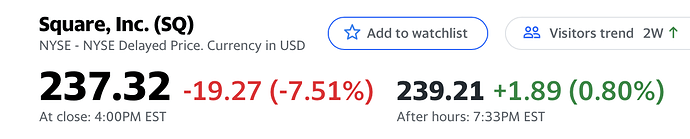

Cathie bought almost $200M worth of SQ today…

Silvergate (SI)

Silvergate (SI), a bank specializing in cryptocurrency, traded down 20% on Tuesday as the equity and crypto markets sold off broadly. In our view, based on the stong network effects of the Silvergate Exchange Network (SEN), Silvergate will be a prime beneficiary of increased institutional and corporate crypto adoption.

Workhorse (WKHS)

Workhorse (WKHS), a technology company that designs, manufactures, builds, and sells battery-electric vehicles and aircraft in the United States, traded down 47% on Tuesday and then up 24% on Thursday. The sharp decline was in response to its loss of the U.S. Postal Service’s (USPS) next generation delivery vehicle contract to Oshkosh. WKHS then appreciated on news that a Democrat in the House of Representatives is attempting to overrule the contract award to Oshkosh. ARK finds it odd that the USPS is not committing to a fully electric platform which, according to our research, will dominate truck production and sales in the next ten years.

BASE Inc. (4477 JP)

BASE Inc. (4477JP), an internet service provider in Japan, declined 15% on Wednesday after SBI Securities downgraded it on valuation concerns. BASE enables individuals and small businesses to launch online stores within minutes.

Organovo (ONVO)

Organovo (ONVO), a biotechnology company focused on 3D-bioprinting, traded up 23% on Wednesday, possibly because investors and speculators may be gaining confidence in Organovo’s ability to maximize its 3D-bioprinting assets and deliver on a revitalized commercial strategy. We believe shares will be volatile until Organovo reveals more about its path forward.

LendingTree (TREE)

LendingTree (TREE), an online financial services marketplace, traded down 15% on Thursday after reporting quarterly results that included a 58% drop in non-mortgage revenues. The stock fell further on Friday after Northland downgraded it to underperform on expected margin pressure, a negative that we believe will reverse with continued strength in the economy.

I am one of those  Keep increasing my stake in ARKG. Didn’t bother to use any FA, TA or EW. Only believe in Cathie the hottie

Keep increasing my stake in ARKG. Didn’t bother to use any FA, TA or EW. Only believe in Cathie the hottie

Cathie is…

Selling BIDU, TCEHY, TSM, NVDA, …

Buying TSLA, TDOC, U, EXAS, …

Cathie is history.

Actually Cathie has positioned for this correction.

Cathie has positioned to keep up the hype. She can never measure up to the image. The media will tear her down because that is what the media does. She rode a market based on conviction and momentum. Created wealth out of thin air. Now the hype is headed in the other direction and there is nothing not even enough bullshit to fill her sails

Every jackass claims to be the new Warren Buffet these days. Cathie Woods, ChaMath, Kevin, da da da. This is crazy and insane. Unless someone has at least a couple if not four decades of sustained and solid returns and wealth building, it would an insult to Warren Buffet compared to these jokers. Now that tide is gonna recede we will see how naked these so called new Warren Buffets are. Cathie is already negative YTD, won’t be surprised if in a few weeks she will be negative entirely and written off and pushed out.

ExOne (XONE)

ExOne (XONE) closed up more than 24% on Monday. ExOne, a leader in binder jetting 3D printing technology, may have been responding to Stratasys’s fourth quarter report in which both revenues and earnings topped expectations.

Pacific Biosciences (PACB)

Pacific Biosciences (PACB), a leading provider of highly accurate, long-read sequencing solutions, surged 15% on Monday as investors and speculators bid it up in advance of the Advances in Genome Biology and Technology (AGBT) conference this week. During AGBT, spokespeople from Pacific Biosciences and Children’s Mercy Hospital unveiled preliminary data suggesting that PacBio’s HiFi long read whole genome sequencing (WGS) significantly outperforms short-read sequencing the diagnosis of rare and Mendelian diseases. In a prospective setting, HiFi WGS generated a 67% diagnostic yield compared to 45% for short-read sequencing. Based on the organic adoption of long read sequencing, a sizable $900 million investment from SoftBank, and a transformational technology partnership with Invitae (NVTA), we believe PacBio is well positioned to dominate the WGS market in both clinical and population-research settings.

Silvergate Capital (SI)

Silvergate Capital (SI) traded up 16% on Monday in line with rising cryptocurrency prices, then traded down 17% on Thursday during a broad-based equity market correction. In our view, the Silvergate Exchange Network (SEN), with its strong network effects, positions it as both a facilitator and prime beneficiary of increased crypto adoption.

Vuzix (VUZI)

Vuzix (VUZI), a company developing wearable display technology, traded up 25% on Monday in response to a press release announcing that Microsoft Teams will support its M400 and M4000 Smart Glasses. On Thursday, the stock dropped 22% in a broad-based equity market correction.

Stratasys (SSYS)

Stratasys (SSYS) closed down nearly 17% on Wednesday after pricing a 6.9 million share secondary at $29. Stratasys is a leader in polymer 3D printing.

Schrödinger (SDGR)

Schrödinger (SDGR), a computational drug and material discovery company leveraging its highly-differentiated, physics-based platform, dropped 27% on Thursday after reporting quarterly and full-year results that disappointed investor expectations. In its 2021 guidance, Schrödinger highlighted that growth in its core software is slowing down as the size of its customer contracts increases, extending sales cycles and limiting near-term revenue visibility. Additionally, Schrödinger’s internal drug development pipeline progress has slowed down slightly, pushing IND-submissions into early 2022 instead of late 2021. Despite these concerns, we believe Schrödinger’s medicinal chemistry platform offers a powerful and unique view into chemical space, which should become more apparent as its internal and collaborative programs enter clinical stages.

Veracyte (VCYT)

Veracyte (VCYT), a vertically integrated provider of molecular diagnostic and prognostic testing, closed down 15% on Thursday in a broad equity market selloff. We believe investors are concerned about the stability of tissue-based biopsies in the face of delays associated with the COVID-19 pandemic. In our view, Veracyte is extremely well positioned in the molecular diagnostics space, especially after its recent acquisition of Decipher Biosciences, which will move it into a market-leading position in 7 of the 10 most lethal cancers in the United States.

Recent setbacks also don’t scare Donald Trump or any other hack.

“ARK has taken in $37 billion in new money since the beginning of 2020, the third-highest inflow among money managers”

Yes, she’s a total hack.

I do wonder about her Unity stake. It has been absolutely hammered since their earnings call.