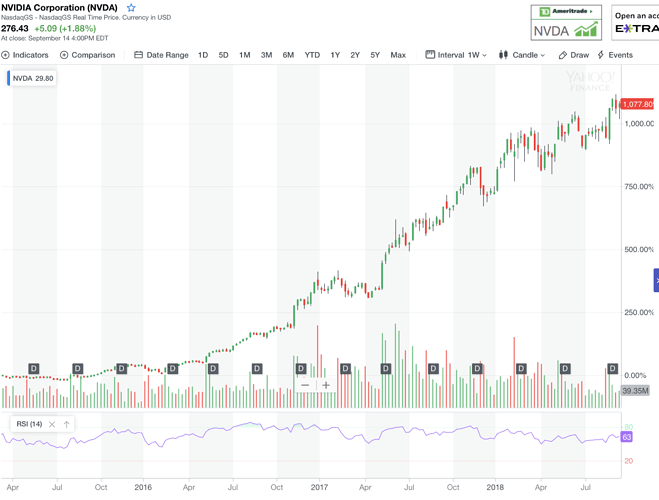

Zoom out a bit to see rest of NVDA history up to now:

Here you go, why AMD and why not MU?

Now we know Soros is a lurker here.

Now we know why MU dropped 10% from $54. Such big drop is usually due to unwinding by a large fund. We now knew is Soros ![]()

Micron Earnings Preview: Things Have Certainly Changed

When the company announced earnings in June, the stock had just dropped from overbought levels in May. The selling pressure the stock has been under for the past three months has taken the oscillators down to their lowest levels since the first half of 2016.

The stock is below its 52-week moving average for the first time since July ’16 and it is flirting with the trendline that connects the lows from 2016 and 2017. Some would argue that the upward trend has been snapped while others would argue that it is still in place as long as the stock continues to close above the trendline. Either way, the momentum isn’t where it was in June.

I am ready and willing to jump back in after Thursday’s earnings. Show me the trend!