I would be dancing ![]() yeah!

yeah!

How long has you being holding your rental? Assuming you have rentals ![]()

BAGB. If 5%, Prop 10 doesn’t affect rental market much. May be in certain neighborhoods but unlikely to affect rental market in Fortress.

I would be dancing ![]() yeah!

yeah!

How long has you being holding your rental? Assuming you have rentals ![]()

BAGB. If 5%, Prop 10 doesn’t affect rental market much. May be in certain neighborhoods but unlikely to affect rental market in Fortress.

Wrong! In 2011, SF allows 0.1% increase. This year it is 1.6%.

https://sfrb.org/sites/default/files/Document/Form/571%20Allowable%20Annual%20Increases%2018-19.pdf

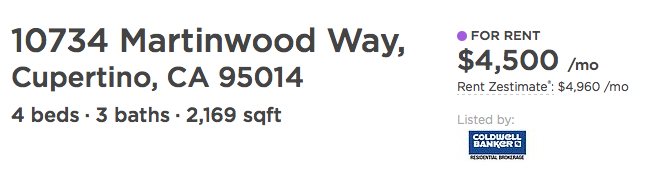

Another random check. This time in Cupertino. Notice the big drop in asking rent. Rental market is very quiet.

Note that asking price and asking rent are plunging very quickly.

Oh, come on! You know this is the wrong time of the year for schools. At least we have to agree that’s seasonal.

What’s wrong?

https://www.bizjournals.com/sanjose/news/2017/02/01/san-jose-places-5-percent-limit-on-some.html

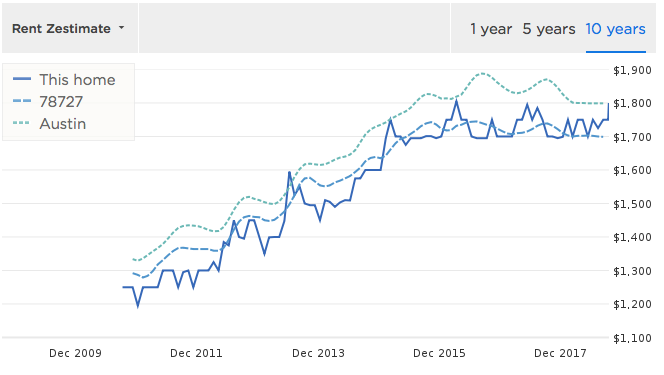

Look at the chart. Is trending down since 2014. Consistent with my experience.

I have never raised rent by 5% in San Jose in the last 2 times I raised rent. In fact not even 3%.

How much did you raise between vacancies? What’s your average increase over the holding period?

@hanera, rents have absolutely gone up in the last 4 years. Let’s wait for the others to chime in.

Guess is depends on neighborhoods and zip codes. Definitely not for me. I adjust rent up by as much as 50% in the first three years of rental history, then hold kind of steady for the next 4 years (I ask in this forum a few times whether there is a ceiling in rent? Many bloggers are too shy to share their real experience, tend to quote articles which I think don’t worth much because real estate is local to the extent of individual house). Guess I was new to the market and ask too low initially. Sure you’re not in the same situation? Asking too low initially hence need to adjust upwards later.

Not everywhere has the same dynamics. Random check on one Austin property. Rent went up ![]() Don’t have the “school” effect that you mentioned. Rent didn’t decline like the two houses I mentioned for SV, just go sideways since 2015. Important: Is not true that rent always go up. Don’t be surprised you get less rent after 20 years. Don’t extrapolate your experience in bay area since 2011

Don’t have the “school” effect that you mentioned. Rent didn’t decline like the two houses I mentioned for SV, just go sideways since 2015. Important: Is not true that rent always go up. Don’t be surprised you get less rent after 20 years. Don’t extrapolate your experience in bay area since 2011

I rented out my former primary for what zillow’s rent estimate told me. That was 3 years ago. Every year since I raised it a little bit over 2% so it has been very close to Zillow estimate throughout the years.

I am curious to see if anyone raised rent by 5% a year for a long period of time without mispricing in Year 1.

San Jose’s rent control is very mild. I don’t mind that at all. 5% ceiling sounds fair to me.

FWIW: we had turnover in San Mateo and Sunnyvale this year. San Mateo we raised about 4% this year (it was in spring), Sunnyvale we raised 2% (it was in fall). Not ideal times in both cases, but looks like Peninsula rental market is still growing relatively strong.

If that’s the case, why not repeal San Jose rent control? Seems that 5% per year limit is unnecessary.

Your single family house and condo is not even under rent control.

FYI: In 2017, 5% was almost destroyed by 1 single vote.

Rent data seems to say renters want apartments and not SFH. Luxury apartments rent for more than larger SFH. Renting is more about urban lifestyle for young people. Once people get married and have kids they buy SFH.

In 2012, rented 2 units in the same city, RC with rent control at 1500, NRC without rent control at 2200. The RC is still having the same tenant with a current rent around $1575. NRC has had 3 tenant turnovers and current rent is 3600. RC tenant may not move in the next 50 years assuming the kids will move out when they grow up.

Question is why not do both?

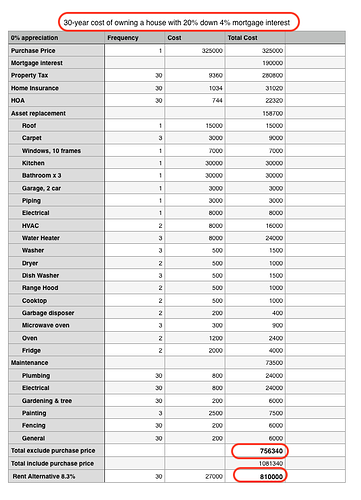

Also, housing gain is 10% on only a down payment.

My feeling is that if rents are lower than buying right now, it’s the right time to watch the market to buy. The housing prices should drop accordingly, then get in before the rents go up again.

People said that back in 2009-2012. They said prices would drop even more to get the rent vs. buy ratio to be right. They didn’t consider that rents could increase. I think rents for SFH could easily increase. It makes no sense a SFH would rent for for the same as a 1,000 sq ft 2/2 apartment.

I want to make sure I understand why you say that. Since the interest amount reduces as you pay down the principal, for a 4.4 percent loan you end up paying about 2% compound rate. Or that’s the number you need to use to compare against inflation, rent increase percent etc. because they are compound interests too. Where am I wrong? Property tax is in addition to that of course.

Read the table I posted. For your convenience, cut n paste the table below. Use detailed computation as if you are staying there for the course of the mortgage loan, for most is 30-year. General computation is incorrect, you would end up having the wrong conclusion… tried to explain BAGB for like few dozens posts, not sure he gets it. In fact, I was questioning the wisdom of staying for so long in the same house from a financial perspective (ignore other reasons).

And DBX dropped 10% in the last two days… Buy or don’t buy, changing companies might be a good idea for him…