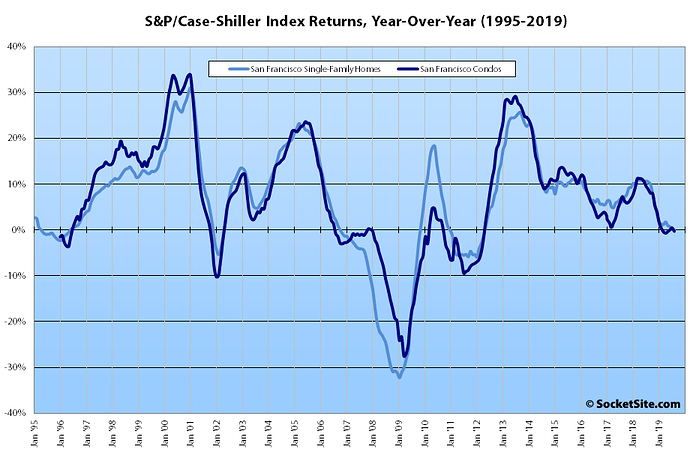

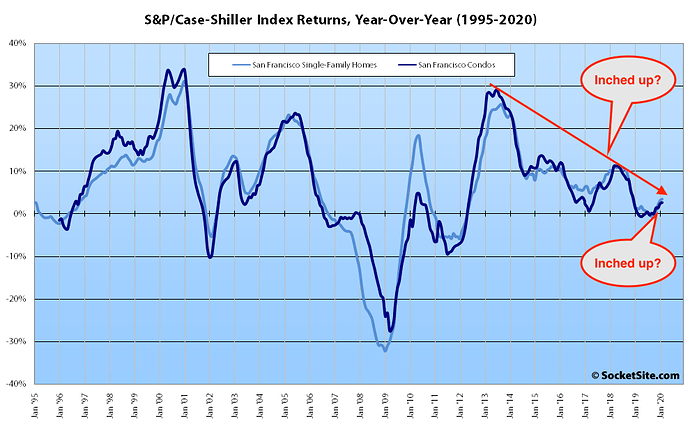

For the first time since early 2012, the S&P CoreLogic Case-Shiller Index for single-family home values within the San Francisco Metropolitan Area – which includes the East Bay, North Bay and Peninsula – has dropped on a year-over-year basis.

Run.

BTFD!!!

Barley a dip. Need a giant fall.

Guess the future is in W-2 income and living below your means and not speculation on housing, raw land or the stock market.

Too boring.

Just getting by on a salary is a sure fire way to the poor house.

Newsflash: the Fed has gone vertical.

Not if you live below your means. I started a thread on here yesterday about Scottsdale, AZ and several posters criticized rentals, housing, and even raw land as a method for multiple streams of income, which is kind of odd on a real estate forum.

I wish the Fed would raise interest rates to nearly 20% like in the early 1980s. That would reward people who save a lot of money and live below their means.

You want to be a passive investor. Those days are gone. Now you have use your own skills and money, sweat equity and cash. That means blindly buying index funds is out. Or just buying a rental and hoping for appreciation. Start a business. Create something. Don’t just hope other people will make money for you while you just stand around and watch.

This Black Swan event has changed everything. Time to take stock and reassess. There will be ways to make money. Just slightly different than before.

I’m sure 20% interest rates on a 30 year mortgage discouraged a lot of people from buying homes. Smart people bought long term bonds.

I was there. Nobody paid 20%. I paid 12% once. Moved into the basement. Rented the the rest of the house to three flight attendants.

Lost my job during escrow. Had seller financing. I was broke. But the tenants paid the expenses. And I survived. I missed those days. 1981 was a massive recession with tons of layoffs. High inflation scarred many for life.

Rentals can still make you rich. Can’t beat having tenants pay for your mortgage. By no means is appreciation gone forever. A couple years to digest the gains is healthy. All the money the Fed prints has to go somewhere. You bet a healthy portion will find its way to real estate.

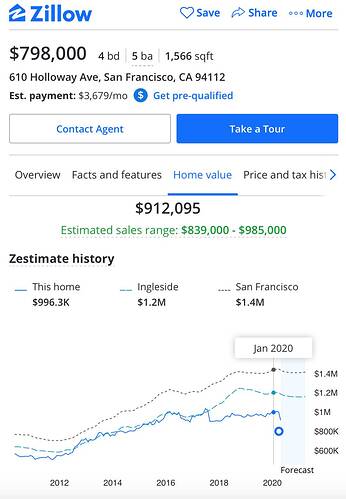

Here is the house. I paid $145k in 1981.Sold it for $185k in 1985. Now worth $2m. I turned the walkout basement into a second unit. I don’t think it is legal even 35 years later.

Fabulous & bright Belmont Home with stunning city light views! It features 3bd/2ba plus a separate lower level in-law unit with a fireplace which was rented for $1700/mo. The home has a remodeled kitchen, granite counters, laundry areas in both the main home and in-law unit and a two car garage. Easy access to cafes, groceries, parks, restaurants, downtown Belmont Village Square, Caltrain and freeways. In-law unit has a separate private entrance with full bathroom and kitchen.

35 years from 185k to 2m is 7% annual compound. Not bad but not spectacular either.

I should have kept it. Because with the rental cash flow it probably would have been over 10% IRR. I didn’t want to bothered by being a landlord. And owning an illegal unit is nerve wracking. Plus a few years ago someone put a lot of money into upgrades. Maybe $150k.

The total rent then would have been $1300/m

Now $6000/m