Austin home price appreciation beats SF by 42% in the last 31 years. Can you believe this?

Growth rate trumps price point, dragonboy

It depends… I would rather have a Ferrari than a Kia (sorry, Kia owners)

Looking at the chart…

Austin metro is appreciating steadily whereas SF metro is volatile.

If you ignore the financial crisis, price appreciation of SF metro is faster.

1970s to 2000s: Austin 40 to 200, SF 40 to 220.

2009 to now: Austin 200 to 320 (+60%), SF 120 to 270 (125%).

Possible takeaways could be:

- If there is a deep recession like recent financial crisis, sell Austin buy SF.

- At this stage of growth, sell SF buy Austin if you want to be defensive.

Any other takeaways?

It’s not Austin vs. SF in particular, but a low price neighborhood vs. a high price neighborhood.

Substitute “Austin” with “Antioch”, and substitute “SF metro” with “Palo Alto”. And you get the same result.

I’m surprised by the chart and not fully believe it. Can someone find contradicting evidence that SF metro appreciates faster than Austin in the past 31 years?

My impression is that Antioch appreciation is a lot lower than SF, based on Tom’s personal experience.

Case Schiller stats rarely mean much…depends on the neighborhood and the house…

I made this post to test the collective critical thinking capability of this forum. Let’s wait for another 7 days to see whether someone can post a credible dispute based on data or personal experience.

Having visited Austin in May looking at different neighborhoods, I can see why this may be. It’s a vibrant city (with traffic  like all other vibrant cities) that should continue to do well. There is a certain upbeat feeling there compared to our area now.

like all other vibrant cities) that should continue to do well. There is a certain upbeat feeling there compared to our area now.

This reminds me of how people discuss a stock is up $10. It’s really a useless piece of info, since the percentage gain is what matters. $10 gain on a $100 stock is huge. A $10 gain on a $1000 stock isn’t even noteworthy. Focusing on the size of the move and not the percent change is an epic fail at math.

Show us a house like this in Austin

Ok, so one cent that is doubled to two cents is a much bigger deal than, oh, 250K to say 350k?

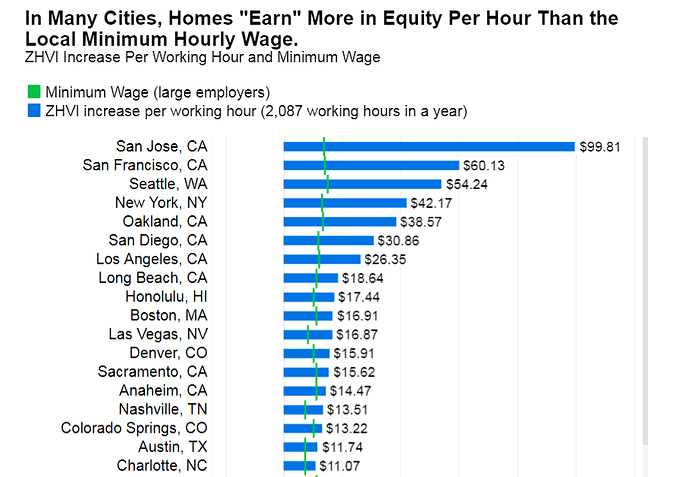

Hahaha… once again this graph confirms there should be no other place to invest in real estate besides the Bay Area. Thanks for solidifying this fact, @sfdragonboy.

No, because similar to the stock example you can buy 10 shares of the $100 stock vs. 1 share of the $1000 stock. When the $100 stock goes up $10 or 10%, you’re going to make a lot more money than the $1000 share going up by $10. As long as there’s enough supply to deploy the same amount of capital, then it’s wise to seek the highest investment return. There’s no shortage of houses that can be bought, so it’s about maximum percentage return.

I see you insist on an answer to your disbelief that Austin MSA (not Austin downtown or city) appreciates faster than SF MSA over your selected timeframe which is arbitrary. Over that arbitrary period,I have pointed out very clearly that Austin MSA appreciates slightly lower than SF MSA, the financial crisis caused a temporary aberration which should correct itself with time (by extrapolation which could be grossly wrong, fundamentals might change). The more pertinent question is why didn’t prices in Austin MSA crashes like SF MSA during the financial crisis? Put your math and graph knowledge to use ![]()

Bingo! Did you visit The Domain? Is very hip. Kind of like Santana Row’s vibe. I bought 2 properties aiming at folks who would likely work there.

I have a feeling buying multi fam in Austin makes financial sense. No rent control (yet) and price point much more affordable than BA.

Used to throw out pretty high cap rates. The gap has since narrowed. I think is still higher than SFH.