I have done well on my past predictions. This year I am going out on a limb and may get push back from our resident troll.

The Stock market is booming. Bitcoin has irrational exuberance. Mortgage rates are dropping. Home sales are growing. National home prices are still positive. BA prices have stabilized. And election years are typically bullish

I predict 10% growth in stock and RE prices by this time next year.

Happy Holidays and a prosperous New Year to all.

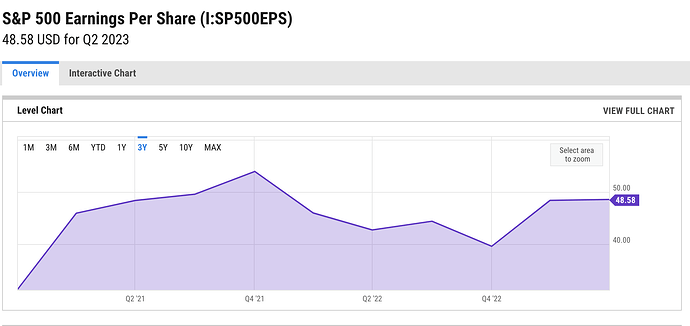

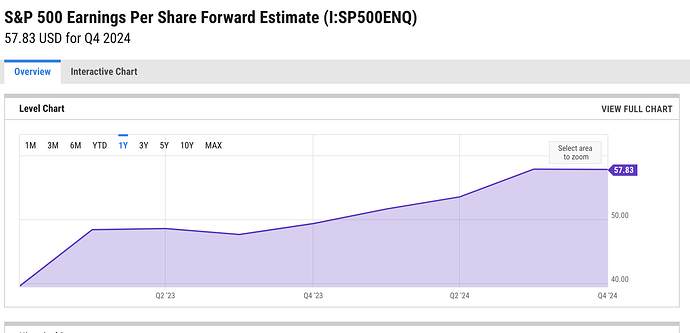

What’s missing is a rise in corporate earnings. P/E is inflating with the market.

Agree. Roaring 20s back on.

But it hinges on Fed playing ball. Everybody agrees they have stopped hiking. Key question is whether they will start cutting before recession sets in so we can have the Goldilocks conditions.

The Covid shock is unlike most of our previous inflation episodes. There is nothing fundamentally inflationary with our economy, but we literally turned off the entire economy and turned it back on again. We had to work through a huge dislocation and it seems we are finally over the hump. No reason the Fed should keep rates this high.

Not that Fed rate hikes will help but the Biden regulatory juggernaut is highly inflationary. He’s changed the rules so even cost/benefit analysis can be fiddled.

My misery stock Ruger is lower than its been years. Gold at ATH … Airbnb booming. People are spending money. $600/ person for NYE diner at Edgewood… Biden wants to pump up the economy… the Fed has to lower rates because raising rates has only made inflation worse especially for housing. Supply change issues are over. Prices are dropping on commodities. Gas prices are dropping. That means more money in every phase of the economy to be spent on personal needs…

The pent up demand for housing is huge. If mortgages drop below 5% there will a huge upsurge in home buying.

Inflation rate right now is 3.24% and Fed fund rate now at 5.25%. That means real rate is over 2%. That is extremely tight by the standard of the last 20 years. If inflation keeps on falling, which looks like it will, Fed must cut, regardless of whether we have a recession in 2024 or not.

All those doomer narrative assumes Fed only cuts when we have a recession. But the Covid shock is different.

This recession has been predicted for years, won’t happen.

Reminds me of that Bloomberg piece last year saying the chance of a recession in 2023 is 100%. Only a few days left. Recession better hurry.

![]()

From a NET investor’s perspective, has been in recession for two years and counting . Can’t afford to buy anything ![]()

Ditto for SNOW investors…

Still works out better than BABA investors. Lucky I didn’t listen to people who have zero understanding of China.

![]()

Stocks went up… even with signs the economy is still booming

Stock Market Outlook 2024: Extremely Rare Signal Points to New Highs Soon.

Dow up 3% in a week. 40,000 in 2024?

Tom thinks small caps would outperform financials & industrials which would outperform tech. However tech would do better than S&P.

Consumers are still dining out despite high interest rates, inflation, and everything else. There’s literally no limit to what consumers will spend. Well, I guess the limit is when the bank shuts off their credit card.

Lots of restaurants closing in Tahoe. Generally the bad ones.

Izzy’s, Denny’s, beach hut deli. Plus Rite Aid. And a few other retailers… the anti business attitude doesn’t help either.

Economy is firing on all cylinders. Don’t know why some people still insists it isn’t. My gym is at a big mall here and it’s been impossible to find parking the last month.

People saved up a bundle during the pandemic. Unemployment is at decades low. Of course they are out spending money. Pity those still sticking their necks out looking for recessions.

Buyers are looking for a recession. Sellers for a boom. It has been a bull market for almost 200 years in CA RE. Better not to bet against that. Same with the stock market

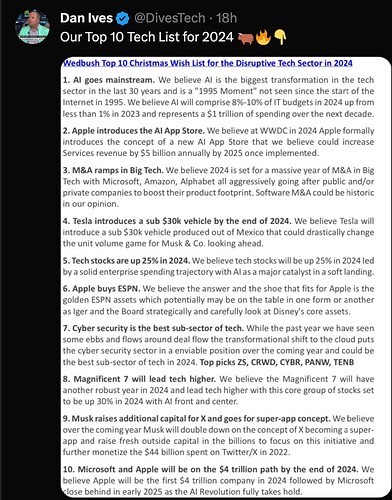

You can already see Ive is a Musk fanboi.

Tesla will introduce a new vehicle in 2024 while Cybertruck is barely being produced?