Good thing of this fast crash is, assuming we all survive, is that it will instill some fear back into the market. I have been saying the melting up in January was too fast and too scary.

Good thing of this fast crash is, assuming we all survive, is that it will instill some fear back into the market. I have been saying the melting up in January was too fast and too scary.

Why be jealous when you have it all

It’s all fear the economy will grow too fast and inflation will get out of control which will lead to rapid interest rate increases. That’s funny, since all these people sad tax cuts wouldn’t create economic growth. Now they say it’ll create too fast of growth.

Only down 800 now!

Are you sure they are the same people?

BTFD buyers , where are you?? we need you now !!! LOL !

Maybe it was the bulk of economists who say tax cuts don’t grow the economy while the money managers know it will grow it. Economists usually don’t manage money.

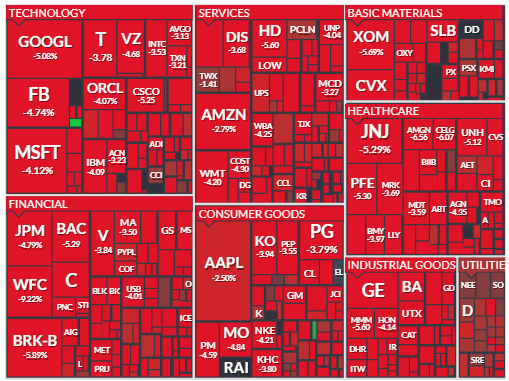

Ok. Exciting ride today. Final damage: -1179.

That was a terrible last 30 min. For no reason at all NRZ went to 15.24. I couldn’t even load the ticket in my Fidelity account to buy more. I am guessing they took a beating on their servers. Finally avg down some more at 15.90…grrrrrr.

I wish I had more dry powder… but then… maybe I need to wait… decisions … decisions.

For no reason at all NRZ went to 15.24.

Hello fellow NRZ owner. Why is it dropping so much today?

