All prop 10 does is put rent control under local control instead of state control. I have seen many misleading ads about it. Local control is not a bad idea. If you have good landlords it won’t pass locally.

Locals can’t be trusted. Don’t blame landlords. Look at the mess local laws have made of SF. 50 years of nimbyies and rent control have created a housing nightmare and the worst homeless situation in the country.

There are always going to be some places where you do want to be a landlord in, such as New York, San Francisco, Berkeley, and Santa Monica. You just buy in other places.

manch like to go over the same issue again and again.

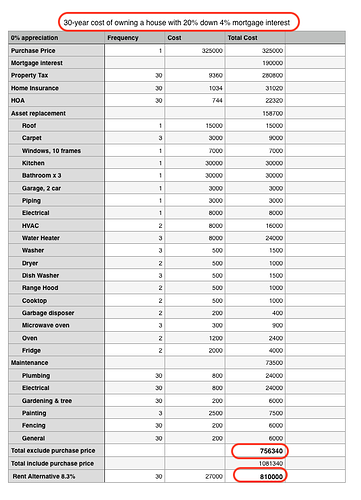

Does buy better than rent for primary works outside Bay Area - a financial perspective of course. Table below show the detailed computation for owning a house with a 20% downpayment and a 30-year 4% fixed mortgage interest. To breakeven, house price needs to appreciate at the same rate of mortgage - intuitively obvious? Please don’t say at the end of 30 years, return is 5 (leverage) x 3 (price appreciation) = 15 times ![]()

It’s the first time I see outside of our forum where people do detailed comparison between housing and stock returns.

The guy is a staff engineer at Dropbox. How much does he make? Is that equivalent to L7 at google? My point is that there may be quite a few SWE’s like him who says duck it, renting makes more sense than buying. Especially for the non Asians who don’t have property worship drilled into their heads from a young age.

And they are the ones that will move to Texas or Colorado etc because housing is too expensive. In the end their net worth will be significantly less than the people who toughed it out in the bay area.

Good calculations. How come they all assume that the rent stays the same the 30 years? Dropbox engineer should know that the houses currently renting for $5000 used to be at $2500 ten years ago. Wonder where they will be 10/20/30 years from now.

Here is a graph of bay area rents that I could find. Note that the prices are adjusted for inflation. So the real numbers and percentages are much higher. For this discussion, we should look at the real numbers instead of inflation adjusted.

Dropbox guy said he accounted for rent increases in his “calculator” post. Anyone downloaded his spreadsheet model and played with it?

In fact all we have to do is this. Can someone point out any single house for which the rent after 10 years of purchase (even if bought at the peak) is less than PITI? We have data going back 40 to 50 years.

That’s not Dropbox Man’s point. His argument is that even after accounting for rent and price increases, at the current price level, it’s better to rent and invest in stock market. That’s the same calculation many are doing right now. To me that’s the right question to ask.

From your behavior, you agree with his conclusion since you went heavily into stock market. What is the intention of your post? Inform others? Subconsciously validate your decision?

Well, own rental in SV for less than 5 years can’t quote my experience here… current rent is less than 4 years ago though. However in Singapore, my rental is now fetching 75% of what I got 20+ years ago.

I want to get more people’s opinions. Most people here are very analytical. Why not harness the brain power?

It doesn’t mean I won’t buy another house. I just need to be level headed about the reasons to buy. Appreciation will likely not going to be as good but for asset diversification and pure enjoyment I will still buy. What’s the point of accumulating wealth without enjoying it?

@hanera, I am assuming your 5 year old rental is already fetching more rent than PITI. is that right?

Current interest allows anyone who bought since 2011 to do that. Thought we are talking in general or at least going forward from here. If you’re just specifically thinking from 2011, the conclusion is quite different from long term steady state. We didn’t have such low interest rate historically. In any case, my example is not good because I throw in tons of downpayment, I’m the ultra conservative type. So I always go for rent > PITI right off the bat.

Dropbox Man’s calculator:

Not only real numbers but real numbers of actual houses on the market and not median rent. I would rather some1 who have rented out for many years tell us their experience, I think @Meguro owned rental over 30 years.

In Singapore, median rent always go up because there are always new condos on the market and new always fetch higher rent (almost twice) for the same square footage.

I downloaded his calculator and checked. Here are the changes that I made to the inputs:

- I can get a loan today from BofA at 4.4% rate (latest numbers). If you can move money from another brokerage account etc. you will get even better price. 0.25% for every $500K. But I used 4.4%

- Reduced HOA from 700 a month to 70 per month. Just to cover insurance expenses.

- Reduced S&P return from 10% to 8%.

- Removed Insurance of 2000 since it’s already covered above.

- Changed both price appreciation and rent to 5% a year. Even rent controlled areas in bay area allow an increase of 5% a year. Why would a owner not do that?

The calculator said that if I can rent for less than 3K per month, I should rent. I think a house worth 1.5M can be rented out for 4K. So we can say owning beats renting by 1K a month.

I also feel that 5% price appreciation in bay area is very unrealistic. Especially when S&P is factored in at 8% growth. I remember that S&P was about 1500 in March 2000. It’s 2900 now. Cupertino homes that were 500K in 2000 are selling for 2.5M now. Pick any part of the bay area and prove that S&P beats it.

What is the max? $2M means 3.4% ![]() $4M means 2.4%

$4M means 2.4% ![]() $8M means 1.4%

$8M means 1.4% ![]()

You can ask for $8M. I did not even think about it. You can definitely go up to $1M.

You can ask for $8M. I did not even think about it. You can definitely go up to $1M.