That’s not surprising. Tons of US tech is blocked in China.

What’s interesting about this is the timing:

In the lead-up to China’s 70th anniversary in October, retaining social and economic stability is a high priority for Beijing.

Founder Eric Yuan was born in China and is widely admired in China as a role model for entrepreneurs.

Somebody’s afraid about the public finding out the truth prior to the big party.

I’m amazed how many people leave China or are children of people who left, then they endlessly defend China. It’s like watching people with Stockholm syndrome defend their abuser.

A fellow interactive brokers user, awesome ![]()

When the market rewards, and penalizes, all cloud software stocks equally, with little differentiation, it’s prudent to choose a select group that has compelling stories for a buy-and-hold strategy.

Sound logical. But which group and which stocks?

I would say to buy when others can’t differentiate among companies.

Unfortunately, I’m one of those who can’t differentiate ![]()

My prediction is this may be one of the last cycles when tech is considered less safe than value stocks. As the market will find out (the hard way), cloud software is actually very safe. It is insulated from trade wars and overseas manufacturing issues. It reduces costs for enterprises, which is ideal for a recession. Lastly, cloud software is at the beginning of a rapid growth cycle compared to its counterparts in tech — such as mobile, e-commerce and advertising — which are reaching saturation, are finding themselves in the cross hairs of anti-trust and are susceptible to consumer spending changes.

Fruits for @marcus and @Jil to debate about.

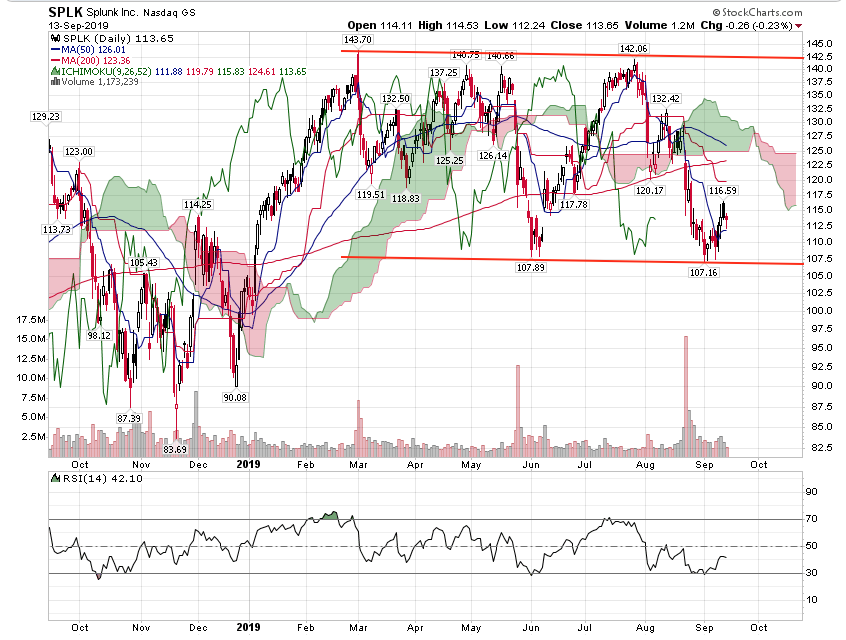

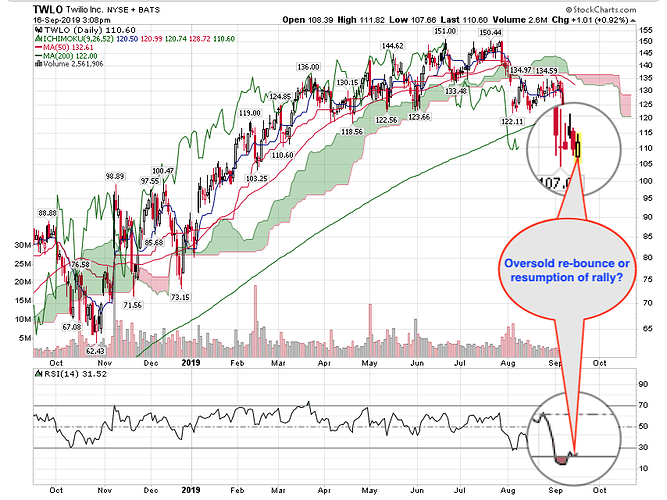

I am trying to get WDAY, TWLO, SPLK and VEEV for cheap.

I am not following any of these companies. I just keep my focus on SPY & BRK-B only.

There are only two other stocks, other than SPY & BRK-B, I own

- NLY bought at $8.20 - IIRC, 10 year low price

- TEVA bought at $6.20 - you know why.

