We are close but small cap index is not even close.

That’s the past. Investment is looking into the future. Get it?

She’s the greatest pandemic fraudster. Instead of jail time she’s still getting press coverage.

Everybody is bashing Cathie.

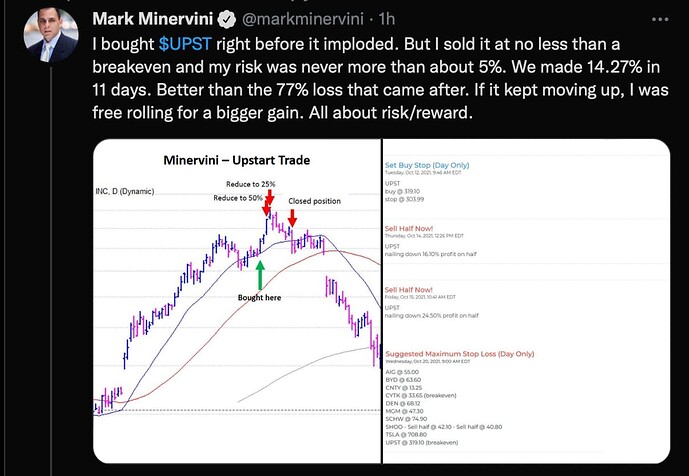

He is the one that mark the top in UPST (not NET, that’s a forum blogger).

.

He is a trader, a pretty good one… a very critical skill required from traders is hedging and cut losses fast. If you can’t do that, stay with S&P index fund/etf.

.

Matthew Tuttle has come up with another use. “If I think we’re going into a correction or a bear market, I’d rather short Zoom, Teladoc and DocuSign , not Apple , Microsoft , and Google,” he says. To that end, he has created the Tuttle Capital Short Innovation ETF (SARK), which might sound like it invests in shoe lifts, but in fact bets against Wood. It has quickly become the biggest fund at Tuttle’s firm, with $300 million in assets.

Followed Cathie into TDOC and ZM, hodl with diamond hands. Deep red.

Its amazing she still has a job. Wear thick glasses and blow in the wind. What a fraud.

Obvious, no need for a baron article to tell us is a growth stocks bust However I am not sure that it would go any lower because of Fed. Did Fed pump the market to counter the Dotcom bust?

Fed cannot pump any further due to record inflation and historically high QE. QT and rising interest is the only path forward and Cathy and her scam will get buried forever.

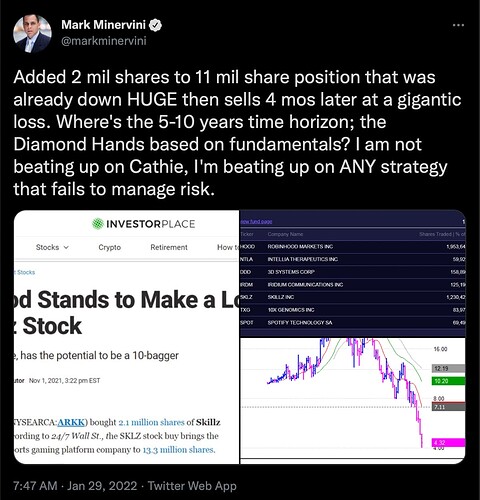

Alternatively most of them are Z SKLZ TWTR type ![]() Her funds sold them off at a great loss. TWTR - not completely sold off yet.

Her funds sold them off at a great loss. TWTR - not completely sold off yet.

FANGMANT as a group prove to be more innovative and profitable than growth stocks. It put into question, are those really growth stocks or being push up because of Covid and Fed money printing? I suspect many of her companies are similar to SUN, ![]() because of Dotcom boom but otherwise are badly run companies.

because of Dotcom boom but otherwise are badly run companies.

She said she doesn’t invest in any of those mature Big Tech companies like Microsoft.

SMH

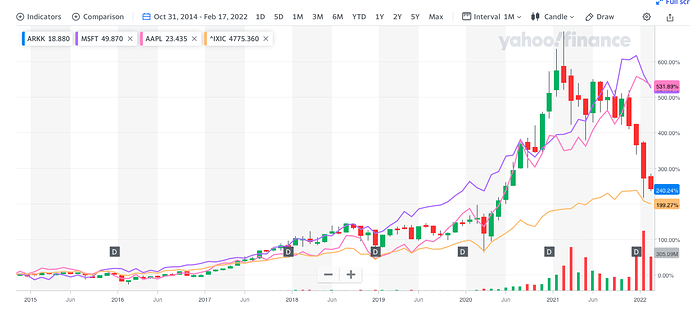

Chart showing performance of ARKK vs MSFT AAPL NASDAQ since inception Oct 31, 2014

ARKK behaves like a Covid stock. Look like it is going to underperform even NASDAQ…

She is saying WS is wrong.

She also made the case that mature growth companies, including those considered in the FAANG category, such as Meta Platforms FB, -0.22% (formerly known as Facebook Inc.), Apple Inc. AAPL, -0.50%, Amazon.com Inc. AMZN, -0.51%, Netflix NFLX, 2.51% and Google-parent Alphabet GOOG, -0.75% GOOGL, -0.95%, would face bigger challenges, if interest rates rise and inflation pressures persist, than her disruptive innovative investments.

These companies have:

- large cash hoards that are well hedged and earn higher $ from higher interest rate;

- pricing power to counter inflation pressures.

So FANGMANT is in far better shape than “disruptive innovative” companies, some of these are just single feature companies which FANGMANT can implement if they deem fit. The biggest problem with these “disruptive innovative” companies are valuation, just too high for the promise that they will be profitable in the tuture… may be they won’t.

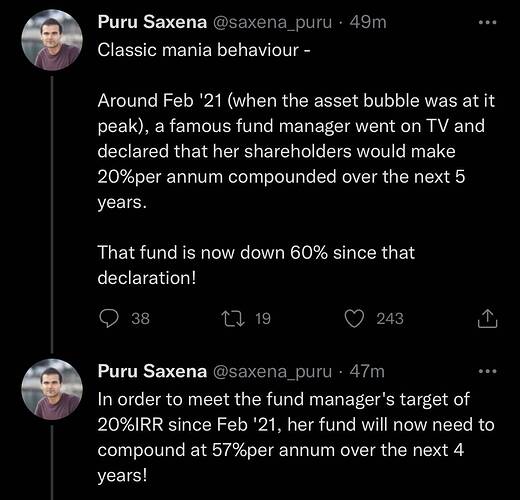

Josh vs Cathie

Josh uses a better word, glamorous ![]() stocks for those “disruptive innovative” stocks that are not that innovative.

stocks for those “disruptive innovative” stocks that are not that innovative.

COST is just as good as ARKK since ARKK inception in Oct 2014.

So much for well researched and carefully selected innovative and disruptive stocks.

It makes wonder, what is the value of a diversified basket of stocks? Might as well just buy one single well known proven stock like COST or all into S&P index or NASDAQ or QQQM.