Matt Prince of Cloudflare x Chris Dixon of a16z:

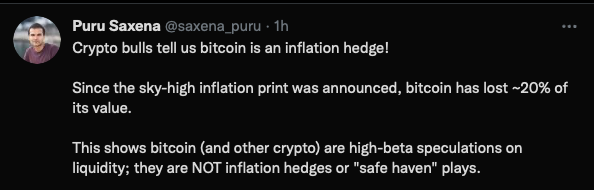

Puru is so happy he is right about crypto.

He is short ARKK ARKG RIVN. I didn’t follow him. Not comfortable with shorting… haven’t done any short in my life… indirectly shorting, yes, long puts, long SPXU and long SQQQ. Didn’t long those because indices especially SPX/Y looks strong and should have more upside… most probably will long those in Dec if there is no Santa Claus rally.

Shorts can have unlimited downside but upside is capped at 100%. It also costs interests to borrow shares. So it stands to reason one has to know much more about their shorts than longs.

I’d encourage Puru to try his hands shorting crypto again.

There was a huge fight on crypto twitter. This post summarizes it well. Basically a Singapore based trader is dissing Ethereum to pump his own coins, and it pissed off many people.

1 in 4 house down payment coming from crypto. Real estate investors should appreciate crypto.

Sounds more like systemic risk…

Do you have a reference to back up this claim? If true, I agree with @DH0 that it presents a systemic risk to the larger economy.

Once they lost money in crypto, they have to sell their houses at the same time! Armageddon!

Tom Lee mentions it at the end of video. I’m sure his research team has some data. I know a few folks who retired from bitcoin gains and got big houses. Every bubble is a systematic risk and we are in the bubble of all things. I say let it rip more…we are not in the final euphoric stage yet imo. I plan to be in 100% very liquid position for all asset classes. Give me more bubble please. When the dust settles after bubble of everything ends, I’ll be ready to pounce again

I am more worried about the systemic risks posed by TSLA than bitcoins. I was trying to buy BITO on my stock account and it won’t let me without filing out tons of forms. There is still no spot ETF. Versus any teenager can just play with TSLA options on Robinhood.

Remember what WB said. Derivatives are weapons of mass destruction. And now banks masquerade these bombs as safe investment vehicles for clueless mom and pop.