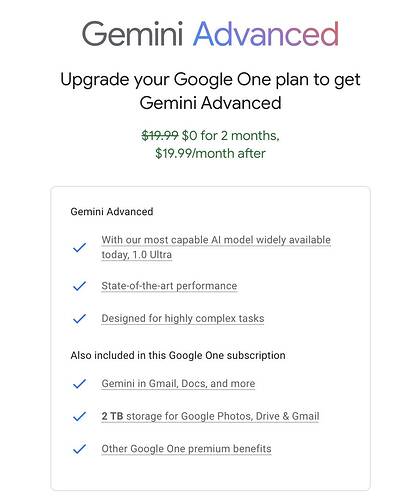

Got this prompt on my gmail account. Google is pushing it AI thru their vast distribution channels. Google is also integrating Gemini into its Plex phones.

Arm plans to launch AI chips in 2025, Nikkei reports

What is an AI chip? Standalone? Include a tensor core in the CPU chip? For server or edge or both?

For edge, AAPL is far ahead.

…

Google just demo what I was expecting from Apple. Wondering whether Apple can one-up Google on Jun 10 WWDC.

Google used to be partner of Apple. It pays Apple many billions of dollars to be default search engine of iOS.

Now Apple is partnering with OpenAI while Google is integrating its own AI into android. The two smart phone duopolies are directly competing. Very interesting setup.

I have been trimming many SAAS stocks eg NET, to add to PLTR. However, I believe the super AI stocks are not discovered yet. Whoever can implement AI agents well is the huge winner.

NVDA is a keeper, however easy multiples gain is over.

Parallel to internet boom: initially hardware stocks eg SUN and CISCO did very well. So do early software stocks eg YAHOO!. The real winners are post dotcom bust software stocks eg META and GOOG.

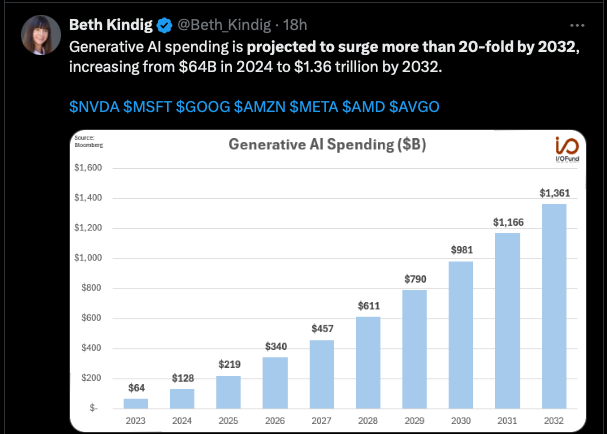

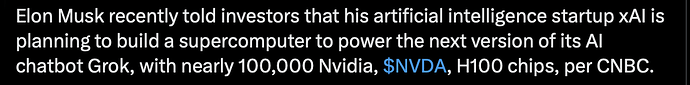

Consumers can’t afford expensive EVs but corporate are willing to spend shareholders’ monies to pay for over-priced NVDA chips.

If it is an AI company, sell because all AI companies are incurring very high Capex for NVDA chips with little profit to show.

![]()

IMHO, has always been so. All top leadership has strong verbal skills. Politicians influence people by their strong verbal skills and are not known for their maths skills.

.

That is…

Most corporate bozos and orifices have a mind sync that they have to spend huge amount of Capex on gen-AI to survive in the long term.

Early warning…

More signs…

Above is because…

Wisdom is knowing what not to do. A certain fruit company is wise enough not to rush into buying overpriced NVDA server chips.

![The AI Bubble is about to Collapse [URGENT Black Monday WARNING].](https://img.youtube.com/vi/gr9cIoGeAfQ/maxresdefault.jpg)