Bitcoin, GBTC, COIN.

I am just trying to buy and accumulate BTC. I purchased a little for the first time last month at 46k, now that has gone up. It would be nice to time it and wait for the pullbacks, but I don’t know when that will happen. Hence trying to dollar cost average a little bit at a time. BTC is at 63k now, it could pull back into the 50k+ level now, or continue to go up, say to 80k, and then pull back a month later. I have no idea how it will behave, since there are no quarterly earnings call or any similar progress report issued by Satoshi Nakamoto. So, just wanting to accumulate a little BTC every so often whenever I have some spare change, in the hope that over time BTC will increase in value (as measured in USD) since it is supply constrained and in general more people are becoming aware of BTC and venturing into it like me.

Is this reasonable way to go? Or am I day dreaming after drinking the BTC kool-aid? ![]()

Yeah, I think so. I have a different strategy so all depends on the perspective. I believe we are in the 7th/8th inning (this super-cycle) so I would actually sell majority close to the 9th inning, then average buy in the coming years on a bear cycle.

How much do you think it will hit in the 9th inning, before beginning the bear cycle?

![]() The so called experts (nobody is an expert in crypto imo) says 100k-300k. I’ll have 50% sell at 90k+ to lock in gains, then avg sell if it continues to move up.

The so called experts (nobody is an expert in crypto imo) says 100k-300k. I’ll have 50% sell at 90k+ to lock in gains, then avg sell if it continues to move up.

Various indicators listed here.

Pi-cycle:

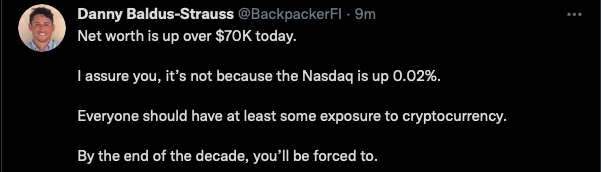

Experts/Finwits:

https://twitter.com/allenau11/status/1450469109204934662?s=21

https://twitter.com/backpackerfi/status/1450540799620435976?s=21

https://twitter.com/TechDev_52/status/1441423015758241793?s=20

https://twitter.com/jclcapital/status/1425135606372343810?s=21

Thank you - so, it’s all technical chart analysis?

You can look at on-chain analysis, some dollar reserve theories, halving cycles, etc but everything is still a voodoo science. Bitcoin itself is not used for transactions so nothing in terms of the growth/fundamental analysis will work. I think most HODLers believe it’s the new digital gold in the coming years as dollar loses its power as the reserve currency. This asset supply is growing slowly and even slower every 4 years so it’s better than gold in many ways.

Digital gold and supply squeeze (mining gets progressively worse) are two best reasons to go long on bitcoin imo.

Yes, we just have to keep the faith that this new digital gold asset will continue to be supply constrained, and more people will jump on the bandwagon. Meanwhile hold one’s nose and buy BTC even though it appears so ridiculously inflated. $63000 is still a significant amount of money in the real world…

64k right now.

above 66k

ATH

As expected, GBTC outperforming bitcoin due to 20% discount. It’s down to 16/17% now. I have chosen poorly…I should’ve gone all-in for my IRA account.

Owning SQ and COIN already exposed to crypto.

Why are you getting financial advice from people with no money?

.

Who should I get advice from? That guy who wrote five books?