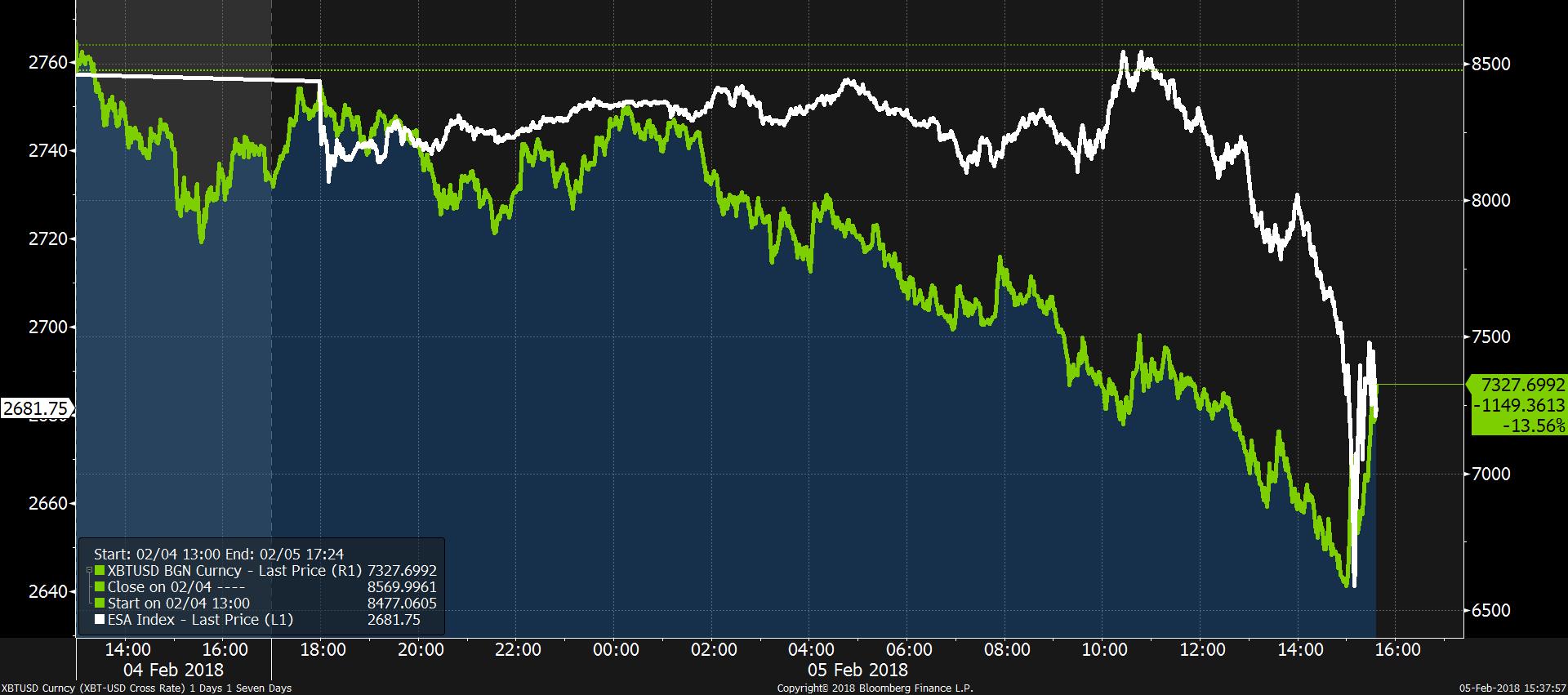

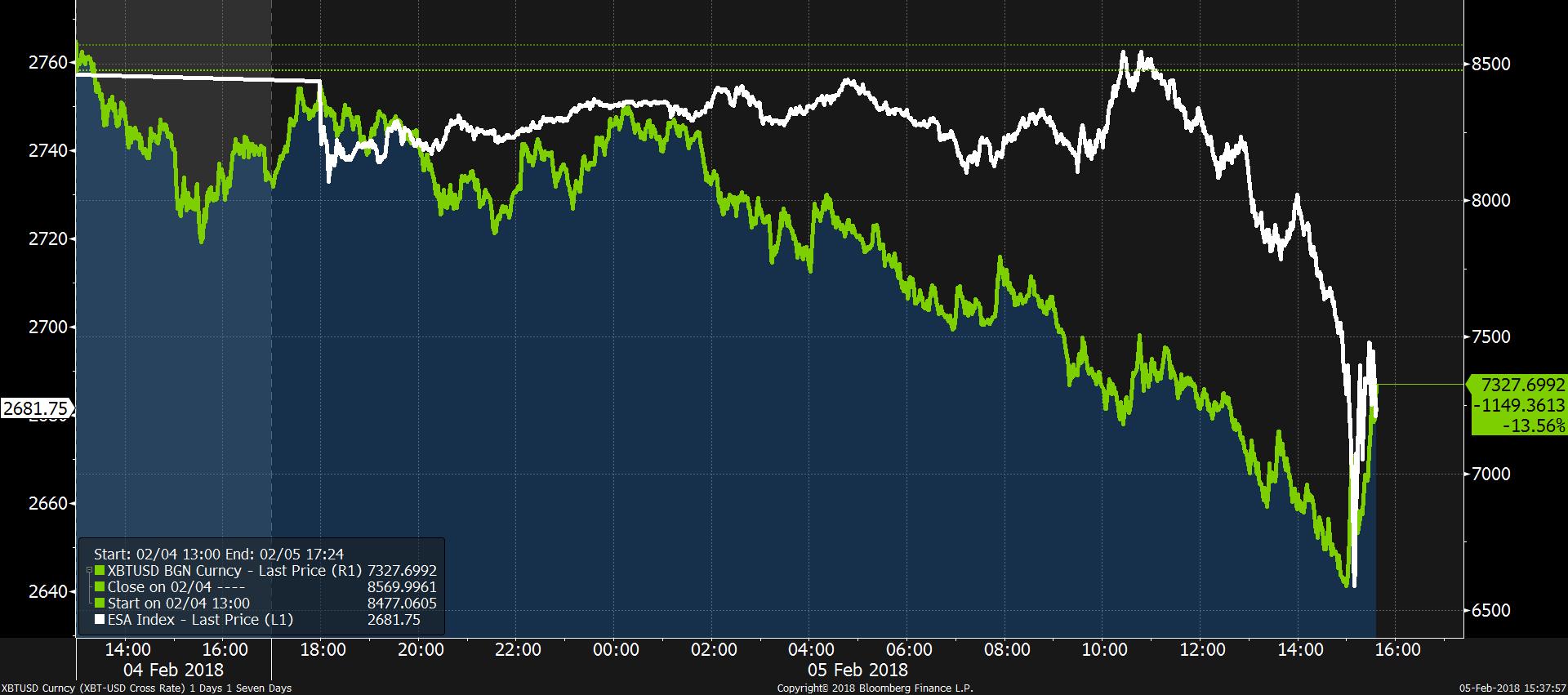

My portfolio continues to sink lower after hour. Also, e-mini now:

S&P closed at 2648 today. Basically the futures are saying it will be flat for the whole year 2018. Seems overly bearish. Anyone wants to buy some?

I wish I had more dry powder… but then… maybe I need to wait… decisions … decisions.

If you’re already fully invested, best to do nothing, guess you didn’t sell covered calls like what marcus335 did.

IMHO, no point in taking any more risk here, best to see what happen when 200-day of S&P 500 is tested. If not tested, your portfolio would continue to rally, no harm done, just make less money.

I wish I had more dry powder… but then… maybe I need to wait… decisions … decisions.

I came back to US yesterday, reviewed 666 down points, put almost all stocks, less than 10% gain, on market sale yesterday night keeping stocks with 30% or above alone holding. All sold at 6:30 AM today. As of now, I am postivie both last year and this year.

Now, reviewing 30% profit or above which I am holding in taxable account. If I sell, I may need to pay almost 50% tax on profit, esp like

UBNT (60%),

NVDA (20%),

BA (60%),

DE (30%),

PYPL (110%),

CSCO ( 70%),

ISRG (10%),

ANET (45%)

I will be selling ISRG tomorrow market sell as this is just 10% gain now.

I am now clear stocks are heading for crash tomorrow too. They continue to slide until new FED says “Hold raising rates”. This is very likely to make a long pending downturn.

Call it market timing or anything, profit is my motive. The current total profit alone is around $80k as of now…!

I have until tomorrow morning to decide whether to pay tax (by selling) or hold it to see crashing further.

Any help or suggestion whether to hold…

If you’re already fully invested, best to do nothing, guess you didn’t sell covered calls like what marcus335 did.

IMHO, no point in taking any more risk here, best to see what happen when 200-day of S&P 500 is tested. If not tested, your portfolio would continue to rally, no harm done, just make less money.

Personally I’m not too worried. I’ll be worried when the S&P is close to 3000.

Is that Green “SNAP” from sea of red?