However my 2 cents:

As the market will find out (the hard way), cloud software is actually very safe. It is insulated from trade wars and overseas manufacturing issues. It reduces costs for enterprises, which is ideal for a recession.

The above is not right. When trade affects companies, economy gets affected which may introduce domino effect.

Most of the cloud are subscription based. When small and medium startups files bankruptcy, all subscription will be cancelled. Growth stalled with huge capital cost of cloud results domino effect, affects these companies.

I have been telling to focus only profitable companies, be it cloud or any sector.

Since then, many have double to quadruple!

Above is for @marcus to defend. Off the cuff, may be enough around for these cloud biz to ride the recession?

How does cloud have huge capital costs?

I know the question is for @Jil, but if I may offer an opinion, cloud businesses usually presume that cloud vendor invests upfront in building and hosting the product/service while revenue is not upfront. So to get started with any cloud business, there is a period of upfront investment while a steady stream of recurring revenue builds up. Every cloud company dreams of the inflection point when annual recurring revenue becomes higher than annual investment to keep improving the product and acquire new customers.

I realize most startups, cloud or not, use services like AWS to themself lower platform costs. However, any cloud startup, even if it in turn uses other cloud services, will need to invest in building and running their service for a few years before they start seeing meaning revenue in tune with their annual expenses.

Exactly! Previously, companies used to hire dedicated servers or companies have themselves own dedicated servers, but now we subscribed to AWS.

Our system is up and running immediately with AWS, but Amazon has huge capital cost to hold the system, maintenance, upkeep…etc.

In downturn, if 50000 small mom and pop startups are closing the shops, they close AWS account, but Amazon has to hold the servers.

Every subscription based cloud service can be cancelled as soon as the customer files bankruptcy.

The cloud service provider will have unused bandwidth, cost over run…etc.

Amazon is big that can handle such a mass subscription loss, but small cloud, esp non profit making, will suffer big time.

Who is a small mom and pop cloud provider? It’s amazon, Microsoft, and google. The cloud business aps are almost all run in AWS. They aren’t buying their own hardware.

As for development, that’s a sunk cost. They could do layoffs to get R&D spend back in line if revenue drops.

Read this ==> if 50000 small mom and pop startups are closing the shops. People like me and you starting a company with cloud subscription…

As for development, that’s a sunk cost. They could do layoffs to get R&D spend back in line if revenue drops. ==> This means no growth, rewinding their business.

Stock reacts for it as people buy companies for future growth.

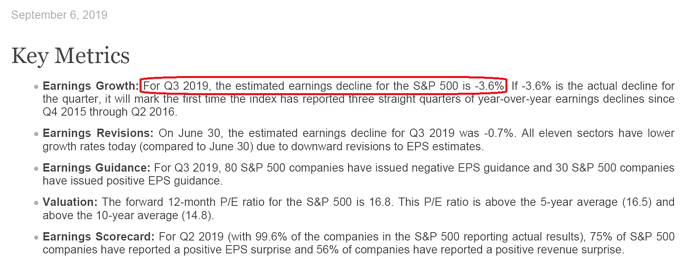

That is why many companies are coming down, expecting growth slowness/deceleration…The GDP growth reduced from 3.2% to 2.0%. Fact set, Next quarter S&P forecast is reduced…

Any way, no more update today for me…

You seem to draw comparisons between things that don’t correlate. You post S&P 500 EPS while talking about small businesses failing. Small business is consumer driven and all the consumer data is positive. The consumer is as strong as ever.

I am not going to argue or defend. It is my thinking and my decision.

If I am wrong, I will face the consequences.

In fact, too many things on my head going on. I better stop updating as every individual needs to do their own analysis and make decision.

Above all, I moved from investing to swing trading, easier for me as I do not need to worry about economy.

Beth Kindig,

My prediction is this may be one of the last cycles when tech is considered less safe than value stocks.

Is today the start of resumption of the rally for cloud kings?

Market running away… FOMO buy like @manch? Bot 100 TWLO. Hopefully WDAY and VEEV come back down!

They are down. Buy buy buy. That or at least sell some OOM puts for the price you want to pay.

Done that. Just wondering whether to long some calls ![]() to ride the rally, greedy

to ride the rally, greedy ![]()

Edit: My long call (VEEV) is equivalent to VEEV at $135, thot it would drop there, it jumps up before touching $135 ![]() .

.

100 is played it safe. Can always add if drop below $100.

“When you try to be objective about the cloud stocks, the ones that you to keep are Adobe, Salesforce, Splunk, Twilio, VMware, Workday, HubSpot, Five9, RingCentral, Zendesk and Dynatrace,” Cramer said. “Everything else … you need to be a lot more cautious.”

Owned 100 TWLO

Owned 300 SPLK

Short put WDAY