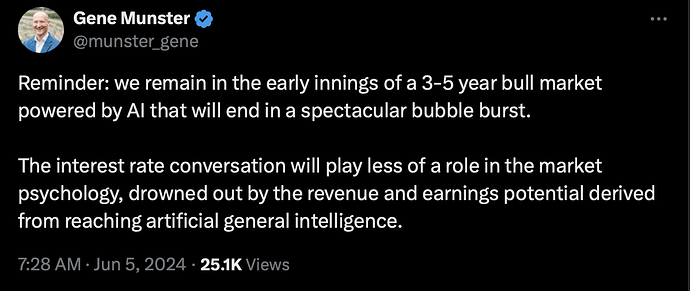

2027-2029.

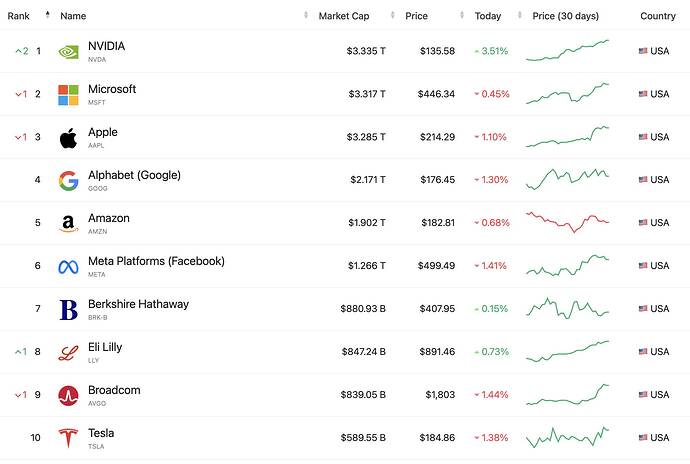

We plan to take profits again in the $1225 to $1315 range. Nvidia is trading in this potential topping zone, at time of writing. Once price moves below $1035, it will signal that the anticipated reversal is underway. Once this happens, our process allows us to get more precise with identifying buy targets. Until then, we have a general range between $920 - $715. Keep in mind, this range can shift once a reversal is identified.

For some stocks, we get more aggressive and would try to time a buy in the lower range of the target zone, which would be around $715 for NVDA. However, due to the strength of its thesis, we will likely buy at the upper end of that target around $920.

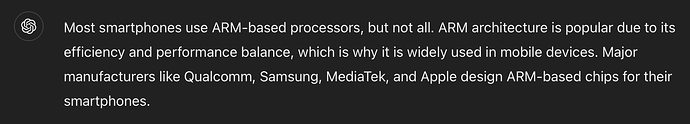

EWT: Sound about right.

No fanfare?

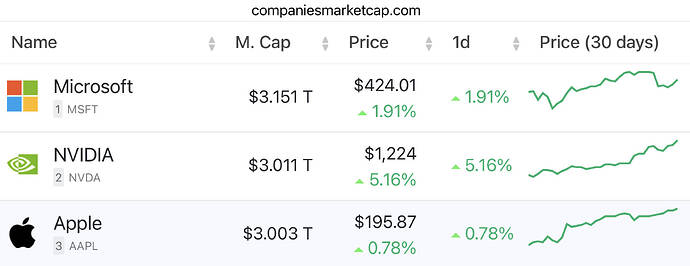

Everybody talking about iPhone super cycle. What about iPad super cycle? Apple Intelligence would make iPad an indispensable device to own. Calculator gives us a glimpse of what future could be like.

![]()

Apple is 4 yrs ahead of the curve for on- device inference. Is Tim Cook’s fault if Apple loses that lead or couldn’t capitalize on this with Apple renowned hardware-software-service ecosystem.

The AI race is likely be a two-horse race for the next 5-10 years… which one would yield higher return? Which one would hit $5T market cap first? hit $10T market cap first?

NVDA is king of the enterprise and server space.

AAPL is king of the consumer and on-device space.

Ofc, we can’t rule out the other Mag7. Also, I believe cybersecurity stock like CRWD would yield fairly good (may be even higher because of their smaller market cap) return.

Three risks to NVDA’s domination…

a. GPU free AI

b. Caching

c. Apple’s on-device AI

The next AI play is AAPL ![]()

.

Apple could have won the AI arm race because Apple intelligence is AI for the rest of us.

Observation: Apple bears are in denial

Need 1/10,000 humans i.e. less than 1 million humans will do. About 6.5 billion people need to go. This dwarf the death toll of Covid.

Automation never replaces humans. It makes us more productive and increases bandwidth leading to growth in new industries and more jobs. This only stops if AI becomes innovative enough to create those new industries and build its own infrastructure to support them. If that happens - who knows. Maybe we get Alan Parson’s “I Robot” scenario. Or, given demographic trends, humans die out from boredom and lack of mojo. No incentive to be creative.

53% of respondents in this poll have net worth above 5M. Almost 40% have 20M+.

South Bay RE on fire.

![]()

Not sure whether to post this under “China rising” or “it just gets weirder and weirder.”

Maybe the stem cells were harvested from Falung Gong practitioners. Who knows what the AI might do.

Remember in Robocop (similar idea) how the police were run by a corporation and the corp ef’ed them over so they went on strike?. The city went into chaos and burned. Then the corporation bought up all the cheap city property.

I’m so glad that things like that don’t happen in real life.

.

That would be crazy.

.

In the future, current form of humans would be considered inferior. Future humans would be cyborgs (humans with embedded chips or robots with human brains) and humans with DNA modified.

Some technical errors in Beth’s interview below. Anyway, she’s betting on AMD having a juicier return than NVDA now.

https://twitter.com/RihardJarc/status/1810679210261815601

- He thinks we will gradually move to 90% of the consumption around inference compared to training.

Inference plays are AAPL, ARM and QCOM.

The networking angle of Nvidia’s moat is very interesting. Did not think of that before but makes total sense.

Inference plays are more diverse. Each hyperscaler has their own custom silicon to do inference, but they all need networking gears. So I’d say Broadcom is a clear winner. Cloudfare has this interesting angle of moving inference to the edge closer to customers. Good in theory but need to see if it’s really a thing. That’s orthogonal to the other hyperscalers at least.

AMD continues to disappoint. Good hardware but lackluster software. How’s the Pytorch port to AMD chips doing?

![Warning: Nvidia Stock vs Apple Stock [Buy One, SELL One].](https://img.youtube.com/vi/EErqHYlnDEo/maxresdefault.jpg)

![LEAKED Apple Documents REVEAL **AI Siri** Plans! [Apple Artificial Intelligence ReALM]](https://img.youtube.com/vi/CZHEcHzwqis/maxresdefault.jpg)